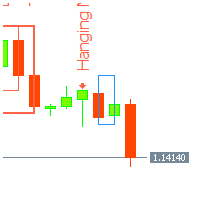

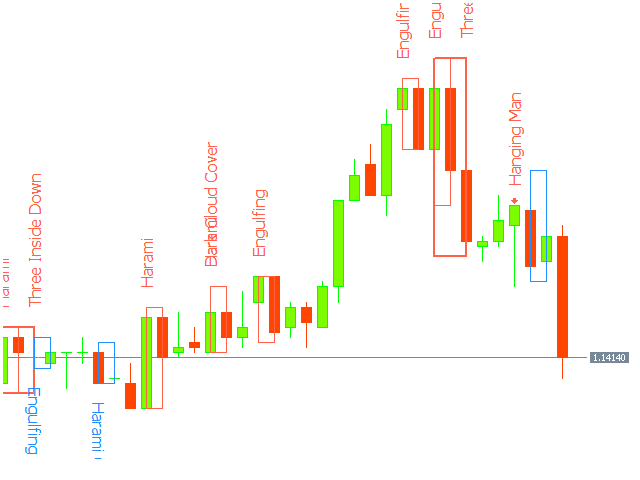

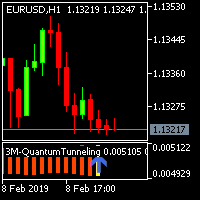

Japan CandleStick Patterns

- 지표

- Nguyen Duc Quy

- 버전: 1.0

Japanese candlestick analysis has been in existence for hundreds of years and is a valid form of technical analysis. Candlestick charting has its roots in the militaristic culture that was prevalent in Japan in the 1700s. One sees many terms throughout the Japanese literature on this topic that reference military analogies, such as the Three White Soldiers pattern

Unlike more conventional charting methods, candlestick charting gives a deeper look into the mind-set of investors, helping to establish a clearer picture of supply/demand dynamics.

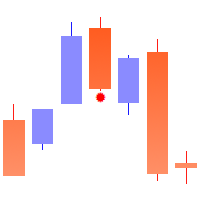

Japanese candlestick charts do not require anything new or different as far as price data are concerned. Open, high, low, and close are all that are needed to construct a candlestick chart. There are two main elements in the construction of a candlestick, the real body and the shadows.

very good accurate indicator