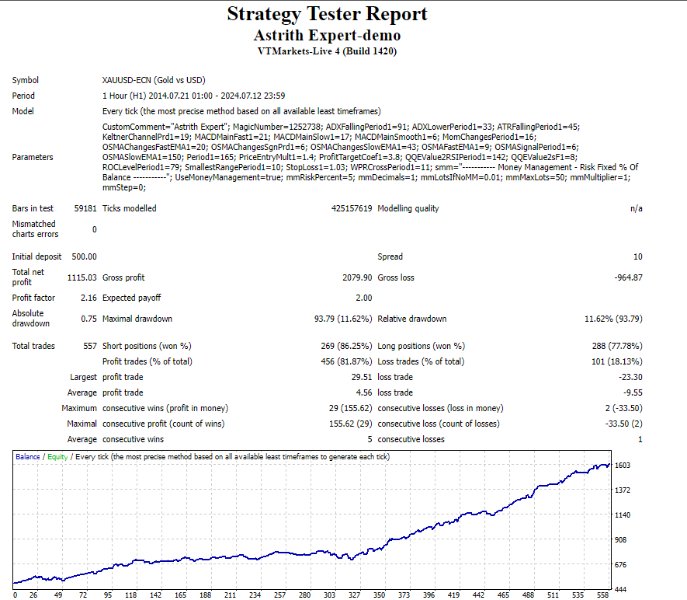

Astrith Expert

- Experts

- Ruengrit Loondecha

- 버전: 1.1

- 활성화: 10

- Astrith Expert

- Working best with GOLD - H1

- Require minimal 300$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

Indicators and Concepts

-

Williams %R (Williams Percent Range):

- Williams %R is a momentum indicator that measures overbought and oversold levels in the market. It ranges from -100 to 0, with readings below -80 indicating oversold conditions and readings above -20 suggesting overbought conditions. It's useful for identifying potential reversal points.

-

Oscillator of Moving Average (OSMA):

- OSMA represents the difference between the MACD line and its signal line. It indicates the momentum of the MACD, helping traders assess the strength and direction of trends.

-

Average Volume (AvgVolume):

- Average Volume measures the average number of shares or contracts traded over a specific period. It's a helpful indicator of market activity and can confirm the strength of a price move when trading volumes are high.

-

Moving Average Convergence Divergence (MACD):

- MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of the MACD line, the signal line, and the histogram. MACD helps identify trend direction and potential reversals.

-

Average Directional Index (ADX):

- ADX measures the strength of a trend, regardless of its direction. A high ADX value indicates a strong trend, while a low value suggests a weak trend or range-bound market.

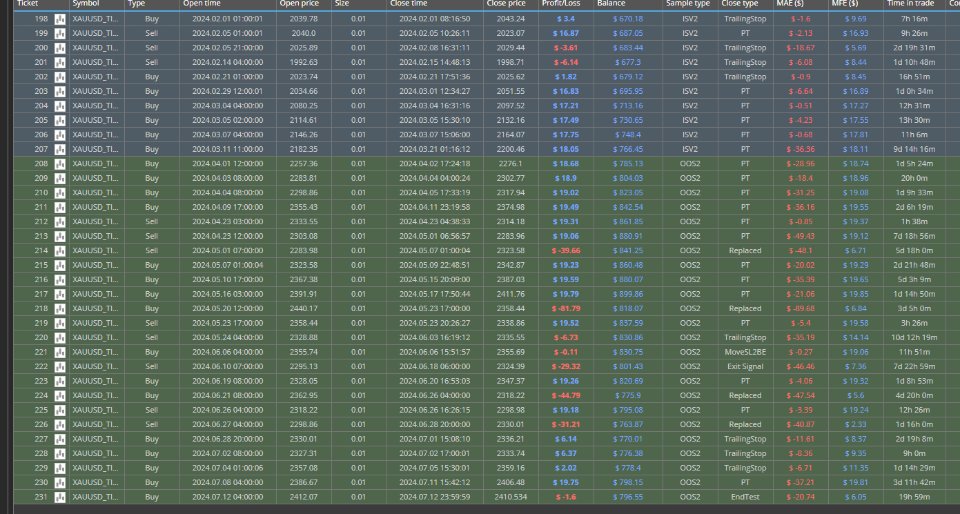

Trade Style: Open/Reverse Order at Market

-

Open/Reverse Order:

- This strategy involves opening a new position or reversing an existing one based on market signals. For example, a trader might go long if the market conditions indicate a bullish trend and then reverse to a short position if the trend changes.

-

Pivots Trailing Stop:

- A trailing stop using pivot points adjusts the stop-loss level based on key support and resistance levels. It helps lock in profits by trailing the stop loss as the market moves in favor of the position.

-

Take Profit (TP) and Stop Loss (SL) by Percentage:

- TP and SL levels are set based on a fixed percentage of the entry price. This approach helps manage risk and potential profits by determining exit points relative to the entry price.

-

Move to Break Even (MOVE2BE) with ATR:

- MOVE2BE involves adjusting the stop-loss level to the break-even point once the market moves a certain distance in favor of the trade, as determined by the ATR. This method helps protect profits and manage risk by ensuring the trade does not result in a loss after a certain level of price movement.