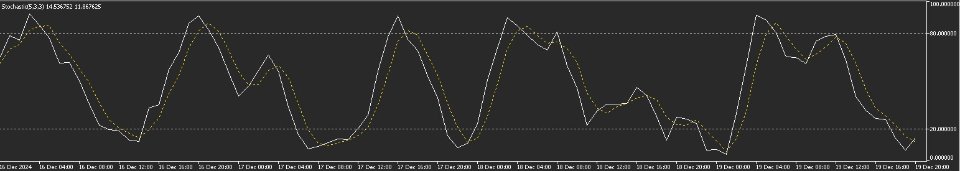

GPF Stochastic

- 지표

- Fabio Passaro Roy Casanova

- 버전: 1.0

GPF Stochastic: a momentum indicator that compares a specific closing price of an asset to a range of its prices over a certain period. It helps traders identify potential overbought or oversold conditions in the market.

The indicator consists of two lines:

- %K Line: The main line, which represents the current closing price relative to the price range over a set period.

- %D Line: The signal line, which is a moving average of %K.

The Stochastic Oscillator ranges from 0 to 100, with levels typically interpreted as:

- Above 80: Overbought (potential reversal or pullback).

- Below 20: Oversold (potential bounce or upward movement).

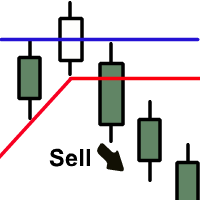

It is not used alone but in conjunction with other indicators or tools for better decision-making.

well