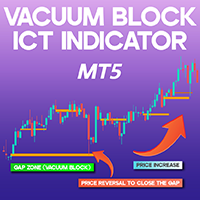

Vacuum Block ICT indicator MT5

Vacuum Block ICT Indicator MT5

The Vacuum Block ICT indicator MT5 is designed to detect price voids in the market that emerge due to inactivity or strong buy/sell momentum during periods of heightened volatility.

These gaps typically appear following major political or economic developments, where a lack of active orders and insufficient liquidity causes price movements to retrace back to these regions. Vacuum blocks are classified as either bullish or bearish and are visually represented in orange.

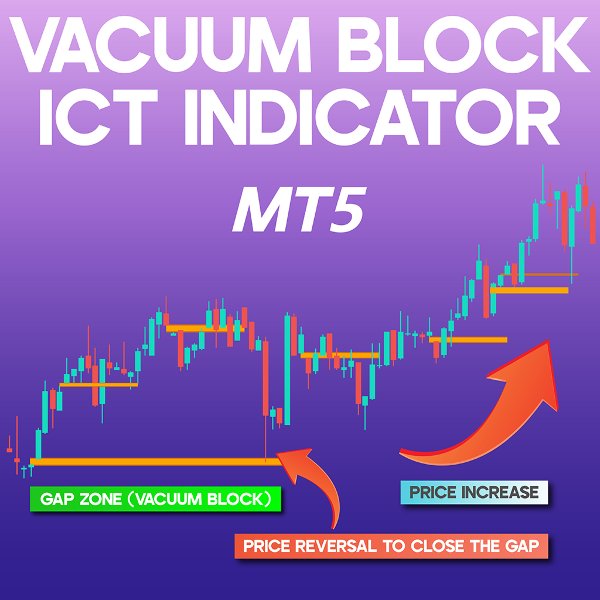

Indicator Table

| Category | ICT - Liquidity - Smart Money |

| Platform | MetaTrader 5 |

| Skill Level | Intermediate |

| Indicator Type | Continuation – Reversal |

| Time Frame | Multi-Time Frame |

| Trading Style | Day Trading |

| Markets | Crypto - Forex - Stocks - Commodities |

Understanding the Indicator

A vacuum block represents a liquidity gap that forms when there is a discrepancy between the closing price of one session and the opening price of the next, resulting in an area where no trading occurs. This absence of transactions creates a liquidity void. Market participants generally anticipate price movement back into these areas before continuing in the dominant trend direction.

Indicator in an Uptrend

On a 15-minute chart of AUD/CHF, a price gap forms, and the price subsequently retraces to this zone to activate pending orders and absorb liquidity. This behavior illustrates the market’s natural tendency to fill these voids before resuming its primary trend. Traders often look for buy signals on lower time frames when price revisits these areas.

Indicator in a Downtrend

A bearish vacuum block forms when a new candlestick opens at a lower price than the previous candle’s close. In an hourly EUR/USD chart, once a gap appears, the price retraces to the liquidity void (highlighted in orange) to accumulate liquidity before resuming its downward trajectory.

Indicator Settings

- Chart and object color scheme: Defines the background color of the chart.

- Shift for vacuum end: Determines the number of vacuum block zones displayed (default value: 5).

Conclusion

The vacuum block concept is a crucial tool for traders, offering insights into price gap analysis and potential market behavior. By recognizing these voids and anticipating price reactions, traders can place well-informed trades with structured risk and profit potential. However, risk management remains essential, ensuring that stop loss and take profit levels are strategically set to protect capital and optimize returns.