Xeloria Expert MT5

- Experts

- Ruengrit Loondecha

- 버전: 1.2

- 활성화: 10

- Xeloria Expert MT5

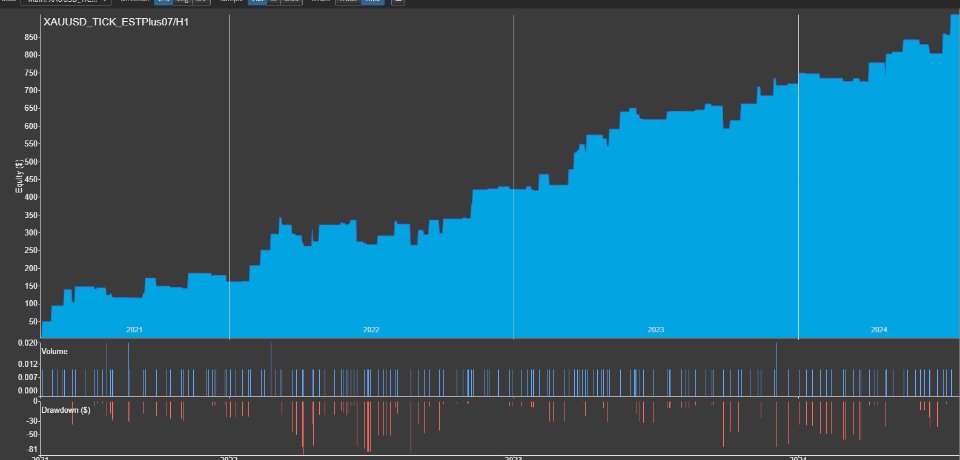

- Working best with GOLD - H1

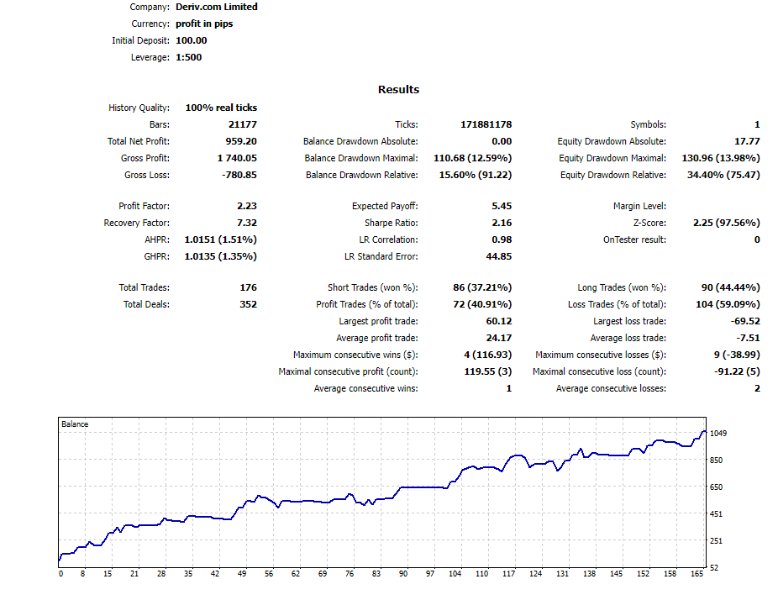

- Require minimal 100-300$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts -

Williams %R:

- Williams %R is a momentum oscillator that measures the closing price in relation to the highest high over a specific period. It ranges from -100 to 0, with readings below -80 indicating oversold conditions and readings above -20 indicating overbought conditions. It helps identify potential reversal points in the market.

-

Hull Moving Average (HMA):

- HMA is a moving average that minimizes lag while enhancing smoothness, offering a more accurate representation of the trend. It reacts quickly to price changes, making it useful for identifying trend direction and potential reversal points.

-

Oscillator of Moving Average (OSMA):

- OSMA measures the difference between the MACD line and its signal line. It helps indicate the momentum and strength of the trend, confirming potential entry and exit points.

-

Moving Average Convergence Divergence (MACD):

- MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. It consists of the MACD line, the signal line, and the histogram, helping to identify trend changes and potential entry and exit signals.

-

Rate of Change (ROC):

- ROC measures the percentage change in price over a specified period, indicating the speed of price movements. It helps identify momentum shifts and potential trend reversals.

Trade Style

-

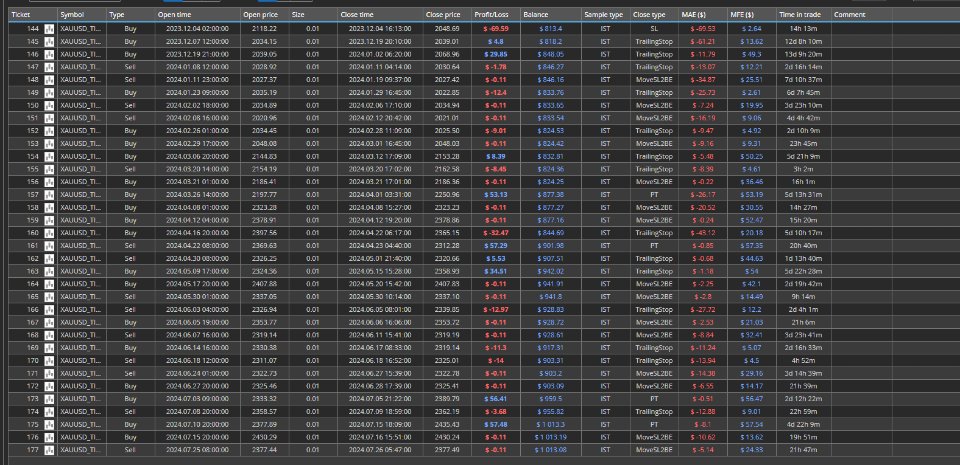

Instant Entry Order:

- An instant entry order involves entering a trade immediately at the current market price. This type of order is used when a trader identifies a trading opportunity and wants to enter the market without delay.

-

Stop Loss (SL) by Percentage:

- The stop-loss level is set as a fixed percentage away from the entry price. This approach limits potential losses to a predefined percentage of the trade's value, providing consistent risk management.

-

Take Profit (TP) by Percentage:

- The take-profit level is also set as a fixed percentage from the entry price. This method defines a clear profit target, helping traders to lock in gains once the price reaches the desired level.

-

Move SL to Break Even (MoveSL2BE) Coefficient with ATR:

- The stop-loss is moved to the break-even point (entry price) once the price moves favorably by a certain distance, defined as a multiple of the ATR (Average True Range). This method locks in the initial capital, reducing the risk of a loss once the trade has moved in the trader's favor.

-

Trailing HighDaily:

- A trailing stop based on the highest price reached during the daily session helps lock in profits as the price moves upward. This method involves adjusting the stop-loss level to follow the highest daily price, ensuring that gains are protected while allowing for further upside potential.