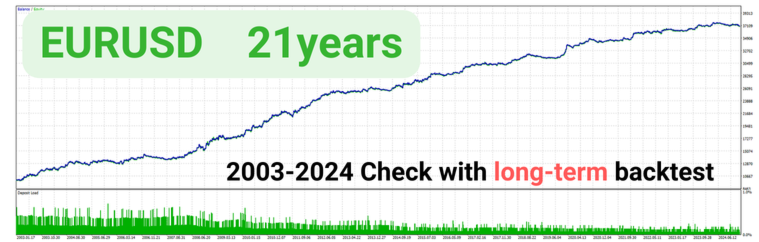

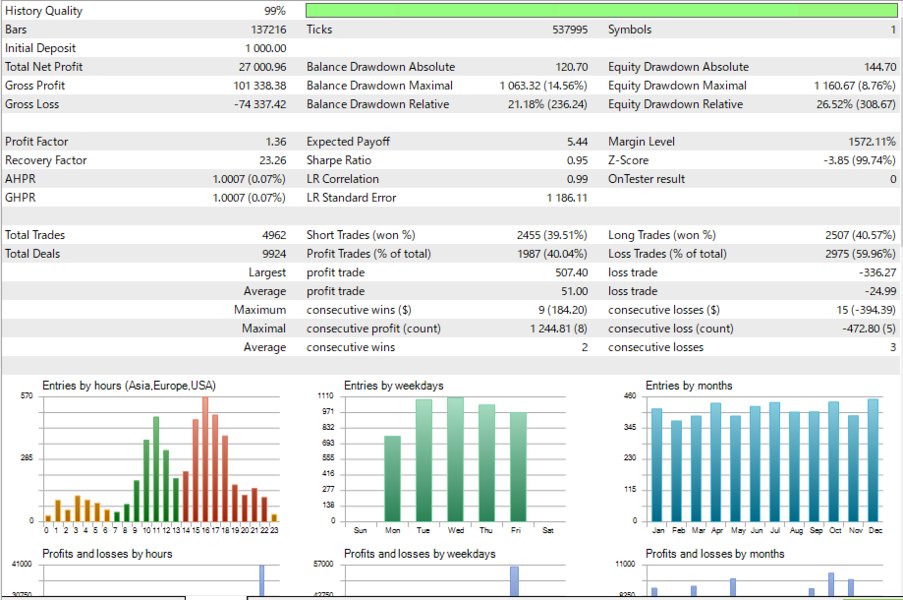

Big Forex Truck EA

- Experts

- Tetsushi O-nishi

- 버전: 1.0

- 활성화: 20

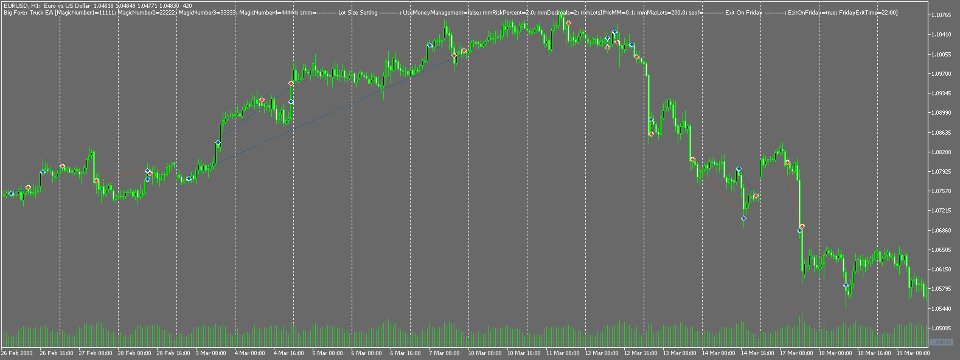

Target Time frame: 1H

- No martingale, no grid

- No scalping

- Stop loss on all positions

This EA is a multi-strategy automated trading system, incorporating four distinct trading logics. Each logic uses its own set of technical indicators to generate entry signals, while exit strategies are managed through predefined profit targets, stop losses, trailing stops, and bar-count-based exit rules.

-

Logic 1: Bollinger Bands-Based Entry

- Indicators Used

Multiple Bollinger Bands with different periods and standard deviations are employed. An entry signal is generated when the previous close exceeds either the upper or lower band. - Exit Strategy

The trade is managed with a stop loss calculated using the ATR and a profit target measured in pips. Additionally, under certain conditions, the stop loss is moved to the break-even point.

- Indicators Used

-

Logic 2: Combination of Power Indicators and the Aroon Indicator

- Indicators Used

Entry signals are generated by combining the zero cross of Bulls Power/Bears Power with the Aroon indicator, capturing shifts in market momentum. - Exit Strategy

A fixed profit target and percentage-based stop loss are set, along with a trailing stop and a rule for moving the stop loss to the break-even point to secure profits and limit losses.

- Indicators Used

-

Logic 3: ADX Cross and Moving Average-Based Entry

- Indicators Used

Multiple confirmations of ADX DI+ and DI– crossovers are utilized, along with a simple moving average to evaluate the bar’s open position, determining the timing of entries. - Exit Strategy

The trade is managed using an ATR-based stop loss and a pip-based profit target, in addition to an automatic exit rule after a specified number of bars.

- Indicators Used

-

Logic 4: Moving Averages and ADX Combination Entry

- Indicators Used

Entry signals are generated by confirming multiple ADX DI crossovers in conjunction with linear weighted and exponential moving averages, considering the bar’s open position. - Exit Strategy

The trade is controlled with an ATR-based stop loss and a percentage-based profit target, along with a rule that moves the stop loss to the break-even point under certain conditions.

- Indicators Used

Each logic combines market assessments based on its specific technical indicators with risk management rules—including profit targets, stop losses, trailing stops, and bar-count-based exits—to enable automated trading that adapts to various market conditions.