EA Secret Scalping

- Experts

- Zafar Iqbal Sheraslam

- 버전: 1.0

- 활성화: 10

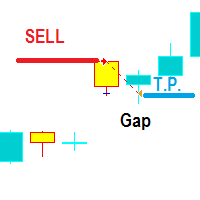

An EA (Expert Advisor) scalping strategy is a trading approach in the foreign exchange (Forex) or other financial markets that utilizes automated trading software to make a large number of small, quick trades to profit from short-term price movements. Scalping is a high-frequency trading strategy where traders aim to capture small price fluctuations within a very short time frame, often seconds or minutes.

Here are some key elements to consider when developing or using an EA scalping strategy:

-

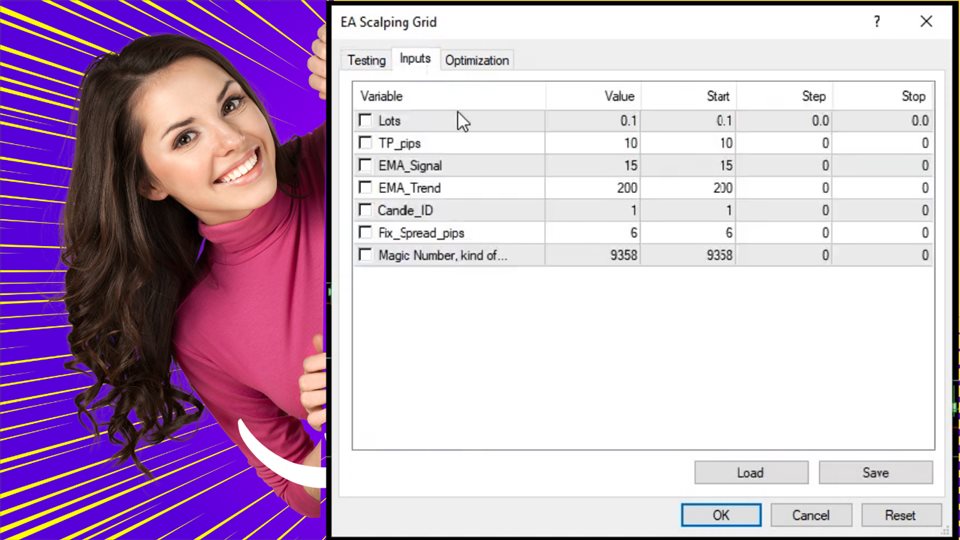

Time Frame: Scalping typically involves trading on very short time frames, such as 1-minute or 5-minute charts. The EA should be set up to analyze price data and execute trades accordingly within these short intervals.

-

Technical Indicators: Scalping EAs often use a combination of technical indicators, such as moving averages, stochastic oscillators, RSI (Relative Strength Index), or Bollinger Bands, to identify entry and exit points. These indicators help the EA make decisions based on price patterns and market conditions.

-

Risk Management: Scalping can be highly risky due to the large number of trades executed in a short period. Effective risk management is crucial to protect your capital. Implement stop-loss orders and position sizing rules to limit potential losses.

-

Spread and Broker Selection: Scalping strategies are sensitive to transaction costs, particularly spreads (the difference between the bid and ask price). Choose a broker with low spreads and fast execution to minimize trading costs.

-

Volatility: Scalping is most effective during periods of high market volatility when price movements are more pronounced. Be aware of economic events and news releases that can impact market volatility.

-

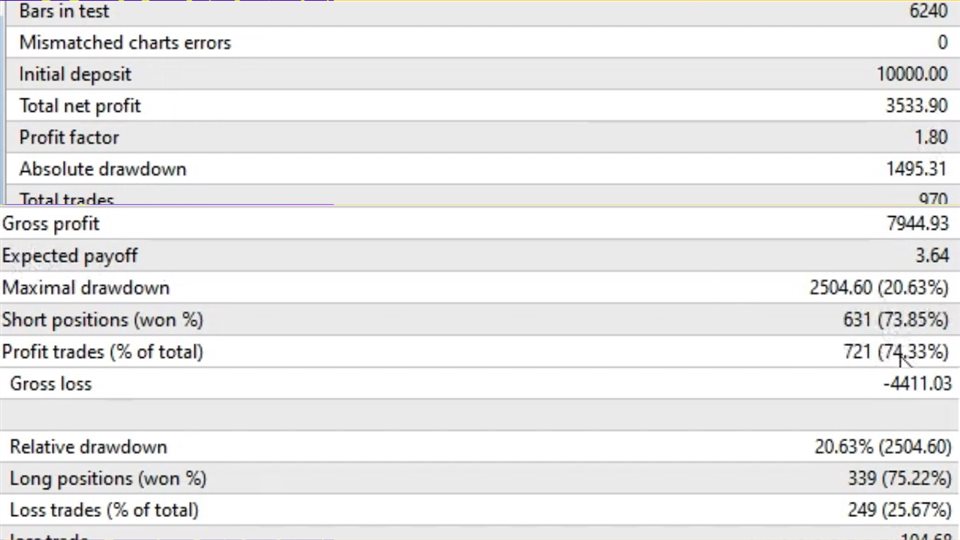

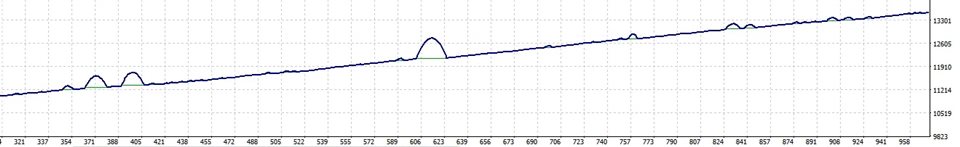

Backtesting: Before deploying an EA scalping strategy in a live trading environment, thoroughly backtest it using historical price data to evaluate its performance. Make adjustments as needed based on the results.

-

Latency: Scalping relies on quick execution, so ensure that your internet connection and trading infrastructure have minimal latency to avoid slippage and delays in order execution.

-

Monitoring: Even with an automated EA, it's essential to monitor its performance regularly and make adjustments as market conditions change. Scalping strategies may require ongoing optimization.

-

Psychological Discipline: Although scalping is automated, traders should maintain discipline and avoid the temptation to interfere with the EA's decisions. Emotional trading can lead to losses.

-

Regulatory Considerations: Ensure that your scalping strategy complies with the regulations of your trading jurisdiction and the broker you're using.

Remember that scalping is a high-risk, high-reward strategy, and it may not be suitable for all traders. It requires a deep understanding of the market, a robust EA, and the ability to handle the fast-paced nature of scalping. Additionally, it's important to have a clear exit strategy and be prepared to adapt to changing market conditions.