Andean Oscillator Scalping by Gerega

- Experts

- Illia Hereha

- 버전: 1.5

- 활성화: 10

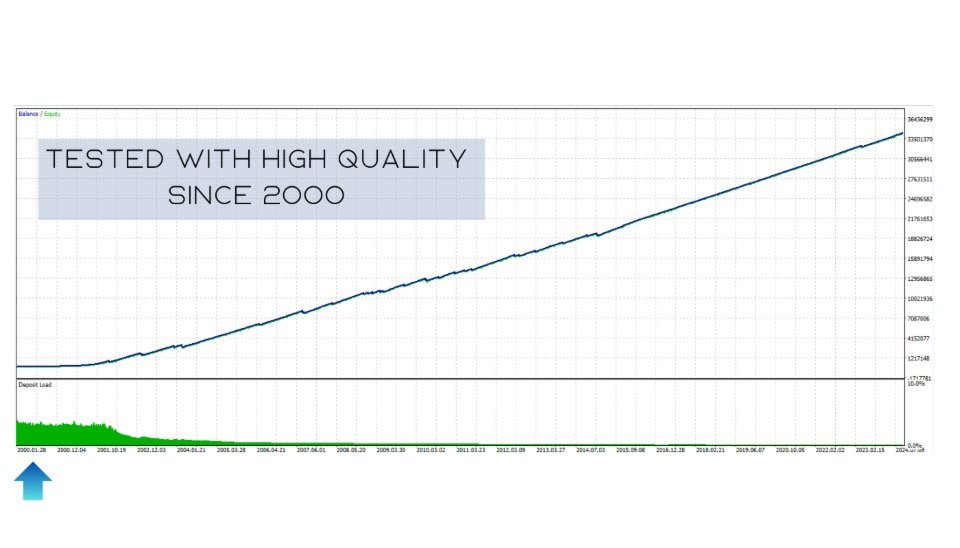

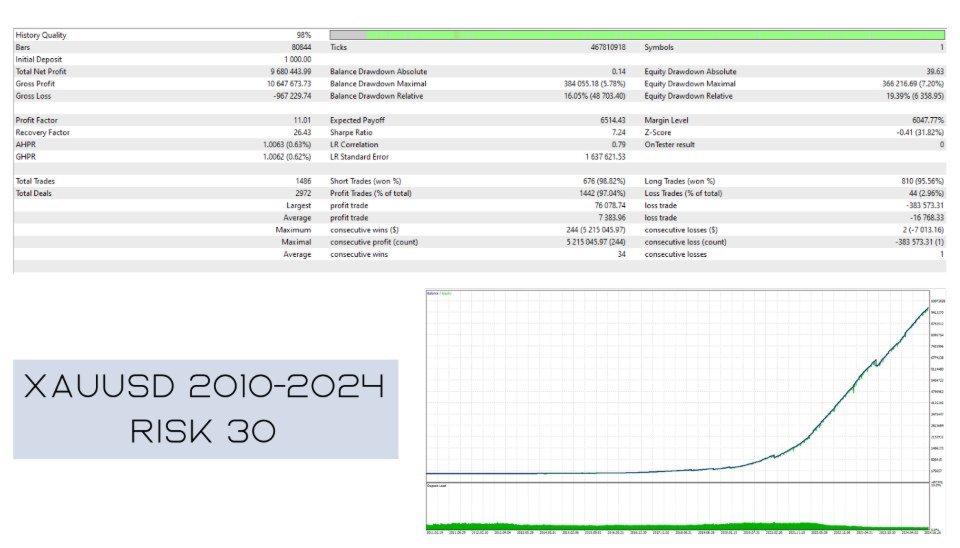

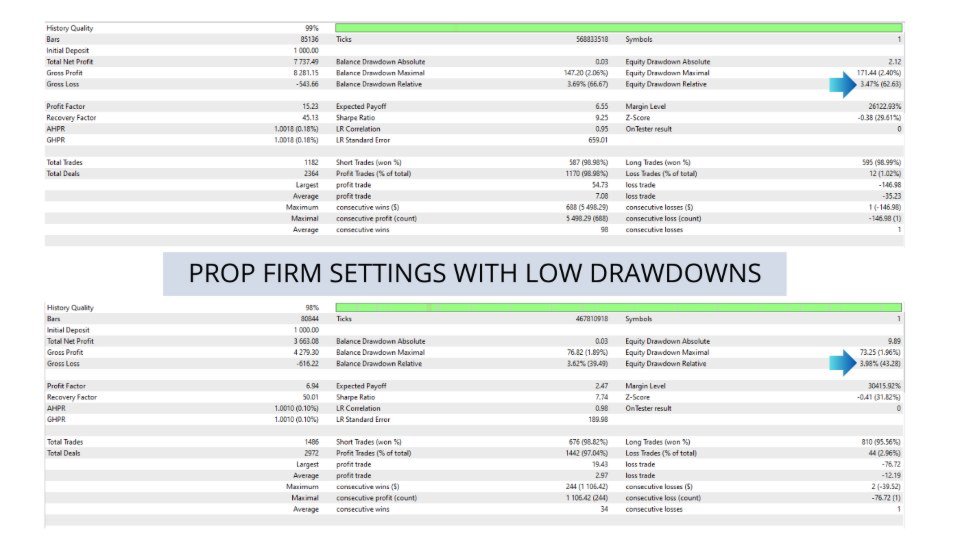

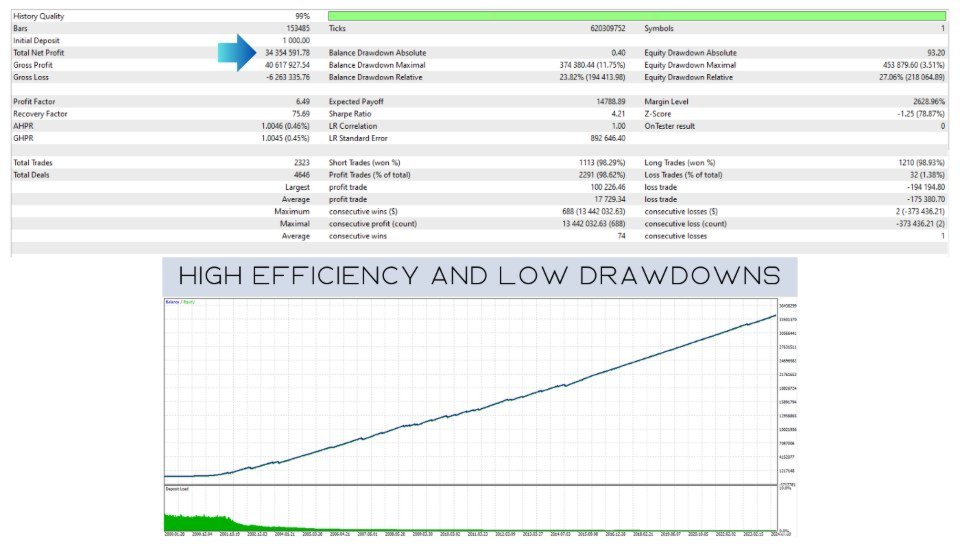

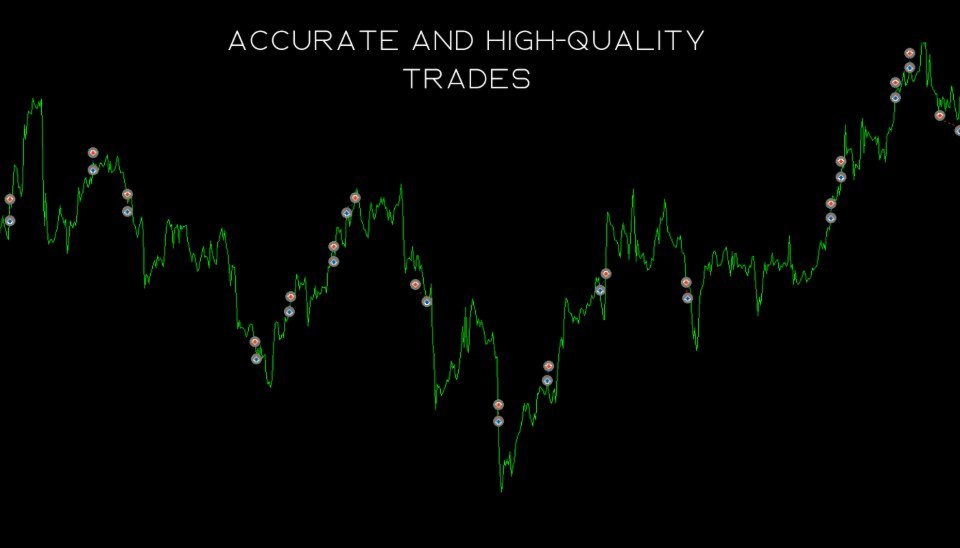

This strategy is designed for high-frequency scalping, utilizing the Daily High/Low levels and the Andean Oscillator to identify optimal trade opportunities. It works best in volatile market conditions where price frequently reacts to key levels.

How It Works:

•Daily High/Low Levelsact as dynamic support and resistance zones where price often consolidates or reverses.

•Andean Oscillatormeasures momentum shifts and trend strength, confirming entries with high precision.

•Trade Entry:

•Buy:When price bounces from the Daily Low and the Andean Oscillator signals bullish momentum.

•Sell:When price rejects the Daily High and the Andean Oscillator confirms bearish momentum.

•Trade Exit:Positions are closed when the momentum weakens or upon reaching a fixed profit target, trailing stop, or opposite signal.

Key Features:

•Precise Scalping Signals– Trades are executed based on strong price reactions and momentum confirmation.

•Works on Multiple Timeframes– Primarily suited forM1 to M15charts.

•Minimizes Risk– Uses clear stop-loss placement near Daily High/Low levels.

•Customizable Settings– Adaptable parameters for different volatility conditions.

Ideal for traders looking to take advantage of quick intraday price movements, this strategy provide sclear trade setups with well-defined risk management.