ASPCT Boom Crash Candle Reversal

- 지표

- Petr Zharuk

- 버전: 1.3

- 업데이트됨: 3 10월 2024

- 활성화: 20

🚀 Indicator for Boom and Crash Synthetic Indices

The indicator will be sold in a limited quantity.

🔍 We present a specialized technical indicator designed exclusively for Boom and Crash synthetic indices offered by Deriv broker. This tool is tailored for traders who prefer a methodical approach to trading with clearly defined price levels.

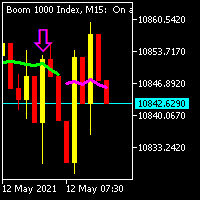

📊 Indicator Functionality:

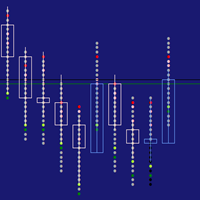

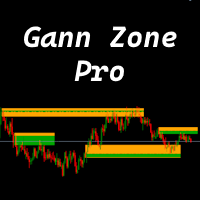

• Displays key price levels for position entry

• Indicates levels for position averaging

• Determines optimal stop-loss levels

• Optional alerts for timely notification of new price grid formation

⏱️ Signal Frequency: 1 to 5 signals per day on each of the 6 available indices, potentially offering up to 30 trading opportunities daily.

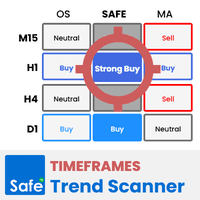

📈 Versatility: The indicator is applicable to any timeframe. The choice of time interval exclusively affects the convenience of visual analysis without altering the number of generated signals.

🔧 Recommended Trading Methodology:

1. Follow the direction of spikes when opening positions

2. Set stop-loss in accordance with the levels indicated by the indicator

3. Utilize an averaging strategy with position size increase at levels specified by the indicator

4. Upon reaching the profit zone, consider closing the position, taking into account potential market volatility

🎓 Educational Materials: For a deeper understanding of the indicator's operation, detailed screenshots and video materials, including graphical backtests, are provided.

⚙️ Configuration: The indicator requires minimal setup, including color scheme selection and the number of historical bars for analysis.

🧪 Testing: Before engaging in live trading, it is strongly recommended to conduct thorough testing of the indicator in your trading terminal's strategy tester.

⚠️ Risk Management: It is crucial to adhere to risk management principles and trade only with capital that, if lost, would not significantly impact your financial situation. The indicator's author bears no responsibility for potential financial losses or incorrect application of this analytical tool.

🔬 This indicator is the result of meticulous analysis and development aimed at optimizing trading decisions in the specific market conditions of synthetic indices. However, it's important to understand that any technical tool requires competent application and does not guarantee trading success.

📚 We recommend thoroughly studying all aspects of working with the indicator and integrating it into your trading system only after fully understanding its functionality and potential limitations.