Viop EA

- Experts

- Ahmet Gokcen Sirma

- 버전: 2.60

- 활성화: 5

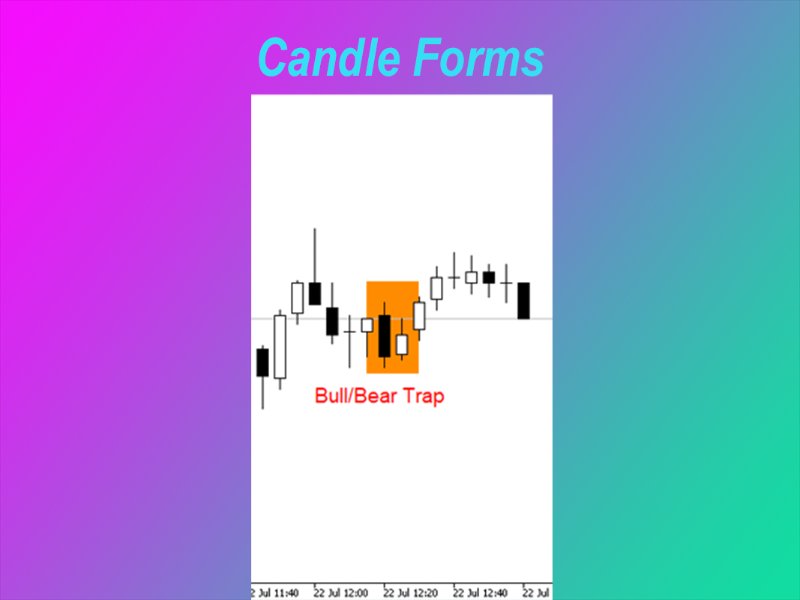

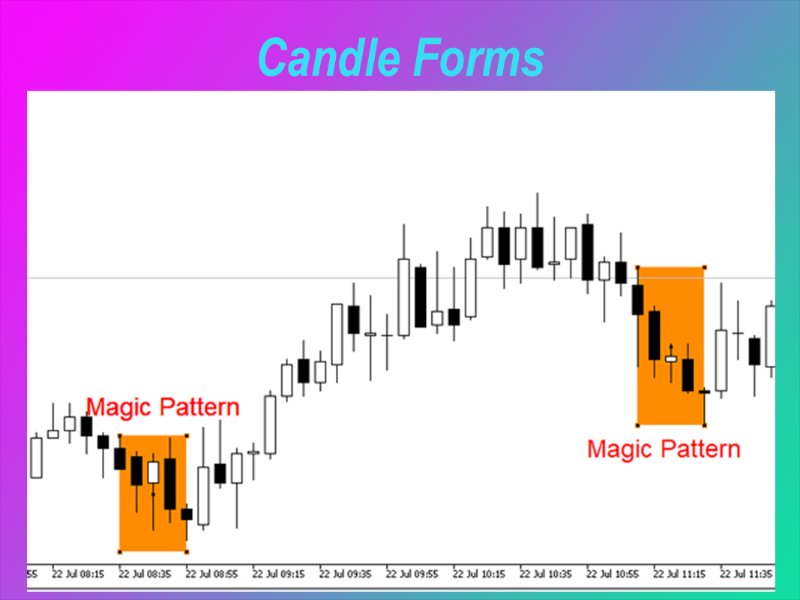

Candle formations are used as strategy. 1 robot has a total of 5 different formations. Inside; "Double engulf", "Taurus/bear traps", "three black crows/three white soldiers", "Pinbar + engulf" and my favorite "Magic Pattern". You can open and close each one as "True (Open)" or "False (closed)".

When opening Buy or Sell positions, TP and SL values cannot be entered. The system does not allow it.

The market works only as a Turkish Lira. If you write 1000 to the "TP Target (TL)" option, each time it reaches 1000 TL, it automatically closes and starts to wait for a new pattern.

Mini or micro lot option is not used as a lotsize value. The default value is set to "1.00" lot. You must adjust the lotsize setting according to your account balance.

I wish you success ...