Adaptive Weighted Average PRO Trend MT5

- 지표

- Dang Cao Tri

- 버전: 1.1

- 업데이트됨: 3 12월 2024

- 활성화: 6

Trend Following with Adaptive Weighted Average (AWA) Indicator

The Adaptive Weighted Average (AWA) indicator is is a powerful technical analysis tool designed to provide highly accurate trading signals across various symbols and timeframes. This indicator leverages a unique Adaptive Weighted Average (AWA) calculation, combining multiple moving averages with user-defined weights, and incorporates advanced filtering techniques to minimize noise and whipsaw signals. The indicator is particularly effective on larger timeframes, offering increased precision for swing and position traders.

Core Features and Functionality

The AWA indicator leverages a sophisticated algorithm that dynamically adjusts its calculations based on market conditions. This adaptability makes it a versatile tool for navigating various market scenarios.

1. Moving Average Methods:

The indicator offers a wide selection of moving average methods, allowing you to tailor the analysis to your specific trading style and market preferences. The available options include:

-

SMA (Simple Moving Average): A basic moving average calculated by summing the closing prices over a specified period and dividing by the number of periods.

-

EMA (Exponential Moving Average): Weights recent prices more heavily, making it more responsive to new market data.

-

SMMA (Smoothed Moving Average): A smoother version of the SMA, reducing noise and providing a more stable signal.

-

LWMA (Linear Weighted Moving Average): Assigns linearly decreasing weights to older prices.

-

ALMA (Arnaud Legoux Moving Average): A smoother and less lagging moving average that offers adjustable offset and sigma parameters.

-

LSMA (Least Squares Moving Average): Uses linear regression to calculate the best-fit line for the price data.

-

VWMA (Volume Weighted Moving Average): Weighs prices based on their corresponding volume, highlighting price movements with significant trading activity.

-

DEMA (Double Exponential Moving Average): Reduces lag by applying a double exponential smoothing to the price data.

-

HULLMA (Hull Moving Average): A fast and smooth moving average known for its responsiveness to price changes.

-

KAMA (Kaufman Adaptive Moving Average): Adjusts its smoothing based on market volatility, making it effective in both trending and ranging markets.

-

TEMA (Triple Exponential Moving Average): Reduces lag further by applying triple exponential smoothing.

-

ZLEMA (Zero Lag Exponential Moving Average): Aims to eliminate lag entirely, providing a more immediate signal.

-

FRAMA (Fractal Adaptive Moving Average): Uses fractal geometry to adapt to market volatility.

-

VIDYA (Variable Index Dynamic Average): Uses the Chande Momentum Oscillator (CMO) to adjust its smoothing.

-

JMA (Jurik Moving Average): A highly customizable moving average with adjustable smoothing and phase parameters.

-

T3 (Tillson Moving Average): A triple smoothed EMA that reduces lag and noise.

-

TRIMA (Triangular Moving Average): A double smoothed SMA.

-

LR (Linear Regression): Calculates the linear regression line for the price data.

-

McGinley Dynamic Average: A type of moving average that is designed to track markets more closely than existing moving averages.

-

Laguerre: A filtering method used to analyze the market to identify potential trend changes and overbought or oversold conditions.

-

Adaptive Weighted Average (ma_taogia): A unique and powerful feature that allows you to combine multiple moving averages with user-defined weights. This enables you to create a custom moving average that leverages the strengths of different methods.

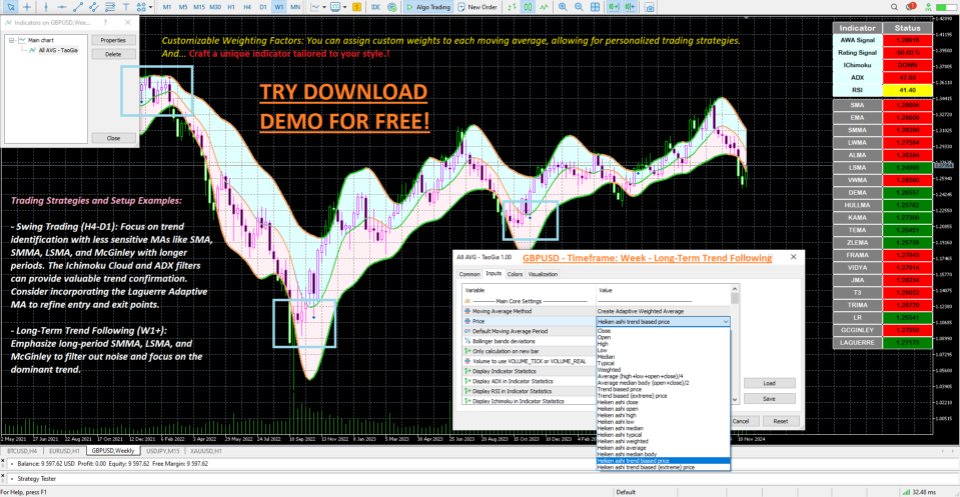

2. Price Inputs:

The AWA indicator supports various price inputs, providing flexibility in how the moving averages are calculated:

-

Close, Open, High, Low: Standard price inputs.

-

Median, Typical, Weighted, Average: Calculated price inputs that incorporate multiple price points.

-

Heiken Ashi variants: Smoothed price inputs that can reduce noise and provide a clearer picture of the trend.

-

Trend Biased variants: Prioritize closing prices higher than opening prices for buy signals and vice versa for sell signals.

3. Bollinger Bands:

The indicator incorporates Bollinger Bands, using deviations from the chosen moving average to identify potential overbought and oversold conditions.

Advanced Filtering Techniques

The AWA indicator integrates advanced filtering mechanisms to enhance the reliability of its signals and minimize false entries.

-

Ehlers Nonlinear Filter: This filter helps to smooth out the moving average and reduce the impact of short-term price fluctuations, enhancing the indicator's ability to identify the underlying trend.

-

ATR Filter: The Average True Range (ATR) filter helps to eliminate whipsaws and noise in the signal line by adjusting the moving average based on market volatility. This ensures that the signals generated by the AWA indicator are more reliable and less susceptible to false breakouts.

-

Jurik Volty Filter: This filter uses the Jurik Volatility indicator to dynamically adjust the period of the moving average, optimizing its responsiveness to changing market conditions. This adaptive period helps to capture more accurate signals, particularly in volatile markets.

-

Super Smoother Filter: This filter, developed by John Ehlers, further smooths the moving average, minimizing noise and providing a clearer picture of the dominant trend.

-

Float Value Filter: This filter helps to determine the trend without relying on the slope of the moving average. It focuses on the magnitude of price changes, providing a more robust trend identification.

-

Flattened Filter: This filter "flattens" the moving average when price changes are insignificant, helping to identify periods of consolidation and avoid false signals during sideways markets.

-

TSI (True Strength Index) Filter: This filter uses the TSI indicator to remove whipsaws and noise from the signal line, enhancing the indicator's ability to identify significant trend changes.

-

ADX (Average Directional Index) Filter: This filter removes weak points in the moving average by considering the ADX indicator, a measure of trend strength. Signals are generated only when the ADX is above a user-defined threshold and the directional indicators (+DI and -DI) confirm the trend direction.

-

Ichimoku Cloud Filter: This filter forces the signal to follow the trend by considering the Ichimoku Cloud indicator. Buy signals are generated when the price is above the cloud and other Ichimoku conditions are met, and sell signals are generated when the price is below the cloud and corresponding conditions are fulfilled.

Signal Generation and Alerts

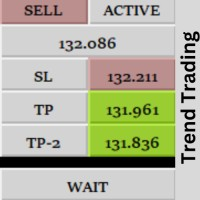

The AWA indicator can generate signals in two ways:

-

Default Signal: Based on the direction of the one chosen moving average and its relationship with the Bollinger Bands. Buy signals are triggered when the moving average is rising and the price is near the lower band; sell signals occur when the moving average is falling and the price is near the upper band. These signals are further filtered using the selected filtering techniques.

-

Cross Signal: Based on the crossover of two moving averages. The indicator includes a second moving average, which can be customized with a different method, price input, and period. Buy signals are generated when the primary moving average crosses above the secondary moving average, and sell signals are generated when the primary moving average crosses below the secondary moving average.

The indicator includes customizable alert options for signal generation, including:

-

Customizable alert messages.

-

Sound alerts, email alerts, and push app notifications.

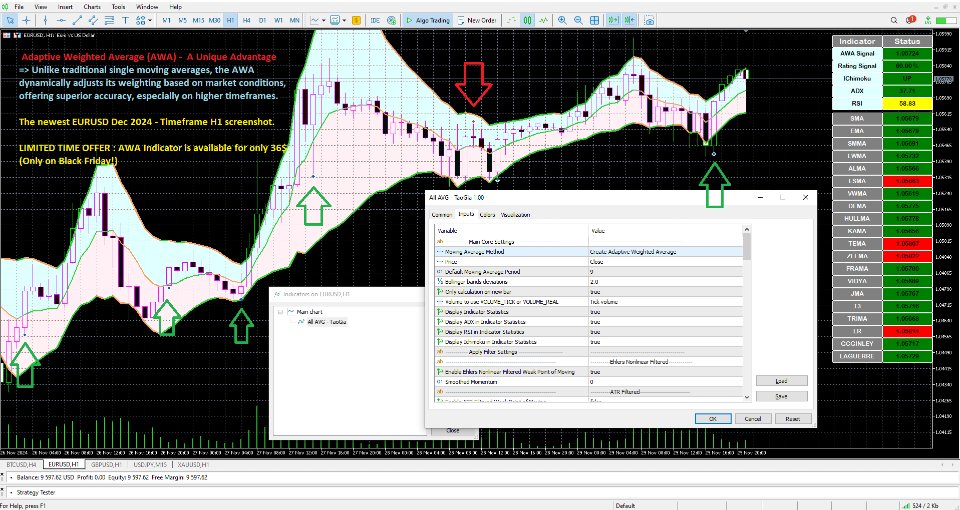

Adaptive Weighted Average (AWA) - A Unique Advantage

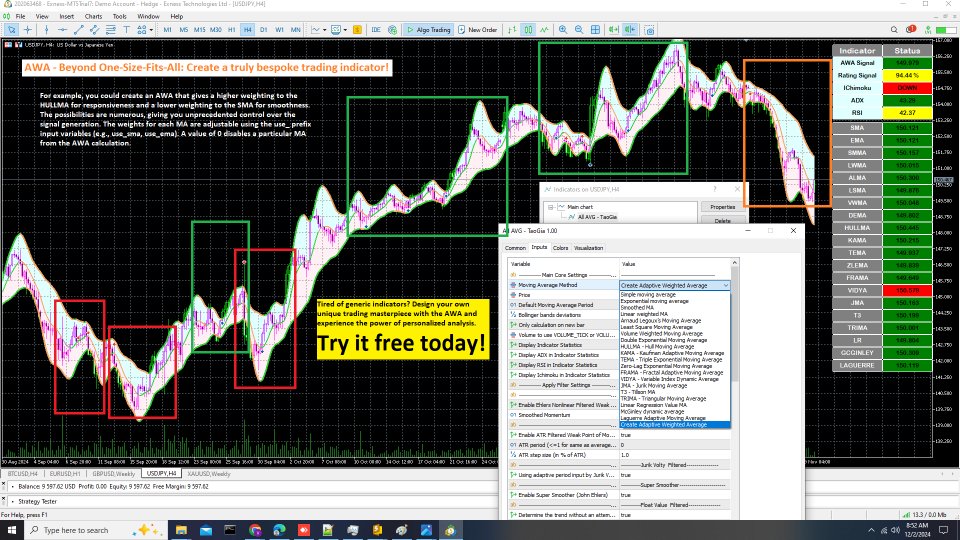

The "Create Adaptive Moving Average" option in the inpMaMethod parameter is a key highlight of this indicator. It allows you to create a custom Adaptive Weighted Average (AWA) by combining different moving averages with user-defined weights. This feature allows you to experiment with various combinations to find an optimal balance between responsiveness and smoothness, potentially leading to more accurate signals and better trading performance. For example, you could create an AWA that gives a higher weighting to the HULLMA for responsiveness and a lower weighting to the SMA for smoothness. The possibilities are numerous, giving you unprecedented control over the signal generation. The weights for each MA are adjustable using the use_ prefix input variables (e.g., use_sma, use_ema). A value of 0 disables a particular MA from the AWA calculation.

Conclusion

The AWA indicator offers a unique and comprehensive approach to technical analysis. Its adaptive nature, combined with advanced filtering techniques and a user-friendly interface, makes it a valuable tool for traders of all levels. The ability to combine various moving averages and customize filters provides a significant advantage, allowing you to fine-tune the indicator to your specific trading strategy and market conditions. Explore the potential of the AWA indicator and experience its accuracy and versatility firsthand.

Limited-Time Offer: Discover the power of personalized indicators. Try the AWA free & Design your own winning formula!

Author: TaoGiaVietNam - If you have some questions or if you need help, contact me via Private Message.