Grid Averaging Strategy

- Experts

- Ron Damstra

- 버전: 1.4

- 업데이트됨: 29 10월 2024

- 활성화: 10

Description:

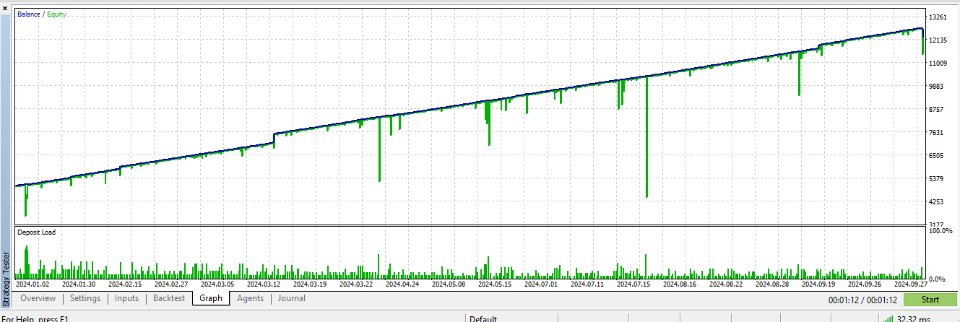

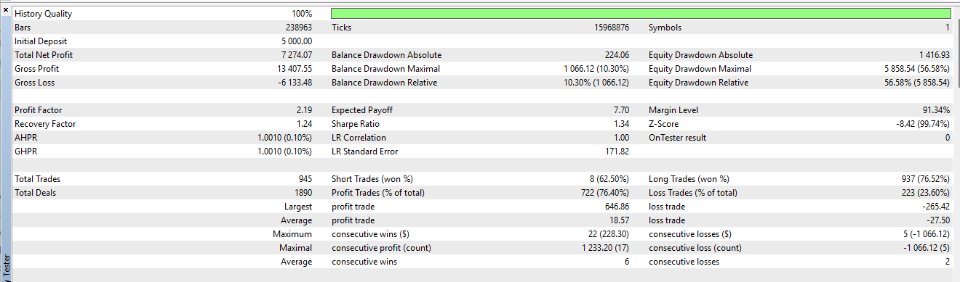

The Grid Averaging Strategy EA is a fully automated trading system designed to maximize profits through grid and averaging techniques, without relying on traditional stop loss methods. Instead, the EA uses an equity-based "stop loss," which ensures that positions are closed when a certain percentage of the account equity is lost. The recommended setting is 100%, meaning the EA will close all positions when the total drawdown reaches 100% of the defined equity.

Key Features:

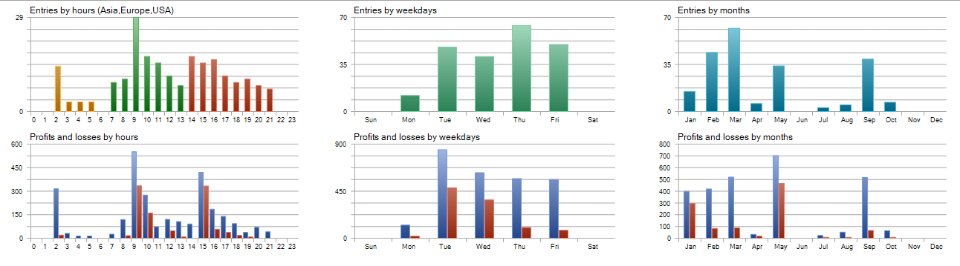

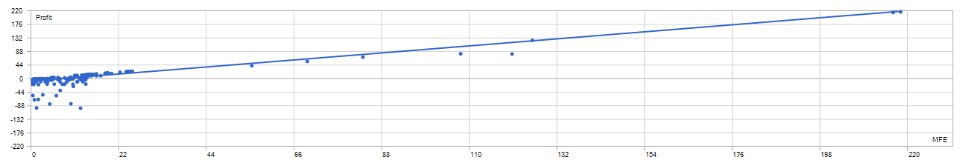

- Grid Trading: Automatically places buy and sell orders at preset intervals, creating a grid of positions to capitalize on price movements.

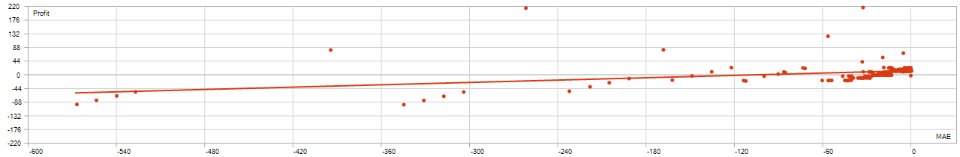

- Averaging Strategy: The EA opens additional trades at better prices when the market moves against an open position, averaging the entry price to close positions in profit during a market reversal.

- Equity Stop Loss: Instead of a conventional stop loss, this EA employs an equity-based approach. When a defined percentage of the account equity is reached in losses (recommended at 100%), all positions will be closed to protect your capital.

- Customizable Parameters: Traders can adjust grid size, lot size, RSI levels, and more to tailor the EA to different instruments and trading styles.

- Trend Avoidance: Built-in moving average and RSI filters reduce trading in less favorable market conditions, avoiding trends that could lead to significant drawdowns.

- Compatible with All Timeframes and Instruments: The EA is suitable for forex pairs, indices, commodities, and other instruments, making it versatile across various markets.

Example Settings for Different Instruments with an account balance of 5000 USD:

| Parameter | GBPUSD | US30 | DE30 | FR40 | GOLD | SILVER |

| Equity Risk % | 100 | 100 | 100 | 100 | 200 | 200 |

| Lot Size | 0.02 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 |

| Timeframe to Run | 1 minute | 1 minute | 1 minute | 1 minute | 1 minute | 1 minute |

| Main Levels | 0.01 | 1000 | 1000 | 1000 | 50 | 5 |

| Grid Levels | 0.002 | 50 | 25 | 25 | 10 | 0.1 |

| Break Even Level | 4 | 4 | 4 | 4 | 4 | 4 |

| Level to Add Weighted Lot | 6 | 5 | 10 | 5 | 6 | 10 |

| Weight Factor | 2 | 2 | 2 | 2 | 2 | 2 |

| Slowdown Level (0=Disabled) | 4 | 8 | 8 | 6 | 0 | 6 |

| Slowdown Factor | 5 | 5 | 10 | 10 | 5 | 10 |

| MA Mode | Smoothed | Smoothed | Smoothed | Smoothed | Smoothed | Smoothed |

| MA Period Line | 50 | 50 | 200 | 200 | 200 | 200 |

| Short MA Timeframe | 15 Minutes | 1 Week | 1 Day | 1 Day | 4 Hours | 4 Hours |

| RSI Period | 14 | 14 | 14 | 14 | 14 | 14 |

| RSI Timeframe | 15 Minutes | 1 Day | 1 Day | 1 Day | 1 Hour | 1 Hour |

| Lower RSI Sell Limit | 30 | 20 | 20 | 20 | 20 | 20 |

| Upper RSI Sell Limit | 60 | 100 | 100 | 100 | 100 | 100 |

| Lower RSI Buy Limit | 40 | 0 | 0 | 0 | 0 | 0 |

| Upper RSI Buy Limit | 70 | 80 | 80 | 80 | 80 | 80 |

How It Works:

- The EA opens trades in both directions, creating a grid of positions at preset intervals.

- If the market moves unfavorably, additional positions are opened to average the entry price, improving chances of closing all positions in profit during a reversal.

- If the total drawdown reaches the defined equity risk limit (e.g., 100%), the EA will automatically close all positions to protect your capital.

Optimized for Ranging and Volatile Markets:

This EA is best suited for volatile or ranging markets where price frequently reverses. It uses grid trading to profit from these movements, but it’s important to remember that trending markets can lead to larger drawdowns, making the equity-based stop loss a critical risk management tool.

Risk Disclaimer: The equity "stop loss" feature provides an added layer of protection, but significant drawdowns can occur before it is triggered. It is recommended to use this EA with cautious risk management, testing it on a demo account to evaluate performance.