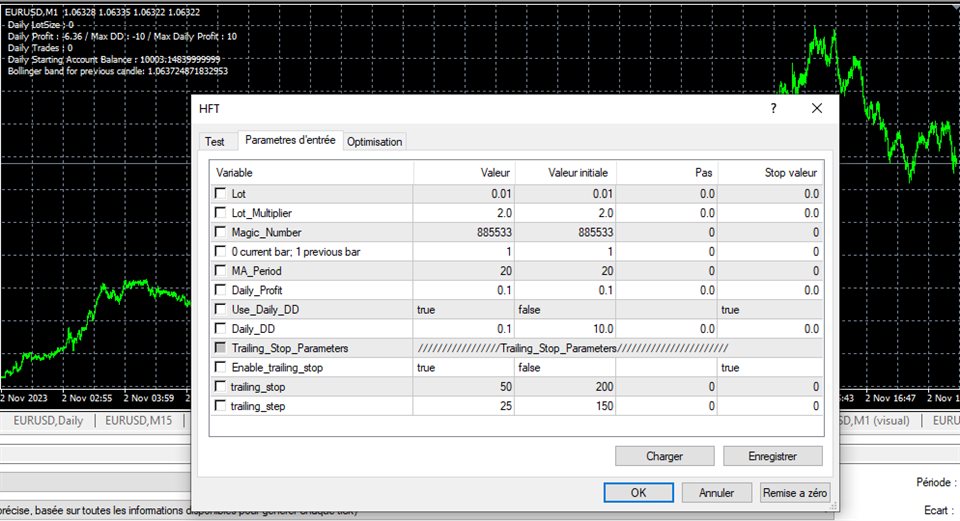

HFT New generation

- Experts

- Himma Youssef

- 버전: 1.3

- 활성화: 5

- HFT is complex algorithmic trading.

- It adds liquidity to the markets and eliminates small bid-ask spreads.

- HFT is criticized for allowing large companies to gain an upper hand in trading.

- Another complaint is that the liquidity produced by this type of trading is momentary—it disappears within seconds, making it impossible for traders to take advantage of it.

How Does High-Frequency Trading Work?

High-frequency trading is an automated form of trading. It involves the use of algorithms to identify trading opportunities. HFT is commonly used by banks, financial institutions, and institutional investors. It allows these entities to execute large batches of trades within a short period of time. Because everything is automated, trading becomes easy. HFT provides the market with liquidity. But it can result in major market moves and removes the human touch from the equation.