MetaCOT 2 Williams Commercial Index COT MT5

- 지표

- Vasiliy Sokolov

- 버전: 2.58

- 업데이트됨: 7 8월 2023

- 활성화: 5

MetaCOT 2 is a set of indicators and specialized utilities for the analysis of the U.S. Commodity Futures Trading Commission reports. Thanks to the reports issued by the Commission, it is possible to analyze the size and direction of the positions of the major market participants, which brings the long-term price prediction accuracy to a new higher-quality level, inaccessible to most traders.

These indicators, related to the fundamental analysis, can also be used as an effective long-term filter when entering a medium-term position. For this, they should be combined with a classic price analysis.

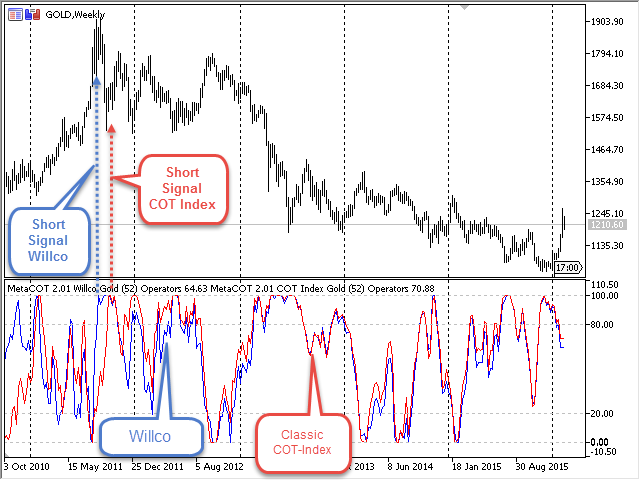

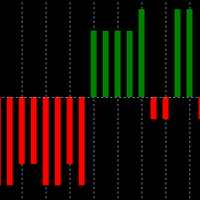

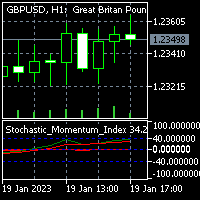

Williams Commercial Index (Willco) developed by Larry Williams is the most advanced version of the standard COT Index. Unlike the latter, Willco compares extreme values of participant groups to cumulative open interest. Thus, Willco is a standard COT Index weighted relative to the entire market. Like the latter, it is an oscillator and changes its value from zero to one hundred percent. The values of the indicator from 0% to 20% and from 80% to 100% point at the moments of the extreme overbought and oversold state market, signaling the frequent reversal of the price after reaching these levels. The data on net positions of traders is used as the basis of the calculation (see the MetaCOT 2 Netto Positions indicator).

Find out more details on the usage methods of this indicator in the book by Larry Williams: Trade Stocks and Commodities with the Insiders: Secrets of the COT Report", and also in the article Meta COT Project - New Horizons for CFTC Report Analysis in MetaTrader 4.

Below are the indicator parameters and their description:

- Source of Report - COT report type. There are two types of report: 'Futures Only' and 'Futures And Options';

- Group of Traders - Group of COT report participants. Includes the groups listed above;

- Release Day - set the day to refresh the indicator. At the default value, 'Release by Friday', the indicator updates its values on Friday (day of data release). At the value 'Release by Tuesday' - on Tuesday (day of data receipt).

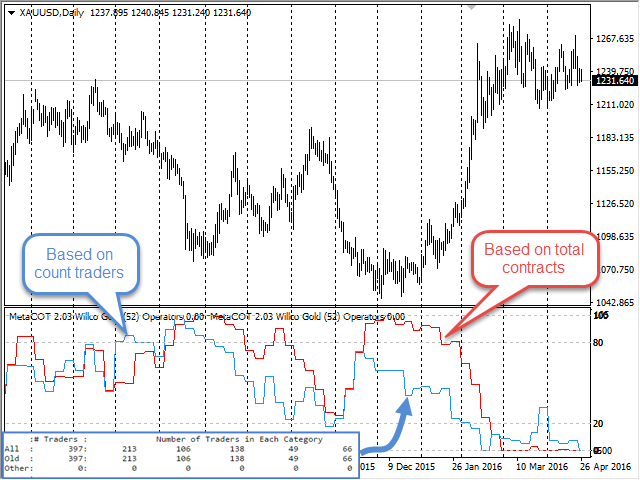

- DataType - select data to plot the indicator. At the default value, 'Contracts of Traders', the indicator calculates its values based on the number of contracts, at the value 'Number of Traders' - based on the number of traders.

- Subgroup of Traders - Subgroup of the participants. Divided into All, Old and Other;

- Period of COT Index - period of COT Index calculation. Recommended values: 25, 52 and 156 weeks;

- Auto Detect Report Name - if true, the indicator automatically downloads the report, corresponding to the market symbol it is running on. If no report corresponding to the current symbol could be identified, then the default report is downloaded, that is specified in the Report Name parameter;

- Report Name - name of the report to download if the Auto Detect Report Name parameter is set to false. The name of one of the MetaCOT database files without its extension must be specified as the report name;

- Mirror Mode - mirror mode of the indicator. If true, the indicator maximums become minimums, and minimums become maximums.

This indicator must be combined with the other indicators of the MetaCOT series, in that case, a higher degree of accuracy in conducting fundamental and technical market analysis is achieved.

The indicator operation requires the CFTC reports to be downloaded and installed on your computer, which can be done with a special report installation utility MetaCOT 2 Install CFTC Reports MT4.

More details on the description of the indicator settings can be found in the blog "MetaCOT 2: Settings and Possibility".