EA EMA Crossover Trend

- Experts

- Zafar Iqbal Sheraslam

- 버전: 1.0

- 활성화: 5

Certainly! An EA (Expert Advisor) EMA (Exponential Moving Average) Trend Following Crossover strategy is a popular algorithm used in trading to identify trends in financial markets, such as stocks, forex, or cryptocurrencies. This strategy uses two Exponential Moving Averages with different periods to generate buy and sell signals based on their crossovers. Here's how it works:

-

Exponential Moving Averages (EMAs):

- An Exponential Moving Average gives more weight to recent price data, making it more responsive to current market conditions.

- Typically, traders use two EMAs with different periods, such as a shorter-term EMA (e.g., 12-period) and a longer-term EMA (e.g., 26-period).

-

Crossover Signals:

- Golden Cross: When the shorter-term EMA crosses above the longer-term EMA, it generates a "Golden Cross" buy signal. This suggests that the current trend is bullish and it may be a good time to enter a long position.

- Death Cross: Conversely, when the shorter-term EMA crosses below the longer-term EMA, it generates a "Death Cross" sell signal. This suggests that the current trend is bearish, and it may be a good time to enter a short position or exit a long position.

-

Entry and Exit Rules:

- Buy Signal (Golden Cross): When the shorter-term EMA crosses above the longer-term EMA, and other confirming factors (e.g., momentum or volume) align, it may signal a buy entry.

- Sell Signal (Death Cross): When the shorter-term EMA crosses below the longer-term EMA, and confirming factors align, it may signal a sell entry or exit from a long position.

-

Risk Management:

- Traders often use stop-loss orders to limit potential losses in case the market moves against their position.

- Take-profit orders can also be used to secure profits when the market moves favorably.

-

Position Sizing:

- Determining the size of each trade is crucial. It can be based on factors like risk tolerance, account size, and the distance to the stop-loss level.

-

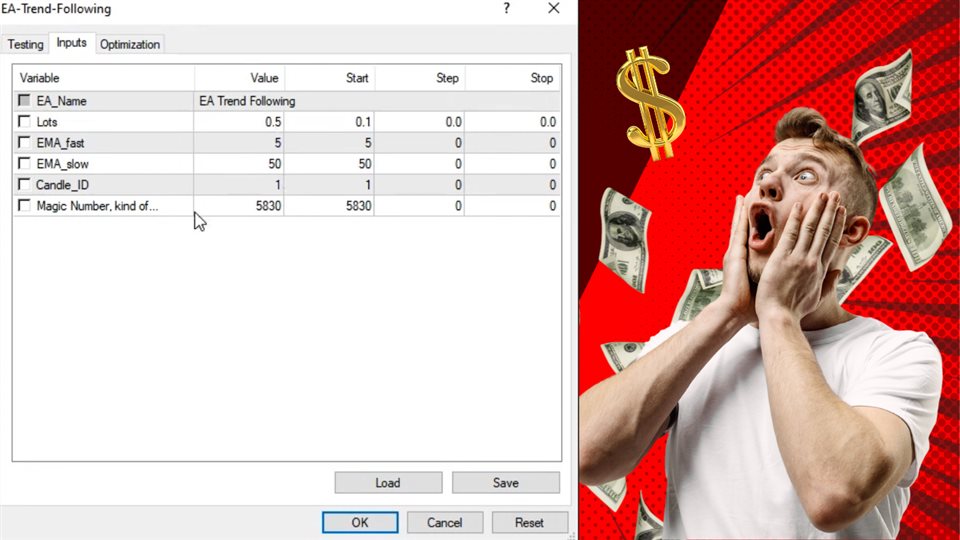

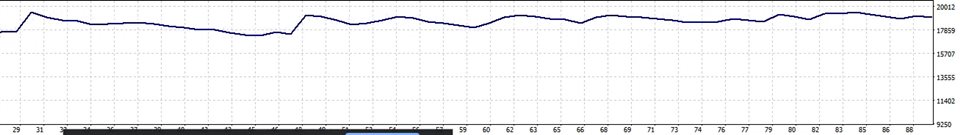

Backtesting and Optimization:

- Traders typically backtest this strategy using historical data to assess its performance in various market conditions.

- Optimization involves fine-tuning the EMA periods and other parameters to maximize profitability while minimizing risk.

-

Automation (Expert Advisor):

- Many traders choose to automate this strategy by coding it into an Expert Advisor (EA). An EA can execute trades automatically based on predefined rules and signals, freeing the trader from constant monitoring.

Remember that while the EMA Trend Following Crossover strategy can be effective, it's not foolproof. Market conditions can change rapidly, and it's important to combine it with other technical and fundamental analysis tools to make informed trading decisions. Additionally, risk management is crucial to protect your capital. It's advisable to practice with a demo account before trading with real money.