Silver Bullet Strategy Indicator

- 지표

- Niquel Mendoza

- 버전: 1.1

- 업데이트됨: 26 9월 2024

- 활성화: 10

Silver Bullet Indicator - Optimize Your Market Analysis with the ICT Strategy

Our Silver Bullet indicator is designed to help you conduct clearer and more effective analysis based on ICT's popular Silver Bullet Strategy. With advanced tools and customizable features, this indicator enhances your ability to identify trading opportunities.

Key Features:

-

Information Panel: Provides key data for your market analysis:

- DOL (Daily Objective Level): The target price for the session, where you should focus your trading strategy.

- DOL Price: The target value of the DOL for the session.

-

Show Objects: Control the display of graphical elements on the chart:

- Show only sessions: Displays only operational sessions.

- Show all: Displays all available graphical objects.

- Hide: Hides all graphical objects from the chart.

-

Server Time: Monitors the current time of your trading server to synchronize your trades.

-

Enable Alerts: Receive notifications when buying or selling opportunities arise according to the indicator's signals.

-

Trend Strength Level: A visual marker indicating the current strength of the market trend.

-

Trend Detection: Easily identify the prevailing market trend for more informed decision-making.

Advanced Settings:

-

Additional Verification: Increases the rigor of the indicator in detecting manipulations and price shifts.

-

Settings for Sell Operations: Customize the indicator's rules for sell operations to match your trading style.

-

Take Profit Reference (Points): Set a reference take profit in the absence of nearby liquidity zones.

-

Minimum Distance between DOL (Points): Defines the minimum distance between the current price and the DOL, crucial for determining stop loss and take profit.

-

Minimum Stop Loss (Points): Set a reference stop loss in the absence of nearby liquidity zones.

-

Minimum Trend Distance (Points): Parameter to define the minimum distance in points for identifying bullish or bearish trends.

Silver Bullet Strategy - ICT: Session Adjustment

The Silver Bullet Strategy by ICT operates during three key sessions based on New York Time:

- London Session: 3:00 AM - 4:00 AM (New York Time).

- New York Morning Session: 10:00 AM - 11:00 AM (New York Time).

- New York Afternoon Session: 2:00 PM - 3:00 PM (New York Time).

Adjustments Based on Personal Analysis

I have made some personal adjustments by moving the start time of the London and New York Morning sessions 10 minutes earlier. This is because, based on my analysis, I’ve observed market manipulations just before these sessions begin.

--- Opening and Closing of Markets --- These settings will allow you to identify the highs and lows of the main global market sessions, such as London, New York, and Asia.

SL - TP: The Stop Loss and Take Profit are based on liquidity zones (if present). If no liquidity zones are detected, the configured reference SL or TP values will be applied.

- Take Profit: Offers 3 levels of Take Profit.

- Stop Loss: Includes 2 levels of Stop Loss.

- Strategies: The indicator offers 2 strategies: one based on market manipulation and another based on trend, both following the Silver Bullet approach. More strategies will be added in future versions.

- Color Customization: You can customize the colors of graphical objects, lines, and texts to fit your trading style.

- Multi-Language Support: You can now set the indicator to either Spanish or English, according to your preference.

Backtesting

We tested the indicator across various trading instruments such as FOREX, metals, cryptocurrencies, and indices. The results presented are completely transparent, based on the number of winning and losing trades. (September 1 - September 20)*

| Win Rate % | |

|---|---|

| WR + 82% | Forex(EURUSD, GBPUSD) , Commodities(XAUUSD) |

| WR 71% - 82% | Commodities (XAGUSD), Indexes(NAS100) |

| WR 50% - 71% | Forex(AUDUSD,USDJPY),Crypto(BTCUSD) |

| WR 50% - | Indexes(US500) |

Recommendation: It is advised to trade symbols with a higher Win Rate using this indicator. Here are some specific tips:

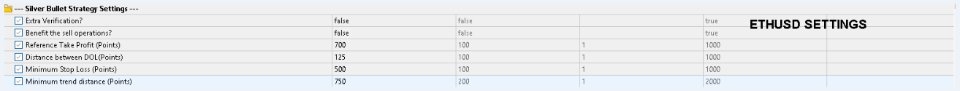

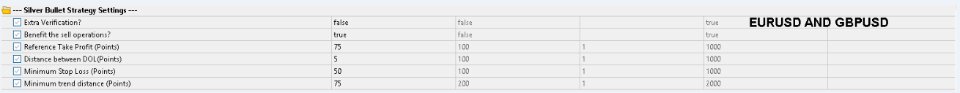

Below are the modifications of the most important variables of the indicator:

most important variables:

- Benefit the sell operations?.

- Extra Verification?.

Indixes:

- Benefit the sell operations?: TRUE

- Extra Verification?: FALSE

Forex:

- Benefit the sell operations?: TRUE

- Extra Verification?: FALSE

Commodities (Gold, Silver) and BTCUSD:

- Benefit the sell operations?: FALSE

- Extra Verification?: FALSE

Note: These settings are not permanent. The current market context has favored these configurations, and according to our analysis, they may continue to work until just before November 2024.

Detailed Explanation of the Most Important Variables of the Indicator:

Variable "Benefit the sell operations?": This variable adds an additional condition to sell positions when set to false. If it is true, no extra condition is added. The impact on the Win Rate (WR) comes from markets with prevailing bullish trends, such as BTC or metals, which have shown strong increases this year. On the other hand, there are more "lateral" assets, such as FOREX pairs, which may experience spikes at certain times but generally maintain stability in their exchange rate, like EURUSD. Additionally, some markets are already showing bearish trends.

When we refer to "trend," we are talking about the general market trend in higher timeframes, such as weekly or daily.

Recommendations:

- In bullish markets: false.

- In bearish or undefined trend markets: true.

Variable "Extra Verification?": This option adds an additional verification to buy positions (similar to "Benefit the sell operations?" but applied to purchases). The verification consists of the indicator ignoring the trade if the price is above the BSL at the time of the trade. This can be unfavorable in bullish trend markets but favorable in lateral markets.

Personal Recommendation: If you prefer a more conservative approach, I suggest activating this variable. Conversely, if you seek faster and more direct trades, I recommend deactivating it.

Recommendation: Before acquiring the indicator, we suggest adjusting the Stop Loss (SL) and Take Profit (TP) according to your preferences. In our backtesting, we used a high-medium TP and a medium SL.

How to Use the Indicator? Step by Step:

-

Download the Demo: Click on "Download Demo" and open your MT5 platform. If it doesn't redirect you automatically, you can manually search for the indicator in the "Market" section of MT5, which comes pre-installed in the platform.

-

Find the Indicator: Go to the "Indicators" section within "Market" and type the indicator's name in the search bar: "Silver Bullet Strategy Indicator". Then, select the option to download the demo.

-

Test the Indicator: Go to the strategy tester in MT5 and select "Indicators."

-

Access the Indicator: Open the "Market" folder and search for our indicator by name.

-

Configure and Run: Adjust the indicator's parameters according to your preferences and start running backtests.

Additionally, here are some recommended settings for the symbols that have shown the best results:

Forex(GBPUSD-EURUSD)

| Variable | State |

|---|---|

| Extra Verification?:(true or false) | False |

| Benefit the sell operations? :(true or false) | True |

| Reference Take Profit (Points) : | 75 |

| Distance between DOL(Points) : | 5 |

| Minimum Stop Loss (Points) : | 50 |

| Minimum trend distance (Points) : | 75 |

Index(NAS100):

| Variable | State |

|---|---|

| Extra Verification?:(true or false) | False |

| Benefit the sell operations? :(true or false) | True |

| Reference Take Profit (Points) : | 600 |

| Distance between DOL(Points) : | 50 |

| Minimum Stop Loss (Points) : | 400 |

| Minimum trend distance (Points) : | 600 |

Crypto(ETHUSD):

| Variable | State |

|---|---|

| Extra Verification?:(true or false) | False |

| Benefit the sell operations? :(true or false) | False |

| Reference Take Profit (Points) : | 700 |

| Distance between DOL(Points) : | 125 |

| Minimum Stop Loss (Points) : | 500 |

| Minimum trend distance (Points) : | 750 |

Futures:

- Remove the time configuration (as it may confuse many people) and adjust it to GMT 0.

- Include more ICT models to improve the Win Rate (WR).

- Add more liquidity zones.

- Add a buffer for entry and sell signals.

Suggestions: If you have any questions about the indicator, feel free to message me privately.

*2024