WaveTraderMA

- Experts

- ANTON KOMISSARENKO

- 버전: 1.31

- 활성화: 5

WaveTraderMA is a fully automated trading system based on the Moving Averages indicator. It supports three classic trading signals and uses a flexible position management system. It is suitable for various trading instruments and adapts to any market conditions.

Key features:

- Three entry signals for flexible strategy customization

- Three types of entry orders:

- Market order

- Pending market stop

- Limit market order

- Trading time configuration – up to six time intervals

- Closing orders after a specified number of bars

- Five types of profit-taking strategies

- Two types of stop-loss strategies

- Three types of trailing stop strategies

- Flexible lot calculation:

- Percentage of deposit

- Fixed value

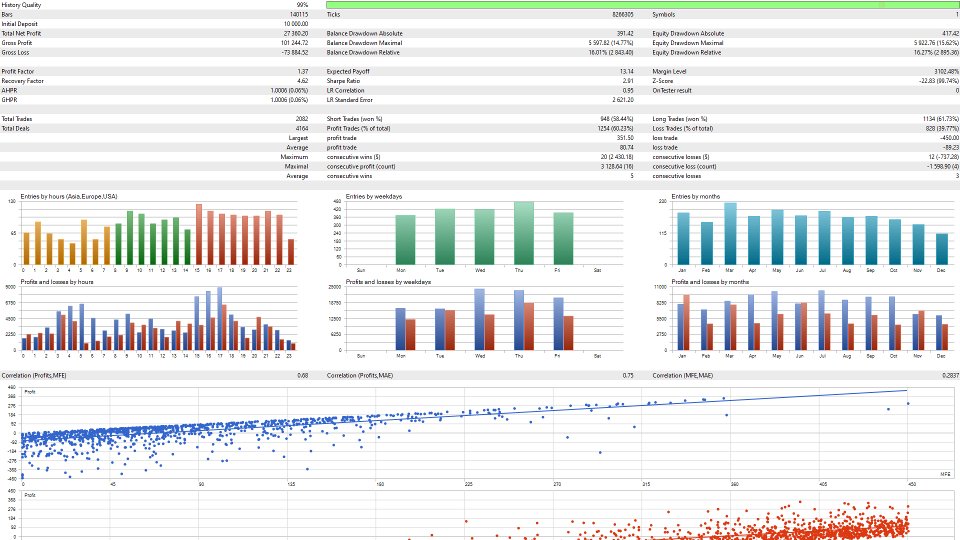

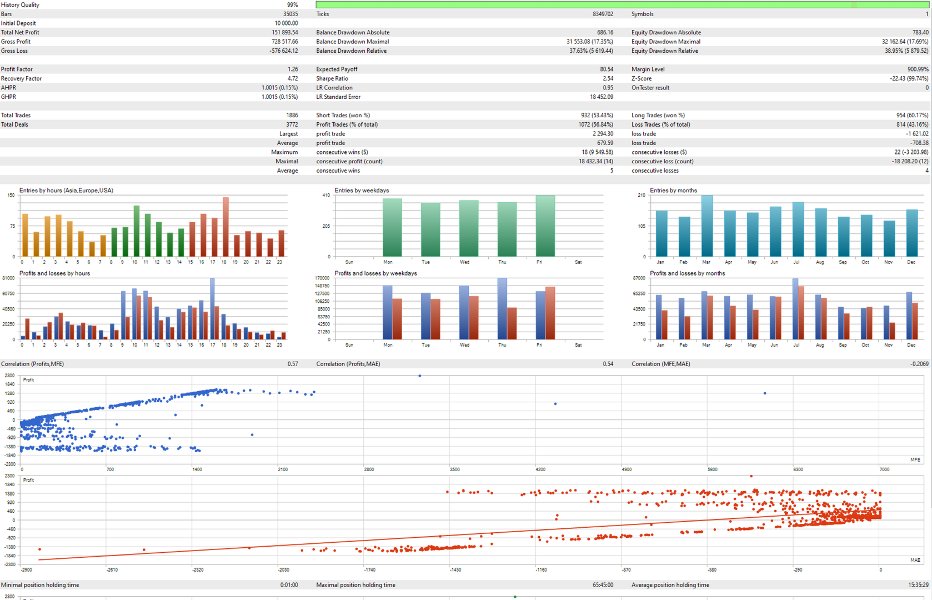

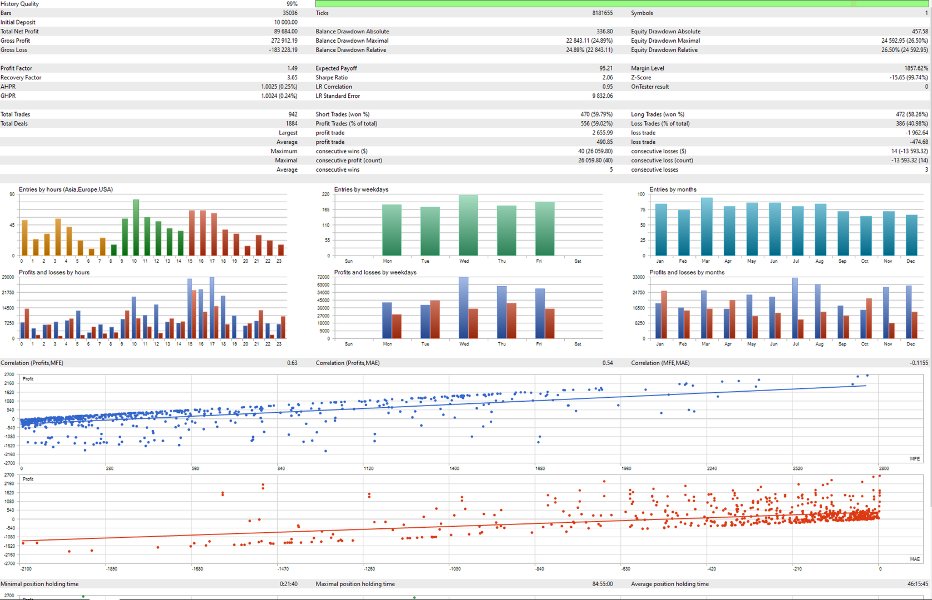

Optimization

WaveTraderMA optimizer

- Load an example template for optimization, select the instrument, timeframe, period, and signal for optimization.

- Disable the signal and parameters that do not require optimization.

- Set the interval and save it for future use.

- In the main settings, choose OHLC modeling on M1 and a genetic algorithm for faster calculations.

- After optimization, select the best result.

- Run single testing on all ticks; if the result meets the requirements, save the template.

It is also possible to use multiple signals and multiple charts for a single instrument. However, to avoid conflicts, a different Magic Number should be used.

Note: All pip calculations are based on 4 and 2 decimal places. For brokers with 5 and 3 decimal places, recalculations to 4 and 2 decimal places are performed.

System parameters:- Three types of entry orders: Market order, pending market stop, and limit market order.

- Ability to configure system operation in six time intervals.

- Profit Target Strategy 1: Fixed value.

- Profit Target Strategy 2: Initially set as a fixed value. If a bar closes towards the profit target, no changes occur. If it closes towards the stop loss, the profit target is modified by the length of the previous bar.

- Profit Target Strategy 3: Initially set as a fixed value. Subsequently, the profit target is modified by the bar length after each bar closure.

- Profit Target Strategy 4: Initially set as a fixed value. When the price moves into a loss by a specified number of pips (set in Loss distance for activation of Profit Target Strategy 4 5), the profit target is modified to break even, and no further actions are taken.

- Profit Target Strategy 5: Initially set as a fixed value. When the price moves into a loss by a specified number of pips (set in Loss distance for activation of Profit Target Strategy 4 5), the profit target is modified to break even, and no further actions are taken. If a bar closes towards the stop loss, the profit target is modified by the length of the previous bar.

- Stop Loss Strategy 1: Fixed value.

- Stop Loss Strategy 2: Stop-loss calculations are based on the low/high of candles. The minimum value from bar analysis is selected (the number of bars for analysis is set in Analysis distance in bars for stop loss strategy 2).

- Trail Strategy 1: Starts working after the stop-loss is moved to break even.

- Trail Strategy 2: Starts working immediately, and calculations are performed after the bar closes.

- Trail Strategy 3: Starts working immediately, and stop-loss modifications are based on the bar length.

-

Order lot calculation: Based on a percentage of the deposit or a fixed risk value.

-

Ability to use two orders with different profit-taking strategies.