Trend Bender Pro

- Experts

- Nebiyou Girma Tilahun

- 버전: 1.0

- 활성화: 5

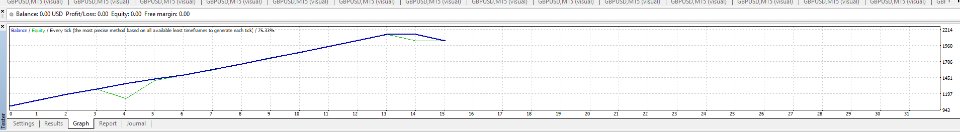

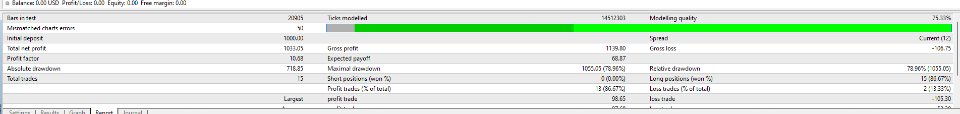

Elevate your trading game with our state-of-the-art MQL4 trading algorithm, engineered for precision and adaptability. This algorithm integrates advanced technical analysis tools and a flexible hedging strategy to help you maximize your trading potential, no matter the market conditions.

Key Features:

-

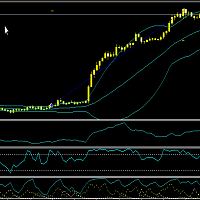

Adaptive Trend Detection: Stay aligned with the market's pulse using trend analysis across multiple timeframes—Weekly, Daily, 4-Hour, and 1-Hour. The algorithm dynamically adapts to the selected trend timeframe, ensuring trades are always in sync with the bigger picture.

-

Intelligent Entry Signals: Gain an edge with our dual-indicator entry system. Combining the power of the Relative Vigor Index (RVI) and Stochastic Oscillator, the algorithm pinpoints optimal buy and sell opportunities. Whether it's an RVI crossover or a Stochastics divergence, you’ll always know when the odds are in your favor.

-

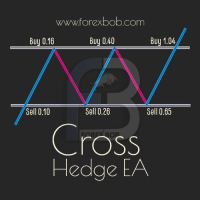

Dynamic Hedging System: When markets turn against you, our algorithm has your back. It automatically deploys a dynamic hedging strategy, placing up to two protective hedge positions in the original trade direction. The first hedge kicks in at a user-defined distance, while the second hedge doubles down for maximum recovery potential.

-

User Input Descriptions:

-

TakeProfit (TP):

- Description: Sets the target profit level for each trade. The algorithm will automatically close a position once this profit target (measured in points) is reached.

- Default Value: 500 points.

- Adjustable: Yes, users can increase or decrease this value based on their trading strategy or desired profit levels.

-

StopLoss (SL):

- Description: Defines the maximum allowable loss for each trade. The algorithm will close a position if it reaches this loss threshold (measured in points), helping to manage risk and limit potential losses.

- Default Value: 6000 points.

- Adjustable: Yes, users can modify this value to suit their risk tolerance or market conditions.

-

LotSize:

- Description: Determines the size of each trade. A higher lot size increases both potential profits and risks, while a lower lot size reduces exposure to the market.

- Default Value: 0.1 lots.

- Adjustable: Yes, users can set this to match their account size, leverage, and trading strategy.

-

TrendTimeFrame:

- Description: Selects the timeframe used for determining the market trend. Options include Weekly, Daily, 4-Hour, or 1-Hour charts, allowing users to align the algorithm with their preferred trading style.

- Options: Weekly, Daily, 4-Hour, 1-Hour.

- Adjustable: Yes, users can choose the timeframe that best fits their market outlook.

-

SignalTimeFrame:

- Description: Specifies the timeframe for generating buy or sell signals based on the Relative Vigor Index (RVI) and Stochastic Oscillator. This timeframe affects how the algorithm interprets short-term market movements.

- Options: Weekly, Daily, 4-Hour, 1-Hour, etc.

- Adjustable: Yes, users can adjust this to fine-tune the responsiveness of the algorithm’s entry signals.

-

HedgeDistance:

- Description: Sets the number of points the market must move against the original trade before placing the first hedge position. This feature allows users to recover from adverse market movements by adding a second position in the same direction.

- Default Value: 1000 points.

- Adjustable: Yes, users can modify this value based on their strategy and market conditions.

-

SecondHedgeDistance:

- Description: Defines the additional number of points required after the first hedge to trigger the second hedge position. This secondary level of hedging helps to further mitigate risks if the market continues to move against the initial trade.

- Default Value: 1500 points.

- Adjustable: Yes, users can adjust this based on their comfort level with risk and desire for added protection.

These user inputs provide traders with the flexibility to tailor the "TrendBender Pro" algorithm to their specific needs, risk appetite, and trading style. By adjusting these parameters, users can optimize their trading performance across various market conditions.

Customizable Risk Management: Set your own Take Profit (TP) and Stop Loss (SL) levels, with default settings at 600 points for both. Adjust the lot size to fit your risk tolerance, starting from an initial 0.1, ensuring that every trade aligns with your strategy.

-

-

Real-Time Profit Monitoring: Stay informed at all times with real-time chart updates. The algorithm displays your account balance, equity, and running profit/loss directly on the chart, color-coded for instant insights—green when in profit, red when in loss. Never miss a beat in your trading performance.

Why Choose This Algorithm?

Designed for traders who want the perfect blend of precision and adaptability, this MQL4 algorithm is your all-in-one solution for navigating volatile markets with confidence. Whether you’re a trend follower or a fan of technical analysis, our algorithm delivers automated, hands-free trading with a focus on capital protection and growth.

Transform your trading strategy today—unlock the power of trend-based analysis and dynamic hedging with the Ultimate Trend-Driven MQL4 Algorithm. Achieve consistency, minimize risk, and let your profits run!