Harmonic Shark pattern

- 지표

- Farhad Kia

- 버전: 2.1

- 활성화: 5

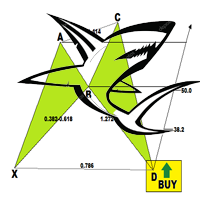

The Shark Pattern is dependent upon the powerful 88.6% retracement and the 113% Reciprocal Ratio, works extremely well retesting prior support/resistance points (0.886/1.13) as a strong counter-trend reaction. Represents a temporary extreme structure that seeks to capitalize on the extended nature of the Extreme Harmonic Impulse Wave.

The indicator demands immediate change in price action character following pattern completion. Extreme Harmonic Impulse Wave utilized depends upon location of 88.6% level – these are minimum requirements. Requires an active management strategy to capture high probability profit segments.

Shark Pattern Basics

- Different from the M-type and W-type alignments in the other patterns but the same Harmonic Trading principles are applied.

- Comprised of two independent price segments, Failed Harmonic Impulse Wave and Extreme Harmonic Impulse Wave.

- Possesses defined profit target.

- Requires active management.

- Possesses precise ratios to define the support/resistance zone.

- As effective as other harmonic patterns.

Key features

- This indicator will help you to find one of the best harmonic patterns which are Shark patterns!

- Unlike other indicators, the indicator shows this strong pattern only when it is confirmed!

- This pattern has a very nice Risk/Reward ratio!

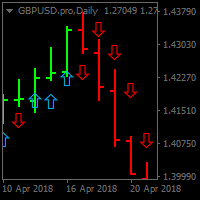

- When you put it on the chart you can set it to show you the last two bullish and bearish Sharks on the chart (this might take some time).

- If the new pattern arrives, it will quickly notify you by alert and show it to you on the chart.

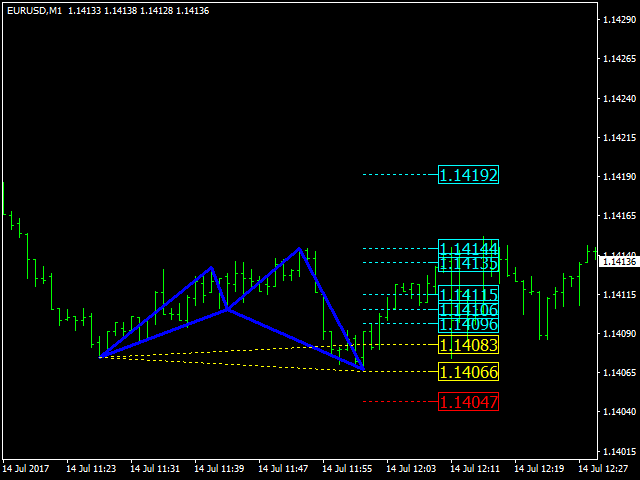

- Once the pattern is identified, the entry points (Gold lines), stop loss (Red Line) and take profit points (Aqua lines) are shown on the chart.