Herodotus H4

- Experts

- Nadiya Mirosh

- 버전: 4.2

- 업데이트됨: 9 4월 2025

- 활성화: 5

Expert Forex Market Analysis Using Elliott Wave Theory

Introduction

Forex market analysis using Elliott Wave Theory offers new opportunities for accurately forecasting currency pair movements. Herodotus, an expert in technical analysis, applies this method to study the dynamics of key currency pairs:

-

EUR/USD

-

GBP/USD

-

USD/JPY

-

AUD/USD

-

USD/CHF

-

EUR/GBP

-

EUR/JPY

-

NZD/USD

-

USD/CAD

-

EUR/CHF

-

AUD/JPY

-

CAD/JPY

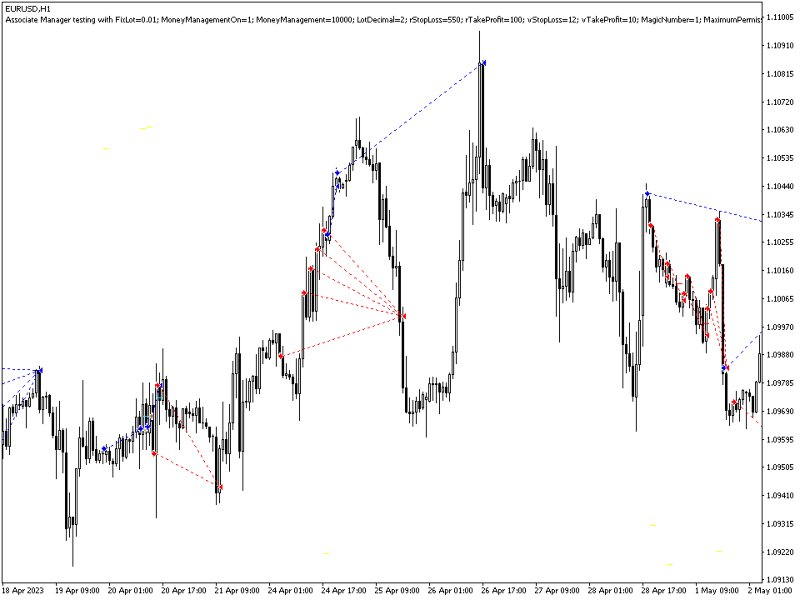

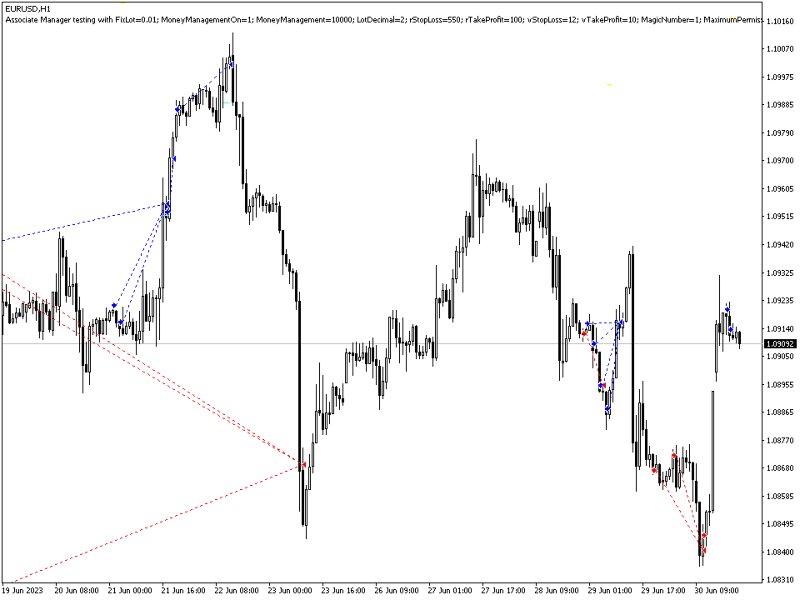

Elliott Wave Theory

This technical analysis method describes price fluctuations as recurring wave structures that reflect market participants' behavioral patterns.

Ralph Nelson Elliott identified the main types of waves:

-

Five impulse waves (1, 2, 3, 4, 5): Trend-following waves where waves 1, 3, and 5 are impulsive, while waves 2 and 4 are corrective.

-

Three corrective waves (A, B, C): Form the retracement phase, completing the market cycle.

Fundamental principles of analysis:

-

Wave 2 does not drop below the start of Wave 1.

-

Wave 3 cannot be the shortest among impulse waves.

-

Wave 4 does not cross into the price zone of Wave 1.

-

Impulse movements consist of five waves, while corrective movements contain three.

Understanding these patterns helps traders identify potential market entry and exit points.

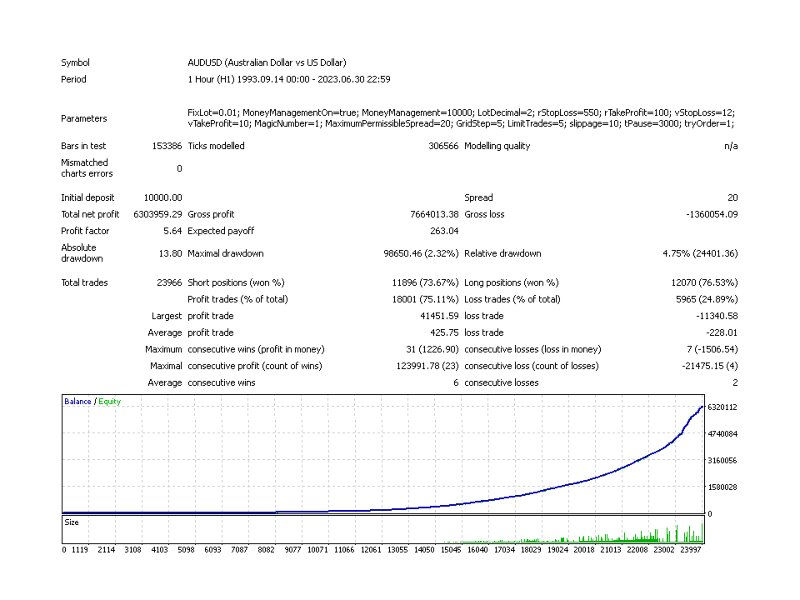

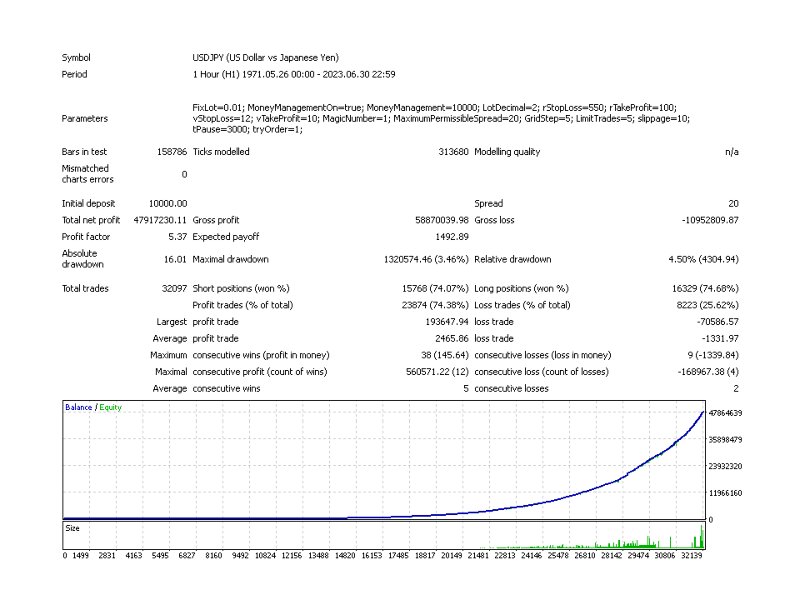

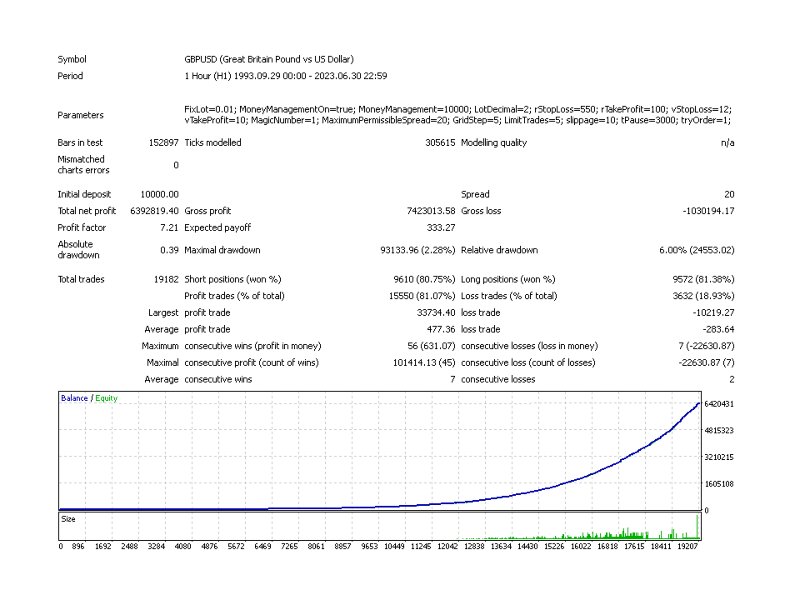

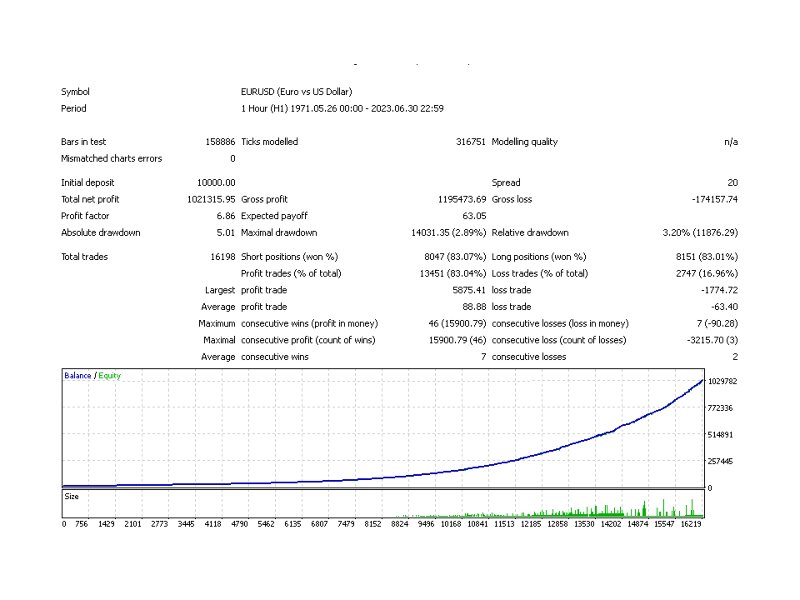

Automated Strategies and Their Parameters

Modern technology allows traders to incorporate Elliott Wave Theory into algorithmic strategies implemented in trading bots. These tools analyze market cycles and automate the trading process.

Key bot parameters:

Trading settings:

-

Fix Lot – Fixed lot size.

-

Money Management – Automatic lot size adjustment.

-

Lot Decimal – Lot rounding.

-

r Stop-Loss – Real stop-loss.

-

r Take-Profit – Real take-profit.

-

v Stop-Loss – Virtual stop-loss.

-

v Take-Profit – Virtual take-profit.

-

Magic Number – Unique trade identifier.

-

Maximum Permissible Spread – Allowable spread level.

Operating conditions:

-

Supported currency pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CHF.

-

Timeframe: H1.

-

Maximum spread: 20 pips.

-

Strategy optimization with a drawdown of up to 30%.

-

Recommended deposit: from $10,000.

Conclusion

Combining Elliott Wave analysis with automated trading strategies enables traders to gain deeper market insights and make informed decisions. With precise analysis and proven algorithms, Forex trading efficiency can be significantly improved. Consistently applying strategies and considering market patterns is essential for achieving stable results.