Vanesa RSI Reverse

- Experts

- Vo Mai Chi

- 버전: 1.50

- 업데이트됨: 16 8월 2018

Vanesa RSI Reverse provides an amazing trading strategy.

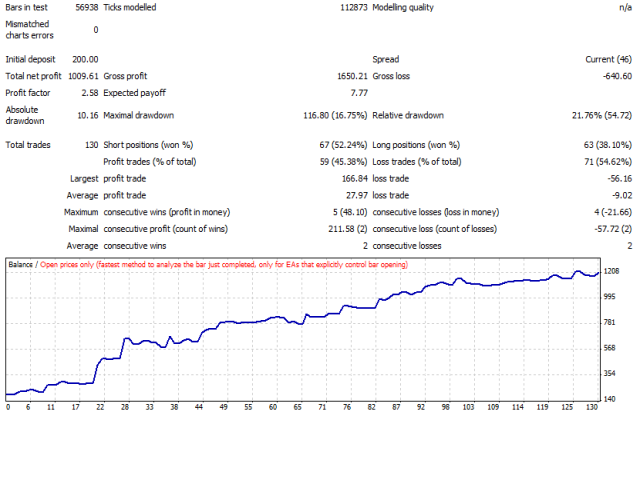

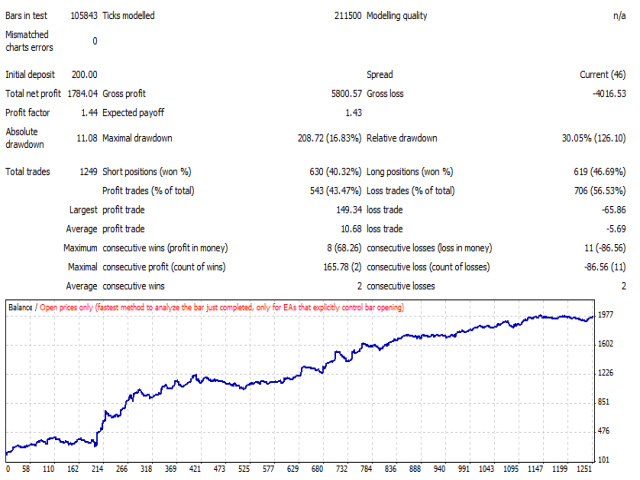

Use optimization function of Strategy Tester in MetaTrader 4 to find out many high potential parameter sets in very long term of history data (more than 2 years).

The EA works well with XAUUSD in M15 but it also give similar results in others symbols and time frame.

It just takes some minutes to try it out in your own history data to see the very good performance.

We will continue to improve the strategy to get better performance in next versions.

Please check the video to know how to instruct MetaTrader 4 to scan out the best parameter sets for you.

Your comments are very highly appreciated.

Parameters

- Lot size: you should adjust value of lot size to get balance between profit rate and risk.

- Take profit in point: to set profit in point. For XAUUSD, 1 point means 0.01; for EURUSD one point means 0.00001; for USDJPY one point means 0.001 ...

- Stop loss in point: to set stop loss in point. In this strategy trading method we don't need to set Take profit and Stop loss if you adjust Lot size small enough, but you can do if you want.

- Number of period: Number of periods to calculate RSI value.

- Over buy level: it can get one of these values 50, 55, 60, 65, 70, 75, ... 95.

- Over sell level : it can get one of these values 15, 20, 25, ... 50

- Average size: it can get one of these value 1, 2, 3, 4, 5, 6, 7, 8, ... (integer number)

- Pre confirmation: it can get one of these value 1, 2, 3, 4, ... ((integer number, just use values for parameter setting, you don't need to care about the meaning of parameter)

- Loss threshold: it can get one of these value 100, 200, 300, 400, ...., 3000, .... (value in point)

- Profit threshold: it can get one of these value 100, 200, 300, 400, ...., 3000, ....(value in point)

Parameters Optimization

When you do Optimization please don't set Initial Deposit to too small value and Lot size parameter to big value so that there maybe not enough money to open new position on optimization. (Make sure you have enough free margin for a new trade with volume as Lot size).

For examle: if your current account requires 13$ for 0.01 lot GBPUSD, it means we need 1300$ as required margin for 1 lot GBPUSD. If you set Initial Deposit to 1000$, you have to set Lot size to 0.01 or 0.1 instead of 1.

When there is not enough margin to open new position you will see this message in Journal log:

Vanesa RSI Reverse USDJPY,M5: 1.00 lots requires 1000.00 margin, current free margin (800.00)

Alert: Not enough money to open position

If you get Drawdown (%) too small and it is too safe in Optimization report, you can increase value of Lot size to increase the Profit Rate.

사용자가 평가에 대한 코멘트를 남기지 않았습니다