Pay Barbossa

- 유틸리티

- Alexander Pryakha

- 버전: 1.30

- 업데이트됨: 24 12월 2024

You can use comercial or free AG version.

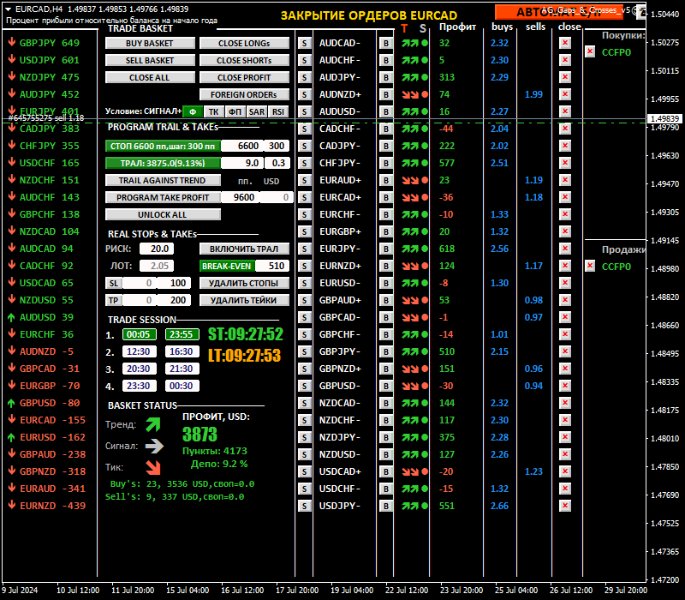

In comercial version you can trade all 28 pairs in your basket.

For free version for testing you can trade only 7 pairs for free

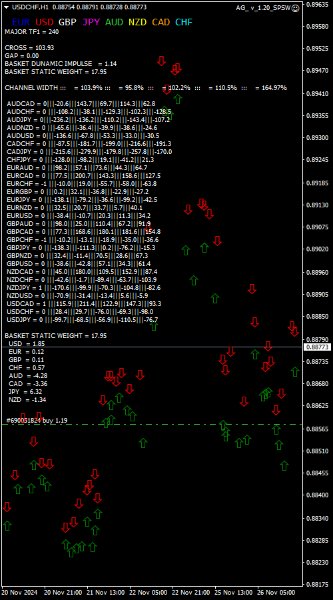

In version 1.20 change the indicator from CCFp to CSS -CurrencySlopeStrength

In algorithm release the construction of Baskets Differencial - 4 baskets

Signal algoritm AG for 28 pairs you can rent in mql5 shop

https://www.mql5.com/ru/market/product/94278

Signal algoritm AG for 7 pairs FREE version you can upload free

https://www.mql5.com/ru/market/product/108070

Pairs for free version

AUDCHF;

CADJPY;

EURCHF;

EURNZD;

GBPAUD;

GBPJPY;

NZDCAD;

you must have cluster insicator SPSW, download from

The AG algorithm is an element of a comprehensive trading system for trading a basket of currencies across 8 major currencies across all 28 currency pairs. The algorithm serves as a signal block for determining entry/exit from a position. To collect initial values, AG uses data from the CSS Currency Slope Strength cluster indicator. This indicator was not chosen by chance - it performed very well during testing of the algorithm.

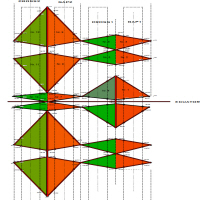

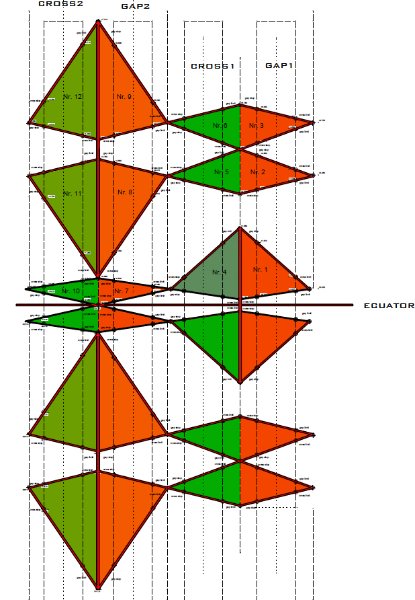

A. AG determines the width of the entire trading channel, and determines the state in which the market is located. There are 4 market states. 1. The channel has a width of >100% and the channel is expanded by CROSS2. 2. The channel has a width of >100% and the channel is compressed by GAP2. 3. The channel width is <100% and the channel is compressed by GAP1. 4. The channel has a width of <100% and the channel is expanded by CROSS1.

Depending on the state of the Forex channel for such a basket, the logic for trading the basket is turned on. The design of the algorithm contains a differential, which sets the conditions for each individual basket and when switching baskets.

A. AG determines the width of the channel of each bar and determines the price of the share of each bet in the basket in each bar, the problem is solved - the share of this instrument grows or falls. B. AG determines the impulse of the entire channel - at what speed the current expansion/compression of the channel thickness occurs. In addition, the current dynamic impulse is determined at what speed the price changes for each instrument. C.After determining the width of the entire channel, the impulse in the channel, dynamic ranges are set for trading, and conditions for opening limit and stop orders, relating to the current market conditions (channel width - compression or expansion), as well as with the share price, impulse for the currencies that are being traded. For each trading pair, the algorithm contains 72 equations, a total of 28x72 = 2,016 for 28 unknowns. The algorithm determines market entry points, which are called CROSS and GAP. These initial data, conditions and equations are transferred to the stiffness matrix and the calculation occurs and the result is determined. The answer in the problem is the answer of the signal block, which is transmitted to the robot for opening or closing a position.

Signals for opening and closing orders are transmitted for automatic trading to the Barboss advisor for all 28 currency pairs through global variables of the MT4 terminal. For automated trading using an algorithm download free CSS indicator and Barboss expert with set https://www.forexfactory.com/thread/1206434-barboss-trading-system-mt4