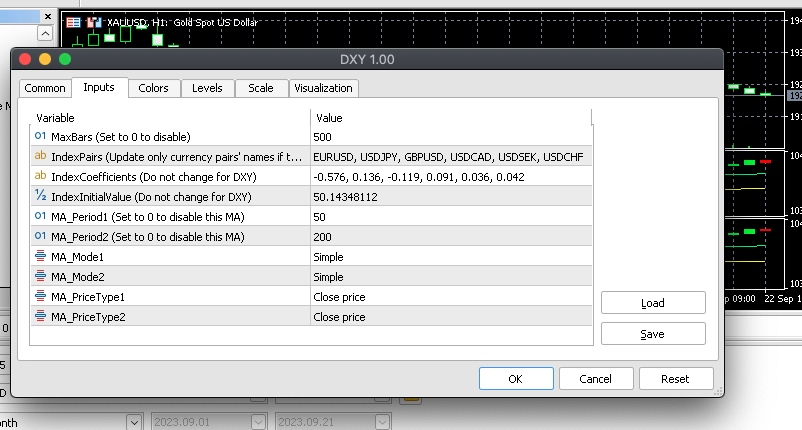

DXY Correlation

- 지표

- Abdelkhabir Yassine Alaoui

- 버전: 1.0

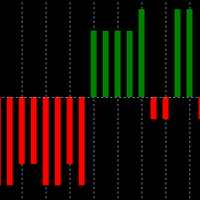

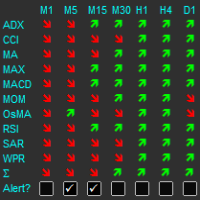

Indicator can be used for dxy correlation trading.

it calculates the dollar index (USDX or DXY) using the EUR/USD, USD/JPY, GBP/USD, USD/CAD, USD/CHF and USD/SEK currency pairs.

In order to trade them, you need to find a confirmed technical analysis pattern on the DXY chart and look for a correlated currency pair that has the same picture on its price chart.

The formula used for calculation is the following:

USDX = 50.14348112 × EURUSD-0.576 × USDJPY0.136 × GBPUSD-0.119 × USDCAD0.091 × USDSEK0.042 × USDCHF0.036

The resulting indicator resembles DXY . The index was introduced in 1973 at an initial value of 100. The rules for its calculation were updated only once — in 1999 to reflect the introduction of euro.

사용자가 평가에 대한 코멘트를 남기지 않았습니다