B3 Rolagem Venda Coberta de Call

- 지표

- Wellington Silva

- 버전: 1.0

- 활성화: 5

Make your decisions easier when rolling Covered Call. This robot provides you with information that aids in decision on how and when to roll your structure.

It works for any asset in the spot market that has authorized options series on B3 (Brazilian stock exchange). Associate the robot with the asset you want to use for the Covered Call.

How to use the robot:

Set parameters for your current structure:

- Purchase price of the base asset in your structure.

- Code of the Call you used to build your structure.

- The premium you received from the sale of the Call.

- The size of the structure, defined by its quantity

Analyze potential rolls by defining:

- The new expected break-even for your structure after rolling.

- The quantity of stocks and options that will be added or removed from your structure after the roll.

- The new expiration of the structure, which is a choice between not changing the current expiration or moving the expiration of your Call to the subsequent expiration.

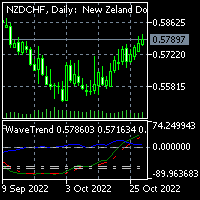

You can change these parameters as much as you want to analyze the best roll to make. Use the price chart for a better view of your strategy.

*** ATTENTION ***

For the robot to work, the service that consults the authorized series of B3 options must be running on your terminal. Download the utility for free at this link.

Installation instructions on this link.

Usage instructions on this link.

If you have any questions, contact us on Telegram.

P.S.: All texts in the robot are in Brazilian Portuguese. Let us know If you need this stuff in English. You need to operate in Brazilian B3 Stock Exchange.