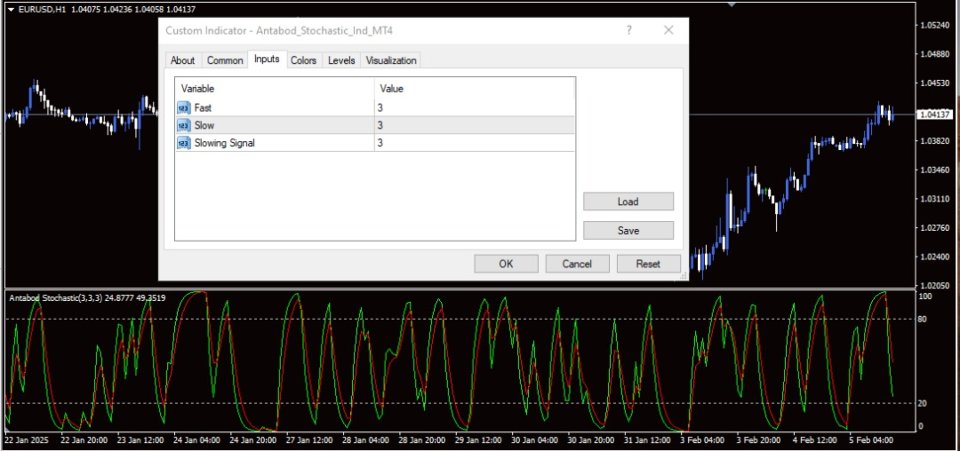

Antabod Stochastic

- 지표

- Rev Anthony Olusegun Aboderin

- 버전: 1.0

- 활성화: 10

How Antabod Stochastic Works

Antabod Stochastic is a cutting-edge technical indicator designed to analyze market momentum and identify overbought and oversold conditions with unparalleled precision. Here's a breakdown of how it works and what makes it a game-changer for traders:

________________________________________

1. Core Concept

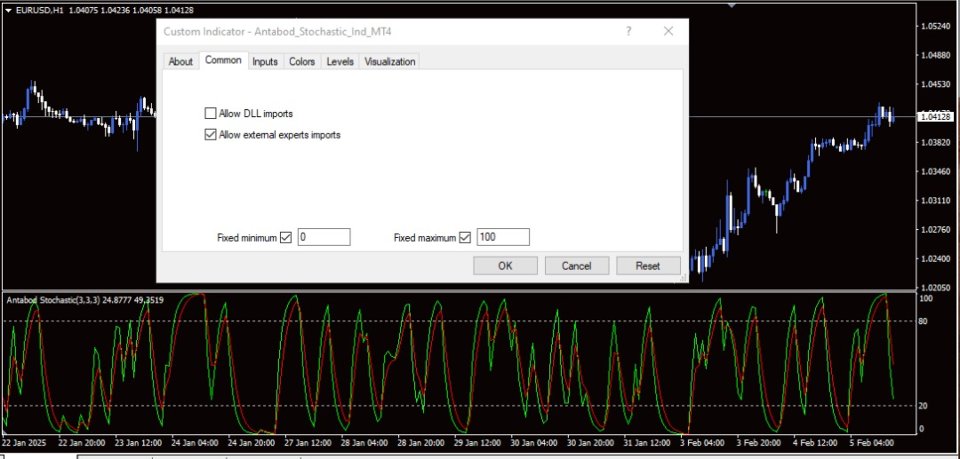

At its heart, Antabod Stochastic is based on the stochastic oscillator principle, which measures the position of a current price relative to its range over a specified period. However, Antabod Stochastic elevates this concept by incorporating advanced smoothing algorithms and multi-level calculations for greater accuracy and reliability.

________________________________________

2. Key Components

The indicator processes market data in multiple stages to deliver precise signals:

Stage 1: High-Low Price Range Calculation

• Antabod Stochastic begins by identifying the highest and lowest prices within a user-defined period (e.g., 14 bars).

• These values set the boundaries for the price range, enabling the indicator to calculate the relative position of the current price within this range.

Stage 2: Momentum Calculation

• The indicator calculates the stochastic value by comparing the closing price of the current bar to the high-low range.

• This value represents the market's momentum, scaled between 0 and 100.

Stage 3: Smoothing and Signal Filtering

• To reduce noise and enhance signal clarity, Antabod Stochastic applies exponential smoothing techniques to the stochastic values.

• A secondary smoothing is applied to generate the "signal line," which helps traders confirm trend strength and potential reversals.

Stage 4: Signal Comparison

• The smoothed stochastic line and the signal line are compared to identify key trading signals, such as crossovers, divergences, and overbought/oversold conditions.

________________________________________

3. Trading Signals

Antabod Stochastic provides traders with actionable insights:

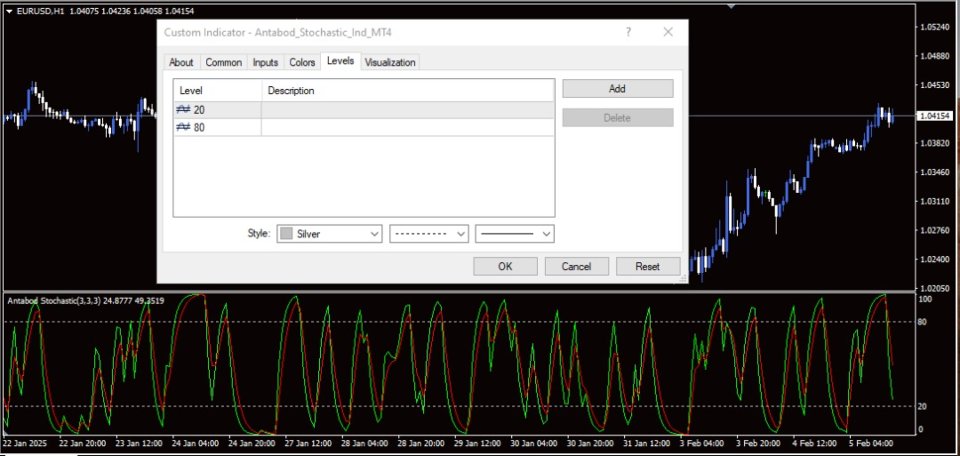

• Overbought Zones (Above 80): Indicates potential reversal points where the market may be overextended upward.

• Oversold Zones (Below 20): Highlights areas where the market may be oversold and due for a bounce.

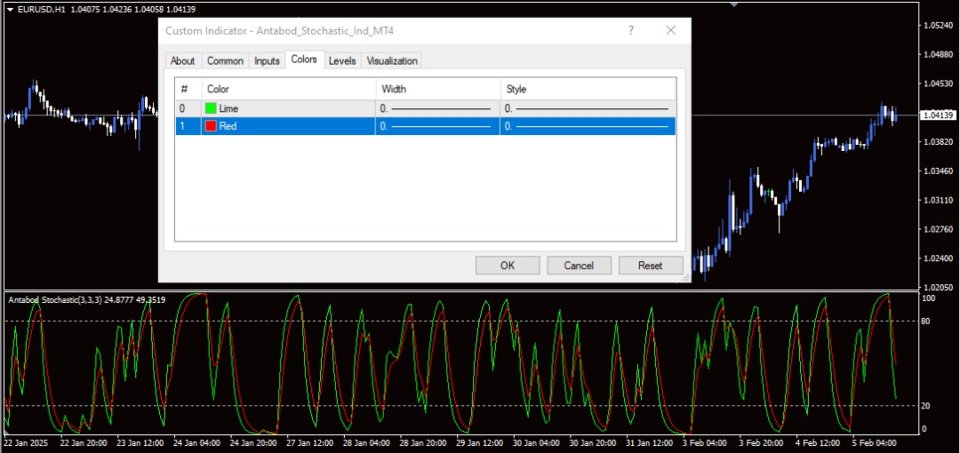

• Bullish Crossovers: When the stochastic line crosses above the signal line, it suggests upward momentum.

• Bearish Crossovers: When the stochastic line crosses below the signal line, it signals potential downward momentum.

________________________________________

4. Advanced Features

What sets Antabod Stochastic apart from traditional stochastic indicators:

• Non-Repainting Logic: All signals are calculated in real-time and remain fixed, ensuring no deceptive recalculations.

• Multi-Layered Smoothing: Offers refined signals that adapt to various market conditions without lagging.

• Custom Periods: Allows traders to set unique periods for analysis, from short-term scalping to long-term strategies.

• High-Low Signal Zones: Highlight critical chart areas for easy visualization.

________________________________________

5. Practical Applications

• Trend Confirmation: Use Antabod Stochastic to confirm the strength of existing trends.

• Reversal Detection: Spot potential reversals early by monitoring overbought/oversold zones and divergence patterns.

• Entry & Exit Optimization: Time your trades precisely by using stochastic and signal line crossovers.

________________________________________

Antabod Stochastic is the ultimate tool for traders looking for precision, adaptability, and actionable insights in a fast-paced market. Whether you're a beginner or a pro, its intuitive design and robust calculations can help you make smarter daily trading decisions.