Triple Hedge Guard

- Experts

- Nebiyou Girma Tilahun

- 버전: 1.0

- 활성화: 5

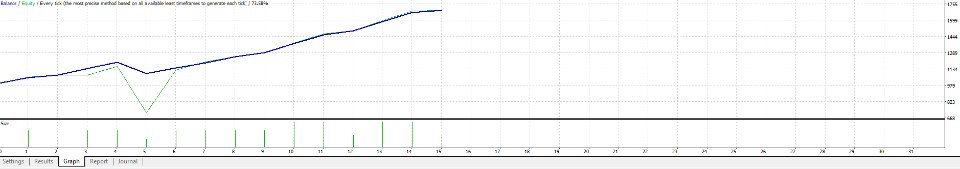

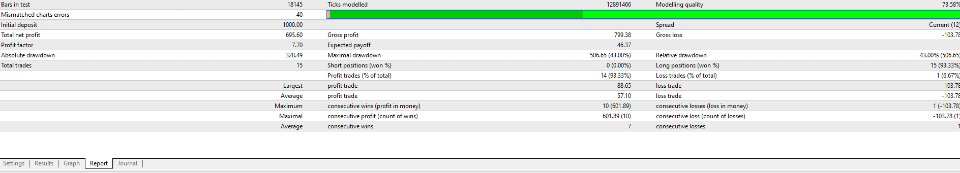

Introducing Triple Hedge Guard, a powerful and adaptive trading algorithm designed to safeguard your investments with advanced risk management strategies. This algorithm is built to operate based on weekly chart trends, dynamically adjusting to market conditions while minimizing potential losses through a unique triple hedge feature.

Key Features:

- Triple Hedge Protection: In times of market volatility, the algorithm triggers up to three hedge positions to strategically counterbalance losses, ensuring that you're always protected.

- Dynamic Lot Sizing: Optimized for flexibility, Triple Hedge Guard can adjust lot sizes dynamically based on your account’s equity, maximizing profitability while managing risk.

- Precision Entries: Using proven technical indicators like Moving Averages (MA) and Relative Strength Index (RSI), the algorithm makes intelligent entry and exit decisions, capturing profitable market opportunities.

- Advanced Risk Control: With customizable Stop Loss and Take Profit settings, including the ability to fine-tune trade parameters, Triple Hedge Guard ensures that you stay in control of your risk exposure at all times.

Whether you're a seasoned trader or just starting out, Triple Hedge Guard offers the perfect blend of protection, strategy, and profit potential. It's your trusted partner in navigating the financial markets with confidence.

Here is a detailed description of all the user input parameters for Triple Hedge Guard:

1. Lots (double)

- Description: The fixed lot size for each trade if dynamic lot sizing is disabled.

- Example: 0.1 means each trade will be opened with 0.1 lots.

- Usage: Set this to your preferred lot size if you don’t want the algorithm to adjust the lot size based on account equity.

2. UseDynamicLot (bool)

- Description: Enables or disables dynamic lot sizing.

- Options: true or false

- Example: true will adjust the lot size based on your equity. false will use the fixed lot size (from the "Lots" parameter).

- Usage: Set this to true to let the algorithm manage lot sizes based on risk.

3. RiskPercent (double)

- Description: The percentage of account equity to risk per trade when dynamic lot sizing is enabled.

- Example: 1.0 means 1% of the account equity will be used to calculate the lot size.

- Usage: Only used when UseDynamicLot is set to true . Adjust this based on your risk tolerance.

4. TakeProfit (double)

- Description: The number of pips for the Take Profit (TP) level.

- Example: 900 means the trade will close with a profit of 900 pips.

- Usage: Set this to your desired profit target.

5. StopLoss (double)

- Description: The number of pips for the Stop Loss (SL) level.

- Example: 5000 means the trade will close with a loss if the price moves 5000 pips against the position.

- Usage: Set this to control the maximum allowable loss per trade.

6. MA_Period (int)

- Description: The period for the Moving Average (MA) used to determine market trends.

- Example: 20 means the algorithm will calculate the 20-period MA.

- Usage: Adjust this based on your preference for short-term or long-term trend analysis.

7. RSI_Period (double)

- Description: The period for the Relative Strength Index (RSI) indicator.

- Example: 14 means the algorithm will calculate the 14-period RSI.

- Usage: Adjust this to fine-tune the RSI for detecting overbought and oversold market conditions.

8. RSI_Overbought (double)

- Description: The level at which the RSI indicates the market is overbought and signals a sell opportunity.

- Example: 70 means the algorithm will consider the market overbought when RSI reaches 70.

- Usage: Set this based on your strategy for identifying sell opportunities.

9. RSI_Oversold (double)

- Description: The level at which the RSI indicates the market is oversold and signals a buy opportunity.

- Example: 30 means the algorithm will consider the market oversold when RSI reaches 30.

- Usage: Set this based on your strategy for identifying buy opportunities.

10. HedgeLossPoints (int)

- Description: The number of points a trade must be in loss before triggering the first hedge position.

- Example: 50 means if the trade moves 50 points in loss, the first hedge position will be opened.

- Usage: Adjust this based on how soon you want the algorithm to hedge your trade.

11. SecondHedgeLossPoints (int)

- Description: The number of points the first hedge position must be in loss before triggering the second hedge.

- Example: 50 means if the first hedge goes 50 points in loss, the second hedge will be opened.

- Usage: Adjust this based on your strategy for handling further losses.

12. ThirdHedgeLossPoints (int)

- Description: The number of points the second hedge position must be in loss before triggering the third hedge.

- Example: 50 means if the second hedge goes 50 points in loss, the third hedge will be opened.

- Usage: Adjust this based on how you want to manage deeper losses.

13. HedgeMultiplier (double)

- Description: The multiplier used to determine the lot size for each hedge position.

- Example: 2.0 means the lot size of each hedge position will be twice the size of the original trade.

- Usage: Set this to control how aggressive the hedging strategy is in terms of lot sizing.

14. TrendTimeframe (ENUM_TIMEFRAMES)

- Description: The timeframe for the chart used to determine the market trend.

- Example: PERIOD_W1 means the algorithm will use the weekly chart to identify trends.

- Usage: Adjust this to change the trend-detection timeframe, depending on your trading strategy (e.g., PERIOD_D1 for daily trends).