Breakout Lookback Bars

- Experts

- Yeoh Kia Gee

- 버전: 1.0

- 활성화: 5

Breakout Lookback Bars EA

1. OVERVIEW

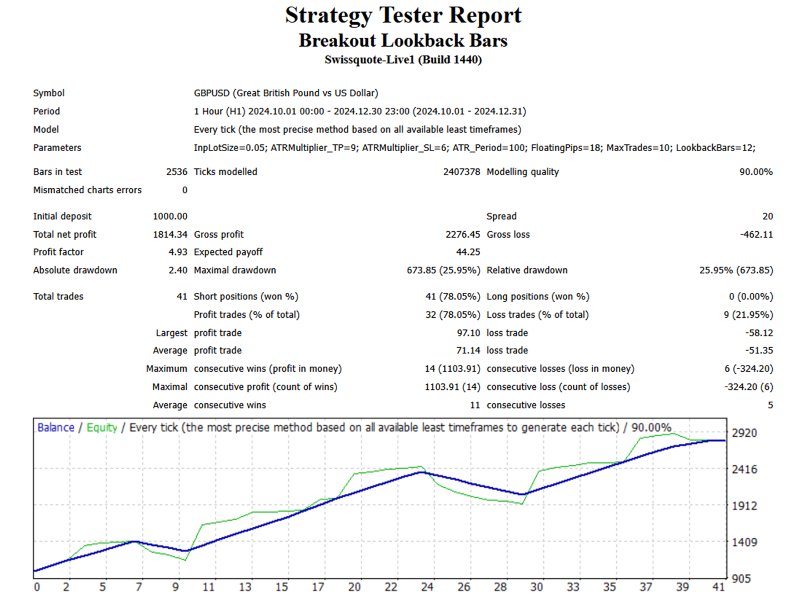

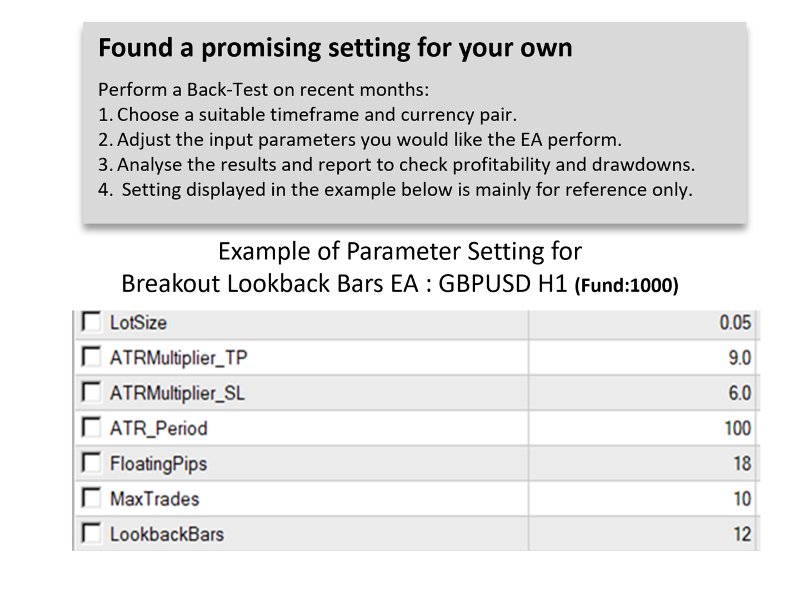

Breakout Lookback Bars EA is a specialized trading algorithm designed to identify and trade price breakouts based on historical high and low levels over a defined period (LookbackBars). The EA ensures systematic trade entries using a FloatingPips mechanism, which helps optimize trade placement and risk management.

2. Trading Strategy

- The EA detects breakout levels by analyzing the highest and lowest price over a defined period (LookbackBars).

- A Buy trade is placed when the price breaks above the resistance level. A Sell trade is placed when the price breaks below the support level.

- Additional trades are opened based on the FloatingPips condition.

- The EA continues placing trades until the MaxTrades limit is reached.

3. Best Timeframes for Breakout EA

- H1 (1 Hour):Best for intraday breakout trading

- H4 (4 Hours):Ideal for swing trading

- M30 (30 Minutes):Good for more frequent trades while maintaining some structure

- Timeframes to Avoid:M1& M5 and D1

- Use on highly liquid currency pairs like EUR/USD, GBP/USD, USD/JPY.

4. Risk Management

- Appropriate Lot Sizing: Ensures account balance sustainability.

- MaxTrades Restriction: Prevents overexposure by capping open positions.

- False Breakout Prevention: Utilizing higher timeframes (H1 or H4) helps filter out noise and improve trade accuracy.