GridTrading

- Experts

- Denys Matiushyn

- 버전: 1.0

- 활성화: 5

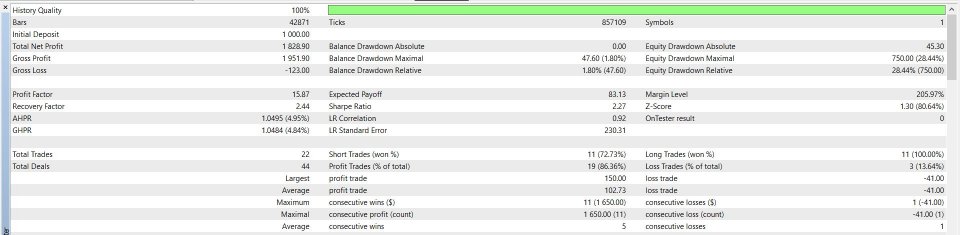

GridTrading is a trading strategy based on using an asset's average price over a specified time period. The strategy involves creating a grid of lines around the average price. When these lines are crossed, two positions are opened simultaneously: a buy and a sell. This approach allows traders to benefit from both upward and downward market movements.

Strategy Settings:

-

grid_distance = 0.02: The distance between grid lines. This parameter determines how far apart the grid lines are placed.

-

grid_range = 0.17: The range of the grid. This parameter specifies how far the outermost grid line is from the average price.

-

slatr_factor = 1.5: Stop-loss factor. This determines how many points away from the crossing line the stop-loss is set for opened positions.

-

TPSLRatio = 0.5: Take-profit to stop-loss ratio. This determines the profit-taking level in relation to the stop-loss set.

-

history_days = 26: The number of days for calculating the average price. Historical data for this number of days is used to determine the average price of the asset.

-

max_crosses = 3: The maximum number of crosses for opening new positions. This parameter limits the number of positions opened in case of frequent grid line crossings.

The example parameters provided were calculated for the EURUSD currency pair on a 5-minute timeframe. Before launching the strategy, users are advised to run optimizations for the specific asset and timeframe to determine the optimal settings.