Forex trading bot ai

- Experts

- Andrey Kozak

- 버전: 2.0

- 업데이트됨: 3 9월 2024

- 활성화: 20

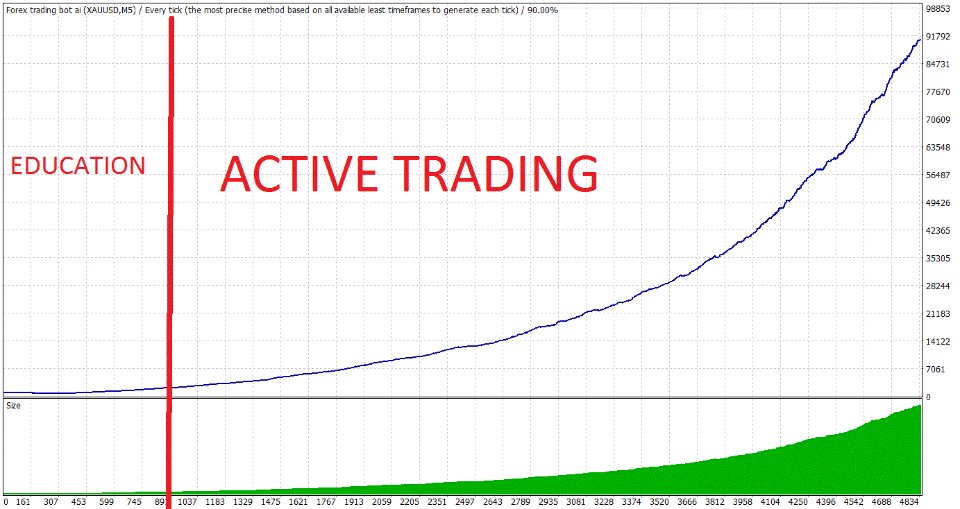

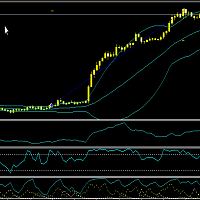

Forex trading bot ai is an artificial intelligence-based robot with self-learning capabilities. This robot initiates its first trades based on the input parameters specified in the settings. Each trade executed by the robot is recorded in a file (memorized). The robot then analyzes all the closed trades and the conditions under which they were closed. If the overall profit of the closed trades is negative, the robot examines the parameters with which they were opened and adjusts them to improve trading results. In this way, the robot continuously learns and independently selects the most effective trading parameters. The robot's learning process begins once the first 10 orders have been closed. The robot trains on the last 100 trades it has executed. The input parameters in the settings are needed only for opening the first 10 orders, after which the robot starts optimizing the settings on its own. Thus, the longer the robot trades on the chart, the better its performance becomes.

What do you get when you purchase the robot?

- An automated trading robot.

- SET files with settings for effectively opening the first trades while the robot is still in the learning phase.

- Access to a closed VIP channel for developers.

- The ability to install the robot on 20 different PCs.

- You can install the robot on an unlimited number of trading accounts. The robot is linked to the PC.

- Free access to all the latest updates for the robot.

- Lifetime usage of the robot without restrictions.

Advantages of the robot:

- The robot is based on artificial intelligence, capable of self-learning and improving trading results.

- The robot independently selects the most effective trading parameters.

- The robot can trade on different currency pairs, but it delivers the best results on XAUUSD (GOLD).

- The robot can learn to trade with almost any broker.

- The robot can also learn to trade on any timeframe.

Trading conditions under which we tested the robot:

- Broker: FXopen

- Currency pair: XAUUSD

- Timeframe: M1

- Spread on XAUUSD: 12-15 points

- Leverage: 1:100

- Initial balance: $1000

Description of the robot's settings:

- Distance between orders in points: This parameter sets the distance in points between orders (e.g., Buy Stop and Sell Stop). The higher the value, the further apart the orders will be. This helps avoid frequent position openings in low volatility conditions.

- Acceleration factor for order modification: This parameter controls the acceleration in order modification. If the price changes faster than expected, the robot may adjust the stop-loss or take-profit to protect capital or maximize profits. This parameter also affects the deletion of pending orders if the price does not reach their level within a certain time frame.

- Trailing stop distance in points: Trailing Stop is the automatic movement of the stop-loss following the price by a specified distance in points. This parameter determines how far from the current price the stop-loss will be placed. For example, if set to 15 points, the stop-loss will move 15 points from the current price as soon as the price moves in the direction of profit.

- Take profit in points: This parameter sets a fixed distance in points from the trade entry level at which the take-profit will be placed. It is the level at which the position will be automatically closed with a profit.

- Maximum stop loss in points: This parameter defines the maximum distance in points for setting the stop-loss. It is used to limit losses on each trade, preventing excessively large losses on individual positions.

- Break-even point in points: This parameter sets the break-even point in points. When the price reaches this point, the stop-loss will be moved to the entry point (or slightly above/below) to ensure that the trade no longer incurs a loss.

- Trailing step adjustment in points: Specifies the step by which the trailing stop will be adjusted. Each time the price moves by this step, the stop-loss is moved by the corresponding number of points.

- Initial lot size for the first trade: Sets the initial lot size for the first trade. The lot size determines the trade volume and, accordingly, the level of risk and potential profit/loss.

- Increment for lot size based on balance: This parameter controls the increase in lot size as the account balance grows. For example, with an increase in balance by a certain amount (balanceIncrement), the lot size will be increased by this value.

- Balance increment required to increase lot: Specifies the amount of balance growth required to increase the lot size by the value of lotIncrement. This helps adapt the strategy to balance growth and manage risks.

- Stochastic K period: The length of the K period used in the Stochastic oscillator. The shorter the period, the more sensitive the oscillator is to market changes.

- Stochastic D period: The length of the D period for the Stochastic oscillator, usually used to smooth the K line. This helps reduce noise and make the signal more reliable.

- Stochastic slowing factor: The slowing coefficient for the Stochastic oscillator. This parameter is used for additional smoothing of the K line and reducing the number of false signals.

- Maximum number of open trades: Determines the maximum number of simultaneously open trades. This parameter helps control the overall risk on the account and avoid situations where too many positions are open in the market.

- Coefficient to determine stop levels: A coefficient used to calculate stop levels. It determines the distance in points at which stop-loss and take-profit will be placed from the current price.

- Number of ticks to evaluate: Specifies the number of ticks used for analyzing market dynamics. This can be used to calculate the average spread, volatility, and other market characteristics.

- Maximum allowable spread in points: The maximum allowable spread in points at which the robot will make decisions. If the current spread in the market exceeds this value, the robot will not open new positions.

- magicNumber: A unique identifier assigned to each trade opened by this robot. This number is used to distinguish trades opened by different robots or strategies running on the same account.

I'm very satisfied with the Forex AI Trading Bot. The EA works quite well. I highly appreciate Andrey's professionalism and prompt responses, as well as the excellent support from the IT team. Their dedication and assistance have been outstanding. I look forward to seeing how the AI learning feature performs over time and will keep updating my experience. Overall, a great experience with both the product and the team. Thank you!