Index Daily Breakout MT5

- Experts

- Cristian Alexander Aravena Danin

- 버전: 1.21

- 업데이트됨: 8 11월 2024

- 활성화: 10

CHRISTMAS OFFER PRICE!! $750

NO MARTINGALE, NO GRID, NO ARBITRAGE, NO NEURAL NETWORKS

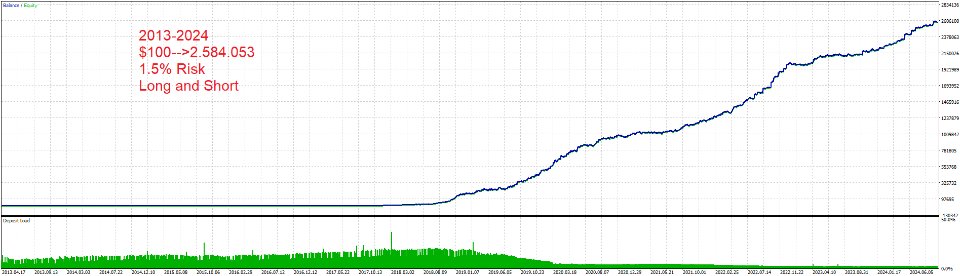

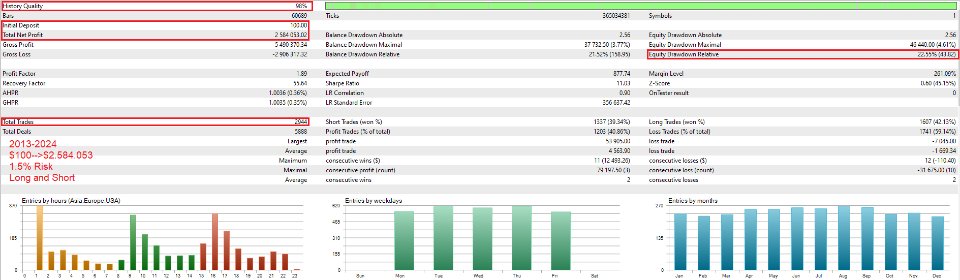

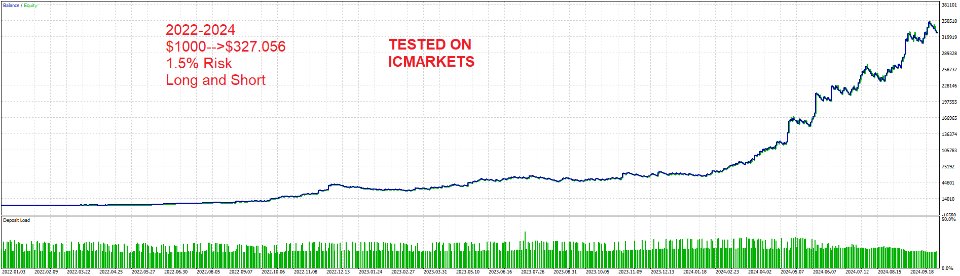

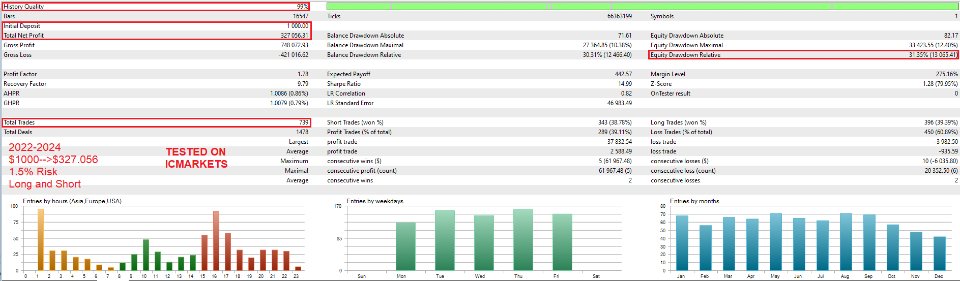

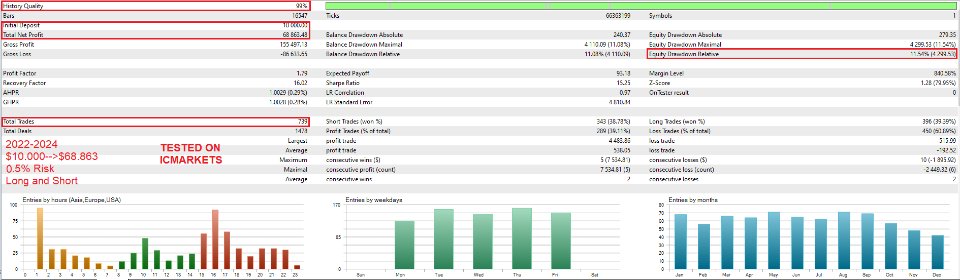

10+ YEARS TEST

Index Daily breakout is an EA that trades the US30/DowJones daily breakout; it doesn't use martingale or grid; It uses a real strategy and just makes a simple trade with a trailing stop loss.

You can set the desired risk per trade, using a flat amount in USD or using a percentage of the account equity. I recommend using the percentage risk and not using more than 2%. Keep in mind that a higher risk means a higher reward but also bigger drawdowns.

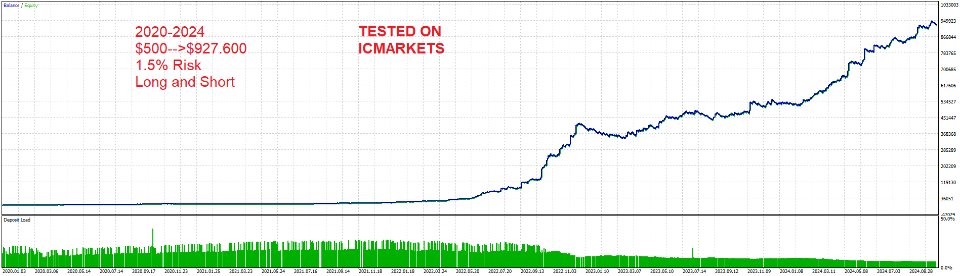

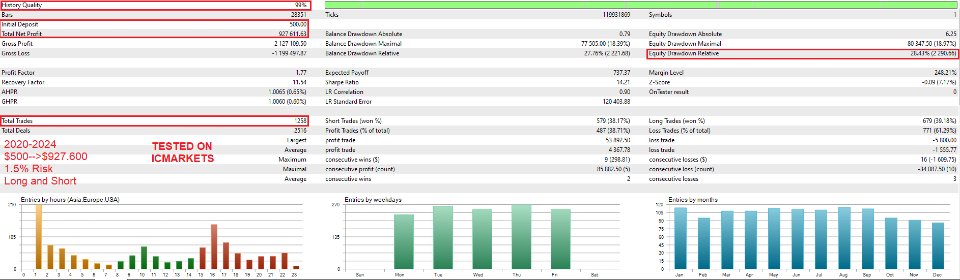

Brokers tested: ICMarkets, FPMarkets, Pepperstone, FusionMarkets (These are the brokers tested; it may work in others that I haven't tested yet) They had different performances; the one with the best performance was ICMarkets.

Working on making a signal for the EA; once the signal is done, the EA price will increase!!

HOW TO USE:

The use of the ea is very simple; just use it in a US30 1H chart.

The ea has to be running at all times, so I recommend using a 24/7 VPS.

IT'S IMPORTANT TO USE AN ACCOUNT WITH NO COMMISSIONS ON INDEXES OR THE EA WON'T WORK AS INTENDED❗ ❗

Having low spreads is good but not vital, so if you have to choose, use an account with spread but no commission over an account with commissions and low spread.

I recommend using the raw spread account from IC Markets as it has low spreads and no commission on indexes.

min deposit: $100 with 1:100 leverage (Keep in mind that using a low deposit can result in a higher risk than desired because the ea will have to trade with the broker's minimum lot size)

Recommended deposit: $500 1:100

PARAMETERS:

Magic Number: It's just a number to identify the trades made by the EA.

USD Risk: It's a fixed amount at risk per trade (set this to 0 to use the %Risk).

Percentage %Risk: It's a percentage of the account equity at risk per trade. (Recommended) (a value higher than 2% is high risk)

Allow Trade Short.

Allow Trade Long. ( I recommend allowing both long and short )