KT MTF Order Blocks MT4

- 지표

- KEENBASE SOFTWARE SOLUTIONS

- 버전: 1.1

- 활성화: 5

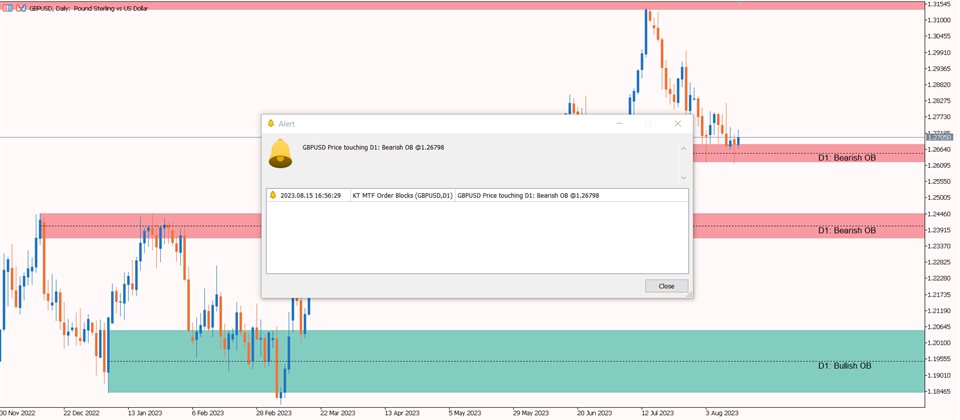

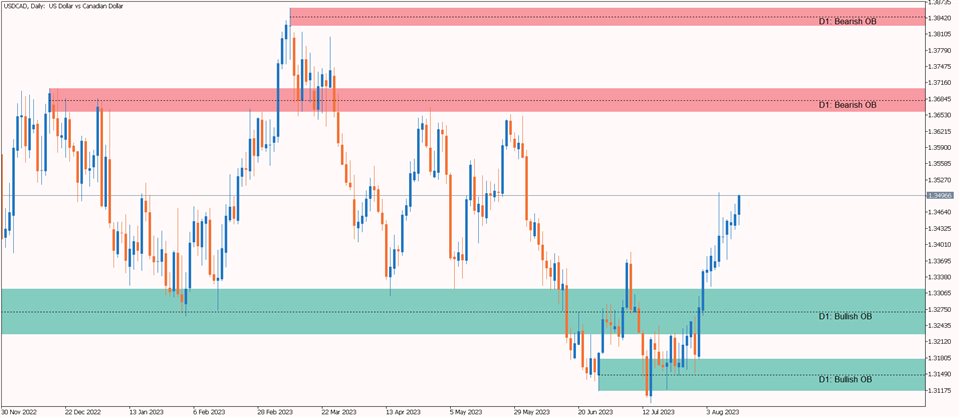

The KT MTF Order Blocks automatically plots the institutional order blocks by using a unique blend of price action with comprehensive multi-timeframe analysis.

This advanced approach reveals the area of price reversal, originating from significant buy and sell orders strategically placed by major market players.

Features

- Algorithmic Precision: A refined and distinctive order block algorithm meticulously crafted to precisely identify the most pivotal order blocks, often triggering price reversals.

- Holistic Market View: Simultaneously displays order blocks from up to three timeframes, revealing a comprehensive market perspective through multi-timeframe analysis.

- Chart Clarity: Ensures a clear and organized chart by meticulously preventing any overlap of order blocks, eliminating clutter and potential confusion.

- Pre-Loaded Chart Template: It comes with a pre-loaded chart template that harmonizes seamlessly with the indicator's properties, ensuring an optimized visual experience.

- Reversal Anticipation: It incorporates a 50% markup line within each order block, providing a tool to anticipate potential reversals stemming from these blocks.

- Dynamic Color Adaptation: Offers the flexibility to dynamically switch the colors of bullish and bearish order blocks, adapting to the prevailing price action.

- Tailored Customization: Empowers users with complete customization options, allowing adjustments ranging from order block amplitude to colors and width, ensuring alignment with individual preferences.

- Proactive Alerts: Provides various alert options, including PopUp notifications, mobile alerts, email notifications, and sound cues, each activated when price approaches an order block.

Inputs

- Order Block Bars: Specify the number of bars to identify order blocks. The order blocks from the recent bars hold stronger influence on price behavior.

- Order Block Amplitude: You can adjust the value to detect order blocks. Greater values yield fewer but more accurate blocks; smaller values increase the number of blocks detected.

- Order Block Confirmation Bars: Define the number of bars for order block confirmation. A higher value enhances the strength of the identified order block.

- Display OB from Current Timeframe: When enabled, it displays order blocks from the current chart timeframe.

- Display OB from Second or Third Timeframe: Activating this option showcases order blocks from the chosen alternate timeframes.

- Show Bullish/Bearish Order Blocks: With this input, you have the choice to display exclusively bullish or bearish order blocks.

- Flip OB Colors based on Price: Enabling this feature causes the colors of bullish and bearish order blocks change based on the current price movement.

- Draw Mid(50%) Line in OB: Activating this option results in the display of a 50% Fibonacci line within each order block.

- Use Chart Template: Enable this setting to load a dynamic chart template that perfectly complements the drawn order blocks.

What Exactly is an Order Block?

An order block is a specific area on a price chart where significant buying or selling activity has occurred. It's often identified by a cluster of price bars that indicate a concentration of trading orders executed at a particular price level. These order blocks are thought to represent areas of strong supply and demand imbalances in the market.

An order block is considered significant because it suggests that a large number of traders placed their buy or sell orders at that level, which can influence future price movements. Traders often use order block analysis to anticipate potential price reversals, breakouts, or trends, as these levels can act as support or resistance zones.

Bullish Order Block

A Bullish order block is an area where considerable number of traders decided to buy, creating a surge in demand. This can indicate a strong belief that the price will rise from that point onward.

Think of it as a gathering of enthusiastic buyers who believe that the price is about to increase. This gathering leaves a mark(or say block) on the chart, suggesting that this area could act as a support zone, where buyers might step in again if the price dips back to that level.

In a nutshell, a bullish order block is a zone on the chart where a significant number of buy orders were placed, signaling a positive sentiment and potential support for further price increases.

Bearish Order Block

A Bearish order block is an area where a substantial number of traders decided to sell, resulting in an influx of supply. This often signifies a strong belief that the price will decline from that point onward.

Imagine a gathering of cautious sellers who anticipate a price decrease. This gathering leaves a mark on the chart, indicating that this area might serve as a resistance zone, where sellers could emerge again if the price rises back to that level.

Applications

- Identifying Key Reversal Points: It helps traders locate critical areas on the chart where price reversals are likely to occur due to significant buy or sell order placements.

- Confirmation for Entry and Exit: Traders can use the order blocks to confirm their entry and exit points for trades, enhancing the accuracy of their trading decisions.

- Enhancing Support and Resistance Analysis: The indicator assists in pinpointing levels of support and resistance, aiding traders in placing stop-loss orders, setting profit targets, and understanding potential price movements.

- Fine-tuning Risk Management: By recognizing areas of substantial order activity, traders can manage their risk more effectively by adjusting position sizes and placement of protective stops.

- Filtering Trade Setups: The indicator acts as a filter for trade setups, allowing traders to focus on opportunities that align with the identified order blocks, increasing the probability of successful trades.

- Integrating with Trend Analysis: When combined with trend analysis, the indicator can help traders identify order blocks that align with the prevailing trend, offering valuable insights for trend-following strategies.

- Spotting Breakout Zones: Traders can utilize the order blocks to identify potential breakout zones where strong order activity might lead to significant price movements.

- Incorporating into Swing Trading Strategies: The order blocks can be integrated into swing trading strategies, aiding traders in capturing price swings over short to medium-term horizons.

- Fine-tuning Entry Timing: The indicator's alerts can notify traders when price is nearing an order block, assisting them in timing their entries with precision.

- Analyzing Price Action Context: Traders can analyze the price action around order blocks to gain insights into market sentiment and potential shifts in supply and demand dynamics.