Corr Hedging Indicator MT5

- 지표

- Zhao Yang Li

- 버전: 2.0

- 활성화: 5

The Corr indicator, also known as the Correlation Indicator, serves as a reference indicator for hedge institutions.

It is used to measure the degree of relationship between two or more financial products. In the financial field, especially in the currency market, correlation coefficients are commonly used to study the correlation and degree of relationship between different currencies.

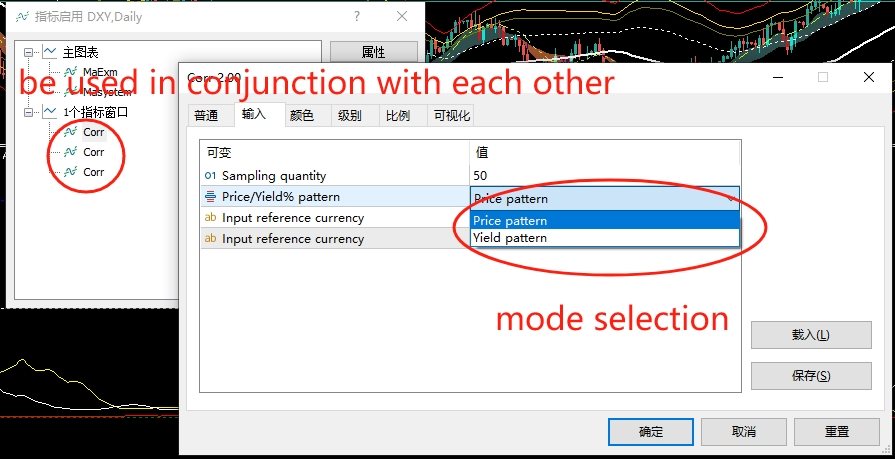

Correlation coefficients are typically represented by values ranging from -1 to 1. Here are some common interpretations of correlation coefficients:

Correlation coefficient of 1: This indicates a perfect positive correlation between two variables, meaning their movements are perfectly aligned. In the currency market, this may suggest that two currency exchange rates move in the same direction, although it is relatively uncommon.

Correlation coefficient of 0: This suggests no linear correlation between two variables, and their movements are independent of each other. In the currency market, this may indicate no linear relationship between two currency exchange rates.

Correlation coefficient of -1: This represents a perfect negative correlation between two variables, meaning their movements are perfectly opposite. In the currency market, this could imply that two currency exchange rates move in opposite directions, although it is relatively rare.

Correlation coefficients are often used to analyze the relationship between currencies, helping investors understand the degree of association between them.

For example, investors can use correlation coefficients to assess whether two currency exchange rates tend to move in the same direction or whether they may exhibit opposing trends in different market scenarios.

This assists investors in better formulating multi-currency investment strategies, managing risks, and seizing opportunities.