Sniper Delta Imbalance

- 지표

- Stanislav Konin

- 버전: 1.2

- 업데이트됨: 27 3월 2025

- 활성화: 5

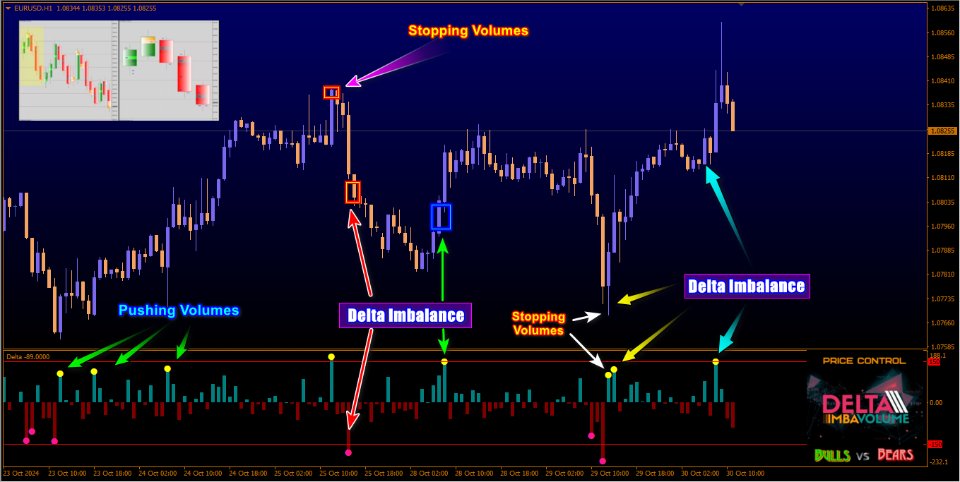

The Sniper Delta Imbalance indicator is designed to analyze delta – the difference in tick volumes between buyers and sellers in the market. It displays the imbalance between market buys and sells, allowing traders to accurately assess the current sentiment of major market participants. This tool provides a unique method of analysis based on the relationship between supply and demand volumes and can be used to identify who controls the price at any given moment.

Key Features:

-

Delta Imbalance — The indicator visually shows who currently controls the market: buyers or sellers. In real time, you can observe the behavior of large players, which helps in predicting future price movements.

-

Identifying Market Control — The indicator allows you to track the behavior of major market participants and determine who is influencing the price. It also highlights the absence of large volumes, which can signal a lack of interest from both sides.

-

Trend Analysis and Entry Points — With this indicator, you can:

- Identify trend continuation when large volumes with a delta imbalance are present (push volumes).

- Determine key reversal points when volumes with a delta imbalance appear (stop volumes).

-

Support for All Types of Alerts — The indicator supports various types of notifications, including:

- Text Alerts (Alert): Receive notifications directly on the MetaTrader platform when certain conditions are met.

- Sound Alerts: The ability to set sound alerts to grab the trader's attention.

- Push Notifications: Notifications can be sent directly to your mobile device through the MetaTrader app. This is especially useful for traders who want to stay updated even when they are not at their computers.

Settings:

- Delta Filter — The minimum difference between the Ask and Bid prices, which must be met before calculations and coloring of key points can begin. If the minimum difference condition is not met, the coloring will not occur.

- Level Settings — The ranges for calculating High and Low, which can be adjusted to fine-tune the analysis of the current market conditions.

Configuration Recommendations:

-

Traded Instrument: The parameters of the indicator depend on the specific trading instrument. Different currency pairs have their own minimum, average, maximum, and anomalous volumes, which should be taken into account when adjusting the delta filter.

-

Timeframe Selection: Different timeframes may require different delta filter settings. For example, for short-term trading on smaller timeframes, more sensitive settings may be required compared to long-term trading.

-

Session Opening Times: Volumes can vary greatly depending on the trading session. The European and American sessions, for example, may have very different volume profiles. It is important to take this into account when adjusting the indicator. Additional analysis and statistics on volume for the instruments you trade are recommended for more effective use of the indicator.