BullStreet AI

- Experts

- Marco Resseghini

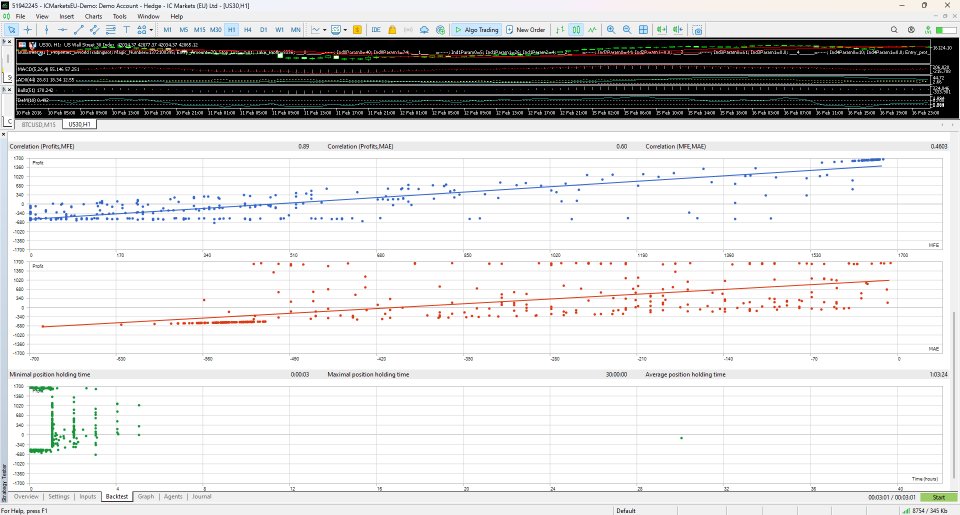

- 버전: 3.4

- 활성화: 5

BullStreet AI: The Future of US30 Trading

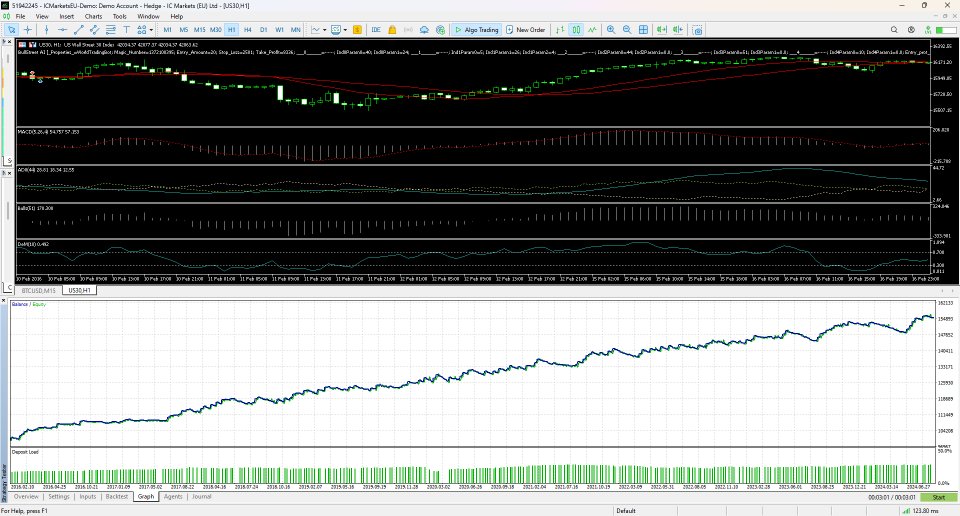

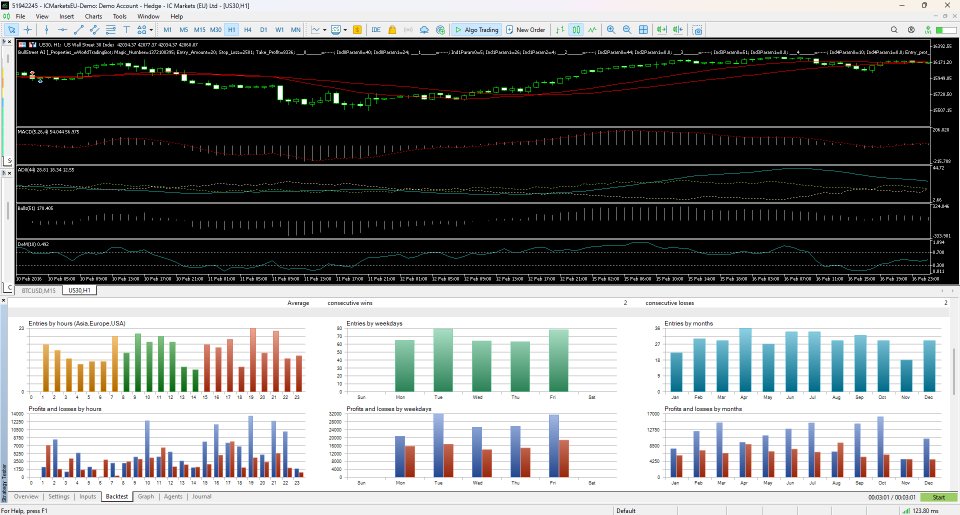

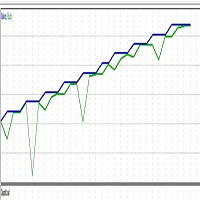

BullStreet AI is the advanced trading bot designed to trade US30 with precision and intelligence, working on a H1 timeframe. Its goal is to maximize capital in the long term, using strategies based on technical analysis and artificial intelligence to make informed trading decisions.

- H1 timeframe analysis to identify significant trends

- Long-term strategy with disciplined approach

- Fully automated to reduce emotion in trading decisions

Trust technology to operate safely!

BullStreet AI offers investors a unique opportunity to tap into the growth potential of the Dow Jones (US30) while eliminating the stress of constantly monitoring the market. With advanced algorithms, BullStreet AI executes trades with precision to grow capital over the long term, without promising quick gains.

- Trading based on mathematical logic and artificial intelligence models

- Reduces the risks associated with the emotional factor in trading

- Suitable for investors aiming for progressive and sustainable growth

Why BullStreet AI?

BullStreet AI is a solution for those who want to approach the US30 market with an automated, reliable strategy supported by cutting-edge technologies. With a focus on long-term strategies and careful capital management, this bot is ideal for investors looking for a methodical and controlled trading experience.

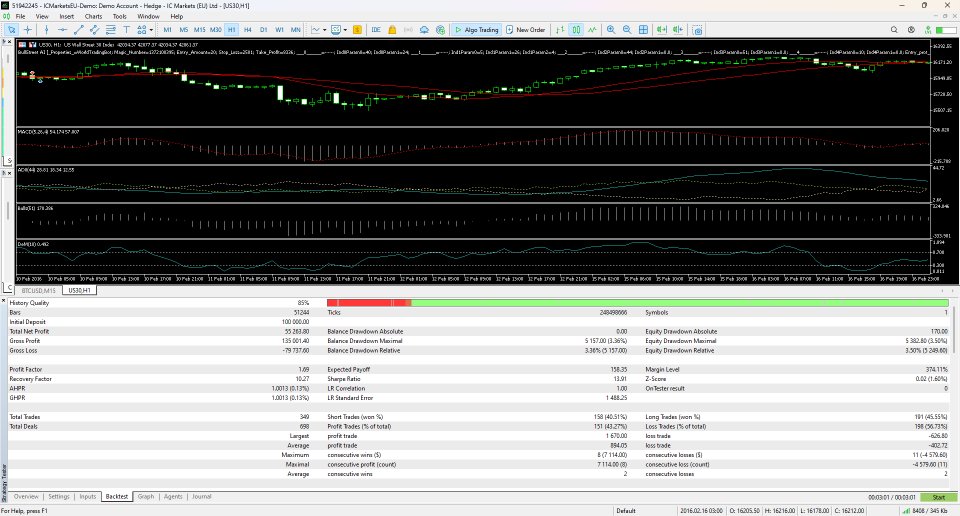

INFORMATION

🟢 Minimum Deposit: $100

🟢 Recommended Broker: ICmarkets (other brokers may not give the same results)

🟢 Period: H1

🟢 Pair: US30

🟢 Win Rate: 40%

🟢 Risk Management

🟢 News Filter

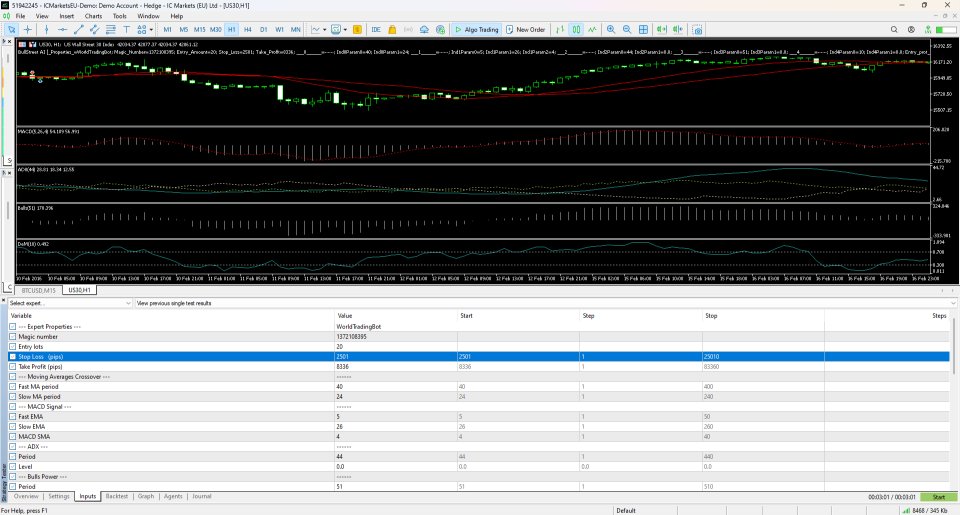

🟢 Customizable settings

🟢 Backtesting since 2016

NO HFT, NO GRID, NO MARTINGALE

IMPORTANT NOTE : BullStreet AI is designed to work on the H1 Timeframe, so it may take days for positions to be opened; in some cases, it may not open trades for a whole month. It is recommended to test the bot on a demo account before switching to a live account to fully understand how it works.

RISK WARNING : Before purchasing BullStreet AI, it is essential to understand the risks associated with automated trading. Past performance does not guarantee future results and the EA can suffer losses. The backtests presented have been optimized to find the best parameters, but do not necessarily reflect real market conditions. Trading involves significant risks, so only invest capital that you are willing to lose. A proper risk management strategy is always recommended.