Stochastic Alert Manager

- 지표

- Jeremy Guilhem

- 버전: 1.0

- 활성화: 10

Stochastic Alert Manager

- Introduction:

The Stochastic Alert Manager is a customizable indicator used to send alerts when trading signals occur. It also gives the user an overall idea of the tendency in all timeframes through a panel, to keep an eye on the global market behaviour. It is based on the stochastic crossovers strategy. The Stochastic Alert Manager is not meant to open trades for now.

- Simple

- Configurable

- Respond quickly

- Monitor the global behaviour

- How is it working?

- It alerts you of buy and sell signal based on your stochastic oscillator

There are two components to the stochastic oscillator: the %K and the %D. The %K is the main line indicating the number of time periods, and the %D is the moving average of the %K.

There are two components to the stochastic oscillator: the %K and the %D. The %K is the main line indicating the number of time periods, and the %D is the moving average of the %K.

A buy signal occurs when the %K line cross above the %D line, in the oversold area.

A sell signal occurs when the %K line cross below the %D line, in the overbought area.

When a signal occurs, an alert will automatically be sent to the user from the client terminal, and by email if the functionality is enabled, and an arrow is drawn at the concerned price.

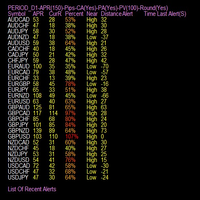

- A panel gives an overview of the asset behaviour in all timeframes.

A buy signal is even more pertinent in an uptrend market, same for a sell signal in a downtrend market. Thus, this panel displays the value of the “signal line” (%D) and tells if the trend is upward (green color) or downward (red color).

- Why is it useful?

The Stochastic Alert Manager alerts you of potential trading signals for you. It prevents you from having to keep your eyes on the stochastic indicator. It will inform you of any crossover with MT4 sound alert, and even by email if wished.

The Stochastic Alert Manager provide you a panel on which you can visualize the value of the stochastic indicator and the trend issued, in all time frames. Checking the stochastic indicator in the other time frames is very important. The panel greatly helps you to monitor all time frames in order to oversee the asset global behaviour and understand each signal in its own context.

- Input Parameters:

input int MA_method=0; moving average calculation methods of the price series smoothing. The following options are available: 1-Simple, 2-Exponential, 3-Smoothed, 4-Linear Weighted.

input int price_field=0; price values on which calculations will be performed: either only Close prices or High and Low prices: 0 - Low/High or 1 - Close/Close.

input int levelmax=75; value from which the asset is considered overbought.

input int levelmin=20; value from which the asset is considered oversold.

input int K=14; Stochastic setting. Period of the %K line.

input int D=3; Stochastic setting. Period of the %D line.

input int slowing=3; Stochastic setting. Slowing value.

input bool email=false; // If true, an email will be sent in case of an alert. Email functionality. If true - enabled, false - disabled.

- Notes:

· Signals are generated using the current price of the bar and not the close price of the bar. This allow the program to identify signal and send an alert right when a crossover occur. There is no need to wait for the close price of the current bar while a signal may have already occurred, which is way faster.

· Thus, only one alert can be sent per bar in order to prevent multiple successive alerts from happening.

· Stochastic Alert Manager works on every asset for every time frame.

· Warning: the indicator is built to be used on any time frame, but one timeframe per window. Which means, changing time frame on the chart on which the indicator is attached will result to end its execution.

· When the program is initialized (just been attached, or just launched Metatrader), if the stochastic is overbought and the signal line is below the main line, then an alert should occur. It informs you that a crossover in overbought area happened a bit earlier and the stochastic is still overbought. Same thing in the oversold area.