Black Box XAUUSD evening MT5

- Experts

- Alexander Gromov

- 버전: 1.0

- 활성화: 5

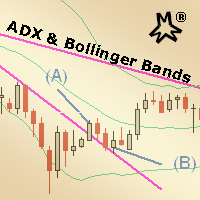

This algorithm uses statistically justified comparison of market data, numerical constant values and output values of Stochastic indicators and Moving Averages in order to take decision whether it is necessary to open a position.

Prior to giving birth to a new EA, this logic was created as a result of usage of Stochastic methods and then tested on historical data and checked with Monte Carlo method, which does not guarantee any results in the future, of course.

No martingale is used.

The robot is designed to trade during evening hours on XAUUSD M15.

Despite the fact that this condition is not obligatory, trading logic assumes that no positions should remain open during publications of significant economic news like Non-farm Payrolls.

From machine learning point of view, the EA should be optimized every 23 days using 88 day interval.

The default settings presume that servers of a chosen broker work in widely spread EET time zone (4 PM - 10 PM by default). If it is necessary to set up trading in UTC time zone, a user should deduct 3 (in winter time) or 2 from the default time settings.

It is not recommended to change the trading range and the instrument itself due to the fact that the logic of the algorithm was created for specific behaviours of currency pairs during specific time periods.

The default trading volume is set to 0.05 standard XAUUSD lots (5 ounces of Gold on a typical non-cent account). In order to trade this volume comfortably, your deposit should not be less than $260 given that you use effective leverage equal to 1:25.

Parameters

- magic - "magic" number, identifier of the EA for marking its own positions

- start_hour - time, at which the EA commences trading

- stop_hour - time, at which the EA ends trading, stops sending orders and closes positions

- friday_close - trigger that determines the individual end time of trading on Fridays

- friday_close_hour - time, at which the EA ends trading on Fridays

- lot - volume of opened positions

- bar - bar number, used in trade logic

- sma_period_1 - period of the first SMA indicator

- sma_period_2 - period of the second SMA indicator

- stoch_k_1 - %K period of the first Stochastic indicator

- stoch_d_1 - %D period of the first Stochastic indicator

- stoch_slowing_1 - slowing parameter of the first Stochastic indicator

- stoch_k_2 - %K period of the second Stochastic indicator

- stoch_d_2 - %D period of the second Stochastic indicator

- stoch_slowing_2 - slowing parameter of the second Stochastic indicator

- stoch_control_1 - value that controls the Stochastic indicators

- stoch_control_2 - value that controls the Stochastic indicators

- stoch_control_3 - value that controls the Stochastic indicators