Risk Manager Basic

- 유틸리티

- Vincent Ocasla

- 버전: 1.4

- 업데이트됨: 29 9월 2023

- 활성화: 5

A fundamental component to have within your trading arsenal is the ability to properly control and manage risk effectively. This tool offers a basic but comprehensive means to manage each and every trade position appropriately.

It can be used across different markets that require percentage-based calculations as opposed to simply measuring the difference in pip or point size i.e. the method for calculating take profit and stop loss in FX currency markets is usually a fixed point/pip size vs. precious metals/stocks/crypto markets which require percentage of the market price. The tool can also control exits as either based on a fixed currency value or percentage of balance i.e. exit position if in profit or loss of $n vs. if in profit or loss of n% of account balance, etc. This is useful when using fixed lot sizes or scaling position size.

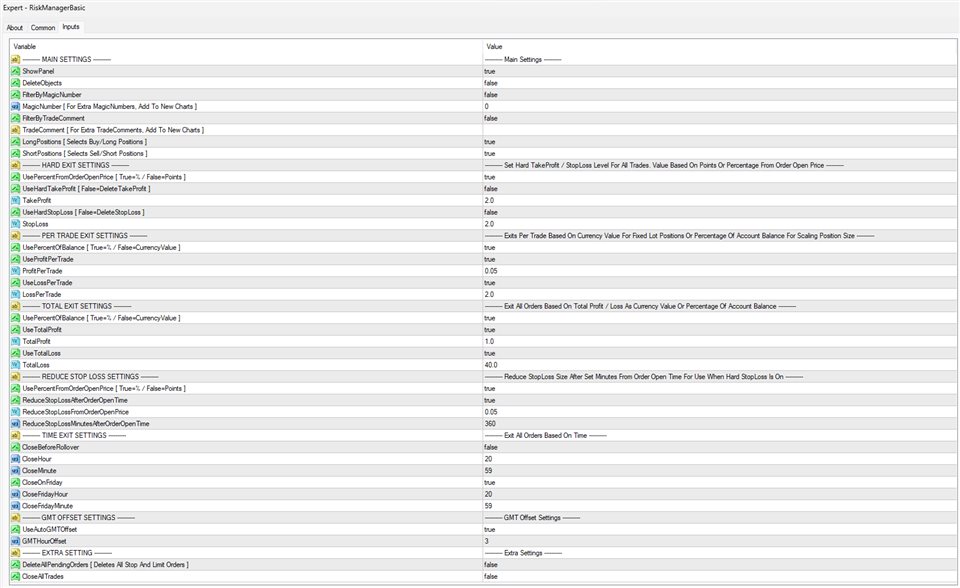

The utility has the ability to:

- Place hard TP and SL based on fixed point size or percentage of order open price

- Exit each trade if in profit or loss per trade based on fixed currency value or percentage of balance

- Close all trades if in total profit or loss of all trades based on fixed currency value or percentage of balance

- Adjust SL after a certain time in minutes after the order opening time

- Close all trades at a certain time of the day or on Friday before the weekend

- Filter by magic number, comment, buy/long and sell/short orders

- Delete all pending orders

- Close all orders

- Adjust GMT offset

Simply add the utility tool to any chart. To control more than one magic number or comment simply add to extra charts.

Please note that when converting from points to percentage of market price, the values must be changed manually i.e. 50 points (5 pips) might equal ~0.025% of some market price like on Gold [as of Sep 5, 2023 = ((1926.50/1926.00)-1))*100 = 0.02596%]; make sure to double check your calculations accordingly.

Got any ideas? Found a bug? Write in the comments section!