Drakanis Expert

- Experts

- Ruengrit Loondecha

- 버전: 24.807

- 활성화: 10

---------------------------------------------------------

---------------------------------------------------------

Drakanis Expert

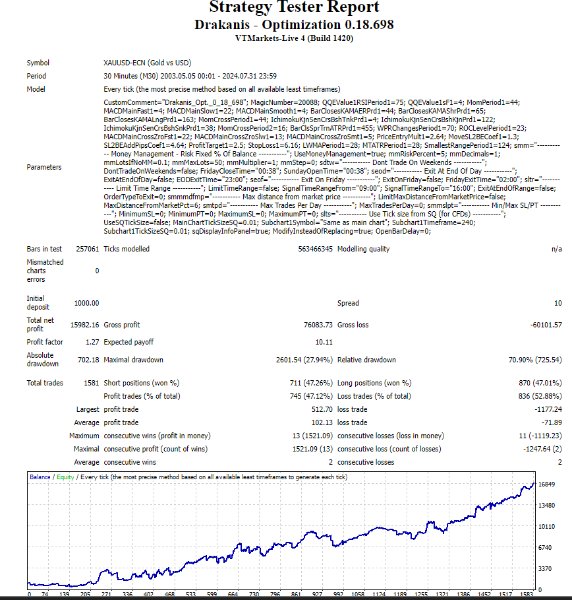

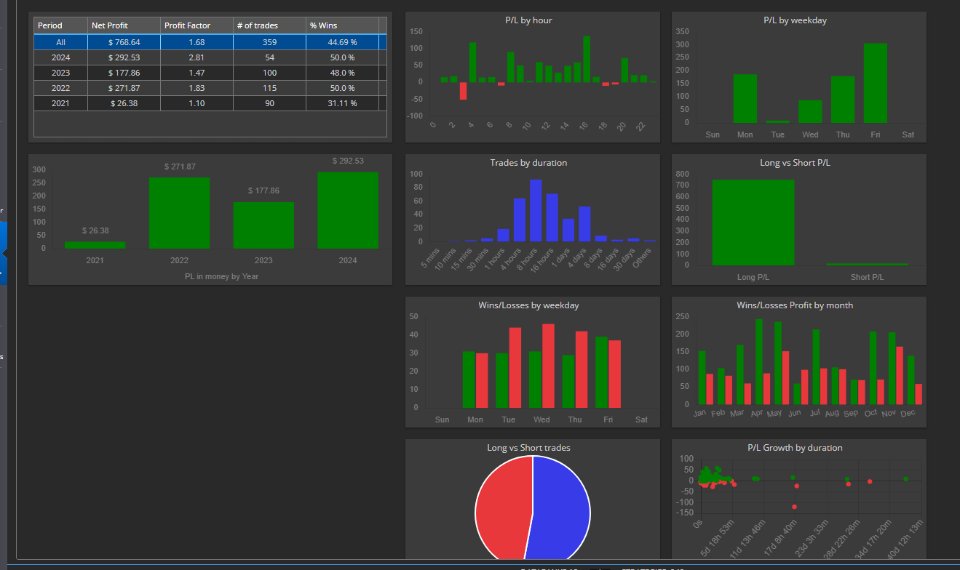

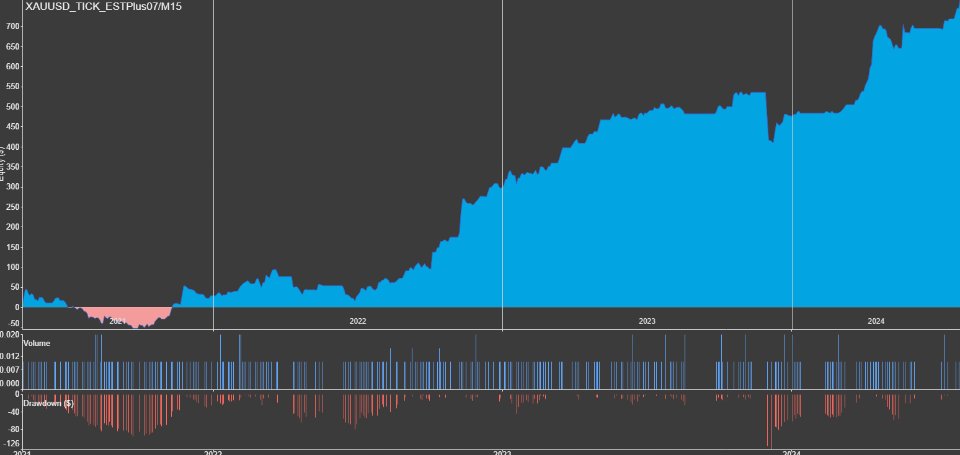

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

- Capital Requirements: Minimum starting capital of $200-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Drakanis Expert

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

- Capital Requirements: Minimum starting capital of $200-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Quantitative Qualitative Estimation (QQE):

- QQE is an enhanced version of the RSI that incorporates smoothing and volatility filters. It helps identify trend strength and potential reversals with reduced noise, providing clearer signals for market entries and exits.

-

Momentum:

- The Momentum indicator measures the rate of change of a security's price over a specified period. It helps identify the strength of price movements, signaling potential trend continuations or reversals. High momentum indicates strong price movements, while low momentum suggests weaker trends.

-

Kaufman's Adaptive Moving Average (KAMA):

- KAMA is an adaptive moving average that adjusts its sensitivity based on market volatility. It reacts quickly to price changes while smoothing out noise, making it useful for identifying trend direction and potential reversal points.

-

Supertrend:

- The Supertrend indicator is used to identify the current market trend. It plots a line above or below the price, depending on the direction of the trend. A buy signal is generated when the price moves above the Supertrend line, and a sell signal is generated when the price moves below it.

-

Moving Average Convergence Divergence (MACD):

- MACD is a momentum indicator that shows the relationship between two moving averages of a security's price. It includes the MACD line, the signal line, and the histogram, helping to identify trend changes, buy and sell signals, and the strength of momentum.

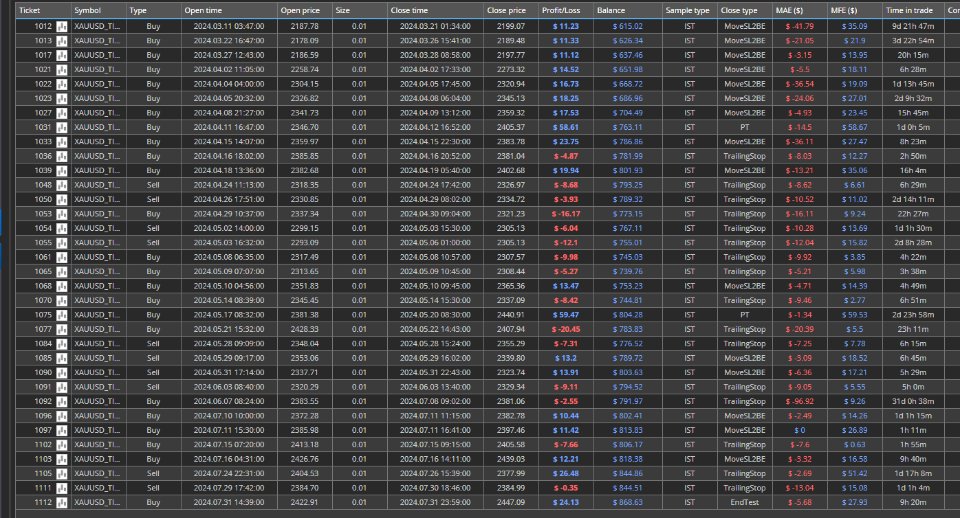

Trade Style

-

Open Stop Order with LWMA:

- A stop order is placed based on the Linear Weighted Moving Average (LWMA). The LWMA gives more weight to recent price data, making it more responsive to current price movements. This ensures that entry orders are placed in line with recent market trends.

-

Take Profit (TP) and Stop Loss (SL) by Percentage:

- TP and SL levels are set as fixed percentages from the entry price. This approach establishes clear exit points based on predetermined percentages, providing consistent risk and reward management.

-

Trailing Stop by LowestInRange:

- The trailing stop is set using the lowest price in a specified range (LowestInRange). This method adjusts the stop-loss level to follow the lowest price within a given range, allowing the trade to lock in profits while adapting to market movements.

-

Move SL to Break Even (MoveSL2BE) with Add Pips using ATR Coefficient:

- The stop-loss is moved to the break-even point (entry price) once the trade moves favorably. Additionally, a number of pips calculated using the ATR (Average True Range) coefficient are added to the break-even level. This approach helps secure some profit while minimizing risk, ensuring the trade is protected against potential reversals while capturing additional gains based on market volatility.

Example Workflow

-

Entry Signal:

- Place a stop order (buy or sell) based on the LWMA, ensuring the entry aligns with the recent market trend.

-

Stop Loss and Take Profit:

- Set the SL and TP levels as fixed percentages from the entry price. For example, an SL at 2% and a TP at 4% from the entry price.

-

Move to Break Even:

- Once the trade moves favorably (e.g., reaching a profit of 2% from the entry price), adjust the SL to the break-even point. Additionally, add a buffer (e.g., 0.5% of the ATR) to the break-even level to secure some profit.

-

Trailing Stop:

- Adjust the trailing stop based on the lowest price in the specified range. This method will allow the stop-loss to follow the lowest price within a given range, locking in profits as the price moves in favor of the trade.