TrendSwing

- Experts

- Andriy Sydoruk

- 버전: 1.0

- 활성화: 5

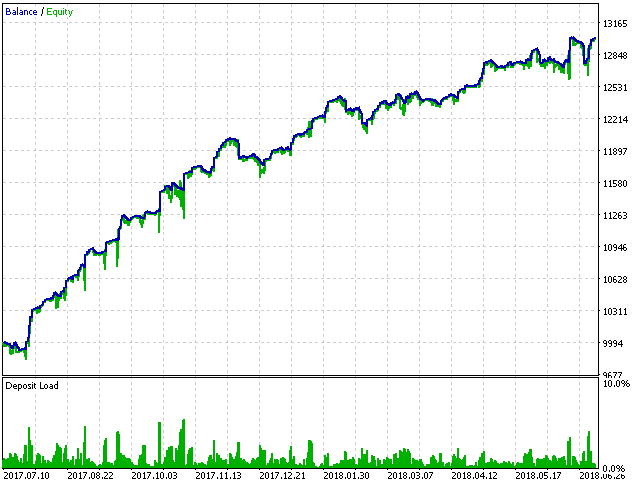

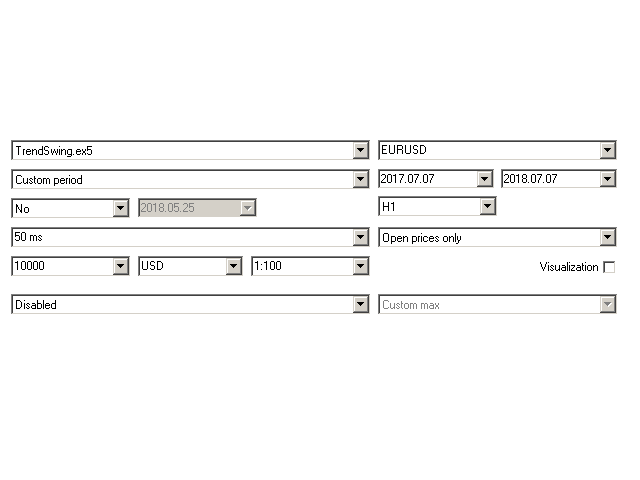

TrendSwing is a professional Expert Advisor, which implements the strategy of trading using neural networks. Operation principle - following the market. Using a neural network, it is possible to generate signals in such a way that every signal in the market appears in the right direction. The position is adjusted all the time. When a signal opposite to the existing position appears, the summary position is adjusted (that is, the position is opened in parts and closed also in parts). Thus, the EA constantly follows the price.

In order to diversify the funds efficiently, it is recommended using the multicurrency operation mode, at which multiple currency pairs are selected, thus reducing the risk. The Expert Advisor correctly handles errors and reliably works with a deposit of 1000 USD and higher. You can start working on a five-minute chart.

In this case, the configuration of the neural network is very simple. Training takes place during optimization. Adjustment of the neural network's weights is stored in the settings.

The EA does not use dangerous strategies such as averaging or martingale, but strictly adheres to the neural network instructions. Stop loss and take profit are set for each trade. The Expert Advisor correctly handles errors and reliably works with a deposit of 1000-10000 USD and higher. The default working timeframe is H1. But any other timeframe or currency pair can be used. The higher the timeframe the better the predictability.

Training of a neural network is performed on a data sample (historical data). The training process follows a genetic algorithm and as it goes on, the network reaction to input signals should be improving. It remains only to check how accurately the optimized parameters predict the future. This is done by a step-by-step verification of results. Markets change, therefore, it is necessary to constantly modify the strategies. The neural network save the trouble of constantly changing the strategy, it is sufficient to simply retrain the system for the current market situation.

Parameters

- TypeFilling - sets order filling type.

- Magic - sets the magic number.

- LimitSpread - spread limit.

- Risk - lot calculation depending on the deposit. We recommend that you use Risk, rather than Lot.

- Lot - sets lot size for market entry (overrides Risk).

- TP, SL - Stop Loss and Take Profit.

- DrawDown - the maximum drawdown, at which closing occurs (in % of a deposit).

- DrawUp - the maximum profit, at which closing occurs (in % of a deposit).

- IndicatorA, IndicatorB, IndicatorC - three indicators for analysis.

- TFIndicatorA, TFIndicatorB, TFIndicatorC - timeframes of the indicators.

- ShiftIndicatorA, ShiftIndicatorB, ShiftIndicatorC - shifts of the indicators.

- PeriodIndicatorA, PeriodIndicatorB, PeriodIndicatorC - periods of the indicators.

- LevelSell - level for entering the market by a sell signal from a neural network.

- LevelBuy - level for entering the market by a buy signal from a neural network.

- wb0 - wb11 - weights for the neural network (these are the settings that store the logic of the neural network directly in the .set file).

Parameters for optimization with a Custom target:

- OPT_TRADES, OPT_BALANCE_DD, OPT_EQUITY_DD - Minimum (trades, drawdown by balance, drawdown by equity) for the corresponding parameter.

- CORRECT_TRADES, CORRECT_BALANCE_DD, CORRECT_EQUITY_DD - adjustment of the target by the corresponding parameter.