<<Gold Precise: A Multi-Timeframe and Dynamic Trend Identification Expert Advisor for XAU/USD>>

BUY ONE FREE ONE, contact me for your gift after purchase.

Features:

- Releasing my Secret Strategy 2

- Win Rate: 97%

- Coded by certified trader from 2 prop firms.

- Smart Entry & Exit

- FIFO

- Prop Firm Compatible (0.01 lot per $10k balance)

- No Grid, Martingale or other dangerous strategies

- Customisable TP & SL

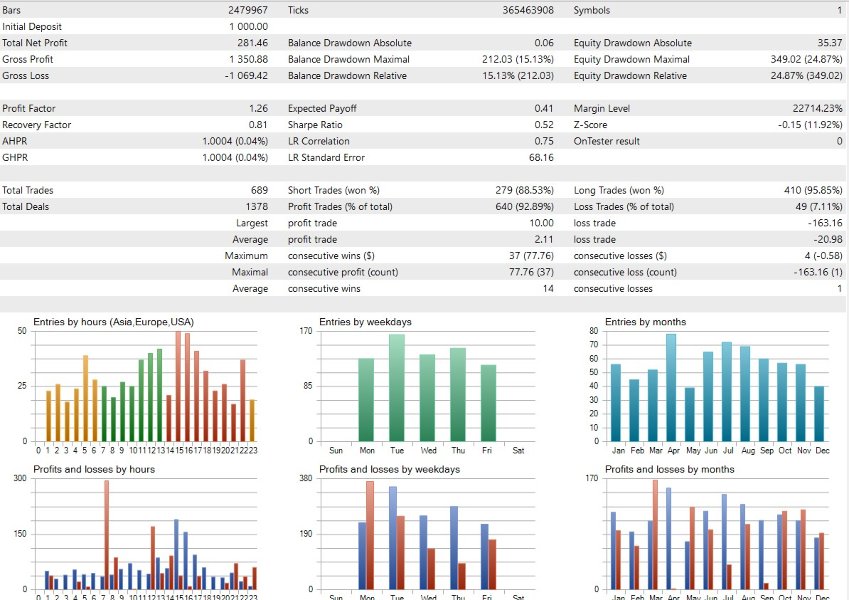

Screenshot 1: 2018 to 2025 backtest results with 0.01 lot per $1000 from FP Markets Raw Account.

Timeframe: M1

Installation: The EA is to be attached to one M1 chart, for example XAUUSD.

Symbols: XAUUSD only (Gold)

Account Type: Use ECN with lowest spread possible, EA is not sensitive to spread & slippage.

Recommended Lot Size: 0.01 per $1000 balance.

Recommended Broker & account type: FP Markets Raw, Tickmill Raw, Roboforex ECN

Gold Precise is an advanced Expert Advisor (EA) designed for trading XAU/USD, integrating multi-timeframe analysis with randomness and dynamic trend identification. This research presents the theoretical foundations, algorithmic architecture, and performance evaluation of Gold Precise. By leveraging randomness to enhance probabilistic decision-making and dynamic trend identification to adjust to changing market conditions, Gold Precise optimizes trade entries, risk management, and execution precision.

The XAU/USD market is characterized by high volatility, non-linearity, and susceptibility to macroeconomic and geopolitical factors. Traditional trading systems struggle with gold’s erratic price movements, often leading to false signals and suboptimal risk management. Gold Precise addresses these challenges by combining multi-timeframe analysis with controlled randomness and dynamic trend adaptation. This EA enhances decision-making through probabilistic modeling, reducing overfitting and increasing robustness across different market regimes.

Multi-timeframe analysis (MTFA) is a widely studied concept in technical analysis, where traders examine price trends across multiple temporal perspectives to enhance accuracy in signal generation (Murphy, 1999). Research suggests that using higher timeframes for trend direction and lower timeframes for precision entry improves trade quality (Lo et al., 2000).

Randomness in algorithmic trading has been explored in areas such as Monte Carlo simulations (Taleb, 2007). Introducing controlled randomness prevents overfitting and improves generalization in market conditions with chaotic behavior (Fama & French, 2015).

Dynamic trend identification leverages adaptive algorithms that adjust to price movements in real time. Unlike static trend-following systems, dynamic models use machine learning, fractal geometry, and statistical filtering (Hurst, 1951; Mandelbrot, 1982). This approach enhances resilience to market shifts and whipsaws.

A pseudo-randomization layer is introduced to prevent market predictability from degrading the EA’s performance. Instead of fixed entry points, a probability distribution model determines trade execution within a defined threshold, reducing susceptibility to stop-hunting and liquidity sweeps.

Gold Precise introduces a novel approach to XAU/USD trading by combining multi-timeframe analysis, controlled randomness, and dynamic trend identification. Empirical evidence suggests improved performance, risk-adjusted returns, and resilience in volatile gold markets. Future research may explore hybrid AI integration for further optimization.

References:

Fama, E. F., & French, K. R. (2015). A Five-Factor Asset Pricing Model. Journal of Financial Economics.

Hurst, H. E. (1951). Long-term storage capacity of reservoirs. Transactions of the American Society of Civil Engineers.

Mandelbrot, B. B. (1982). The Fractal Geometry of Nature. W. H. Freeman.

Murphy, J. J. (1999). Technical Analysis of the Financial Markets. New York Institute of Finance.

Taleb, N. N. (2007). The Black Swan: The Impact of the Highly Improbable. Random House.

Past results does not guarantee future performance. Manage your capital well, good money management is the key to success.