VWAP Z Score Strategy Grid EA

- Experts

- Faisal Alajmi

- 버전: 1.2

- 활성화: 10

- [ What is: VWAP (Volume-Weighted Average Price ]

//-----------------------------------------------------------------------\\

A. it is a trading indicator that calculates the average price at which a particular security (stock, commodity, etc.) has been traded throughout a given trading session,

weighted by the volume of each trade.

It provides insight into the average price level and helps traders understand whether they are buying or selling

at a better price compared to the overall market activity.

B.The VWAP Z-score is a statistical measure that quantifies how far the current price of an asset deviates from its VWAP.

It's calculated by subtracting the VWAP from the current price and then dividing the result by the standard deviation of the prices over a certain period of time.

This (( Z-score )) indicates how many standard deviations the current price is away from the average VWAP price.

C.

Positive VWAP Z-scores suggest that the current price is above the VWAP, potentially indicating bullish sentiment or overvaluation.

Negative VWAP Z-scores suggest that the current price is below the VWAP, potentially indicating bearish sentiment or undervaluation.

D.

Traders and investors use the VWAP Z-score to assess whether the current price is unusually high or low compared to the recent price action and VWAP,

helping them make more informed trading decisions.

\\-------------------------------------------------------------------------//

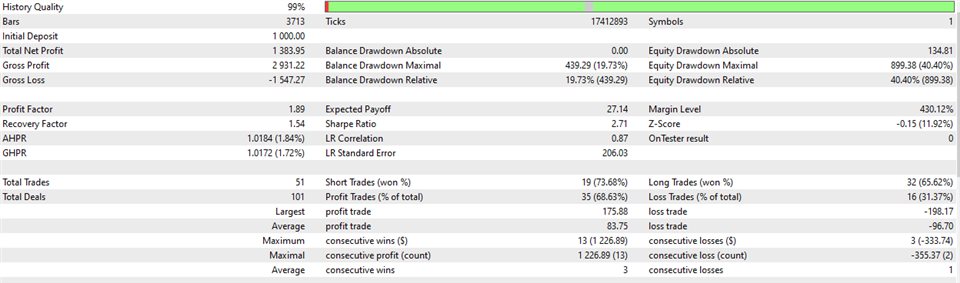

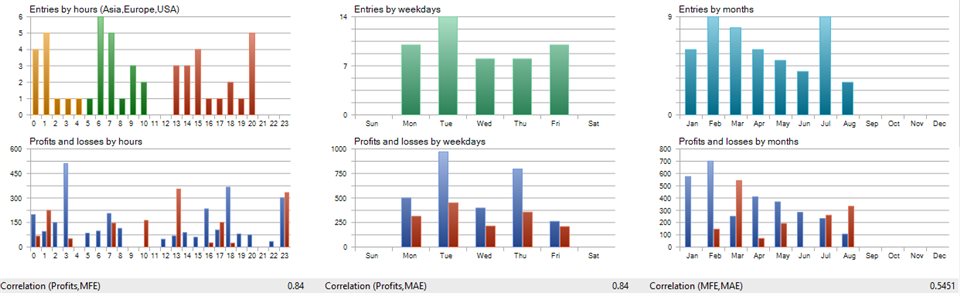

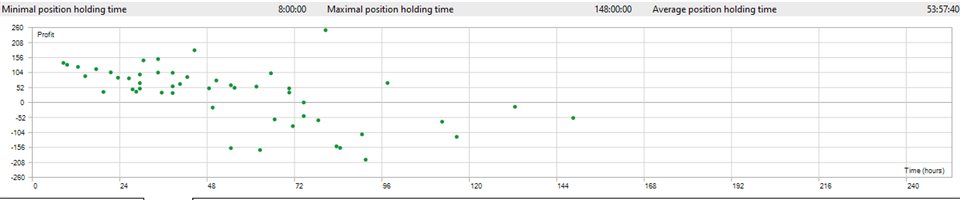

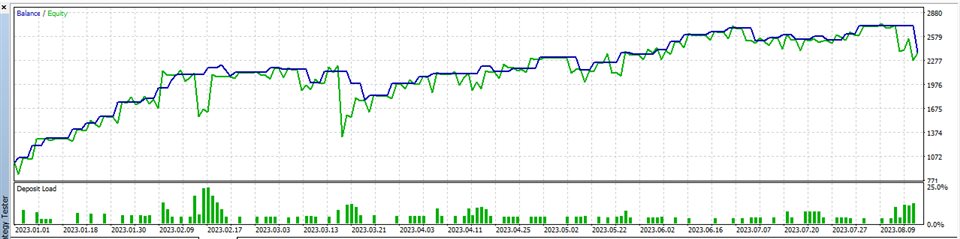

- --{ XAUUSD ( 6 Months later ) by 1 Hour TF }--

-=- Backtest via [ XAUUSD ] Settings Below -=- <--/// dont use same settings here ,because it was backtest only .

---------------

* Settings *

---------------

- Lotsize: 0.1

- Select type trade: BUY / SELL ( the best is single type )

- Max Trades: 5 (( for safe use only 3 ))

- Max profit: false (( take-profit for each trade )) by %

- Max lose: false (( stop-lose for each trade )) by %

- stop-lose: false (( because we have to see our auto tarde movement via 'z-score' strategy ))

----------------------------------

A - Take profit 1 :< --=-- ( cant disable this option so you can skip it by big value 9999 etc.. )

B - Take profit 2:< --=-- ( cant disable this option so you can skip it by big value 9999 etc.. )

Note:- if your take-profit 1 or 2 for example [take-profit1] : '50usd' if reach 50 the calculate is 50 \ 2 = 25 even your lot size if the lot is 1Lot it will be 0.5Lot.

-----------------------------

- Trade option: Market order

- Trailing stop: false (( you have to check that option because it is very fun ))

- Distance Buy and Sell limit: (( not working by default because our trade is Market order not Limit order ))

- [ Close All Trades on Balance ] and there are two types ..

A- ( Balance profit ) = Equity ( Total rollback ) for more safe

for example : if our capital is 1000usd and ( Balance profit ) that we put is = 20% , and 'Equity' reaches 1200usd all trades will be close.

B- ( Balance lose ) = Equity

if our capital is 1000 and ( Balance profit ) that we put is = 20% , and 'Equity' reaches 800usd all trades will be close etc.

- Sessions : all true (( you can switch between them )) as you want

---------------------- Z-score & RSI ------------- Start .

*How Strategy works:?*

The Main strategy is -=- Z Score -=- via [ RSI ] just for more Confermation and more safe .

Note: you can switch between them ( z-score and rsi ) or together .

- Z-SCORE

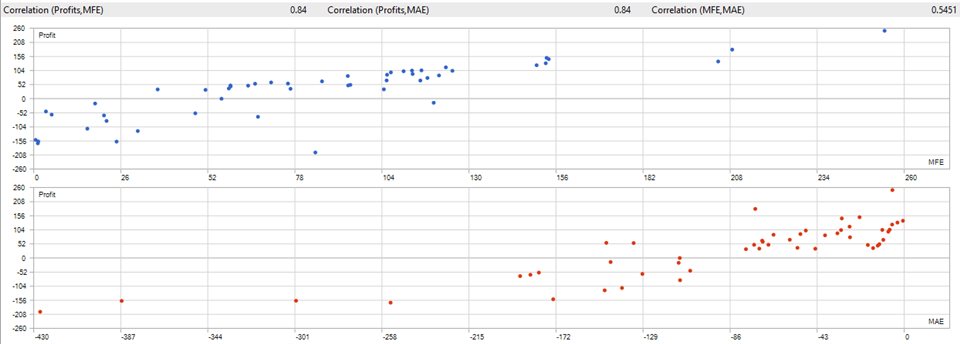

1. Buy Trade: When -Z-score- Cross under -2 the ( Buy ) direction trade will open.

2. Take profit: When -Z-score- Cross over +2 /// <=-- you can change (+2) vlue as you want.

Note: The best settings in the z-score section for high quality results is :-

VWMA Period: 8

Z-score Period: 33

1. Sell Trade: When -Z-score- Cross over +2 the ( Sell ) direction trade will open.

2. Take profit: When -Z-score- Cross under -2 /// <=-- you can change (-2) vlue as you want.

- RSI <= ( Use it via Z-score if you are not professional *Trader* ), or leave it False.

Note: you can use .RSI. alone ( but need to be careful )

1. Buy Trade: When -RSI- Cross under 30 the ( Buy ) direction trade will open.

2. Take profit: When -RSI- Cross over 70 /// <=-- you can change (70) vlue as you want.

1. Sell Trade: When -RSI- Cross over 70 the ( Sell ) direction trade will open.

2. Take profit: When -RSI- Cross under 30 /// <=-- you can change (30) vlue as you want.

---------------------- Z-score & RSI ------------- End .

- Volume: True (( dont make it false at all ))

- Be safe -

Regards.

Q8crackers team.

Contact: Telegram Only [ @Q8Cracker ]