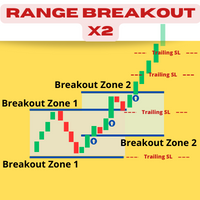

Range Breakout X2

- Experts

- Abdeljalil El Kedmiri

- 버전: 1.2

- 업데이트됨: 8 1월 2024

- 활성화: 15

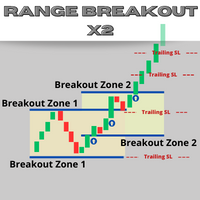

The Range Breakout X2 is following a scalping breakout strategy. This expert will identify the daily 4 key levels of support and resistance and will open Long and short trades on these levels.Profits can be secured with the adjustable trailing stop...

Note : Please be advised that due to the current market conditions (volatile market), we recommend activating the second levels (15H) and deactivating the first levels (11H).

This is an optimized range breakout strategy with a simple and full customization for all markets indices, forex, stocks, commodities and crypto.

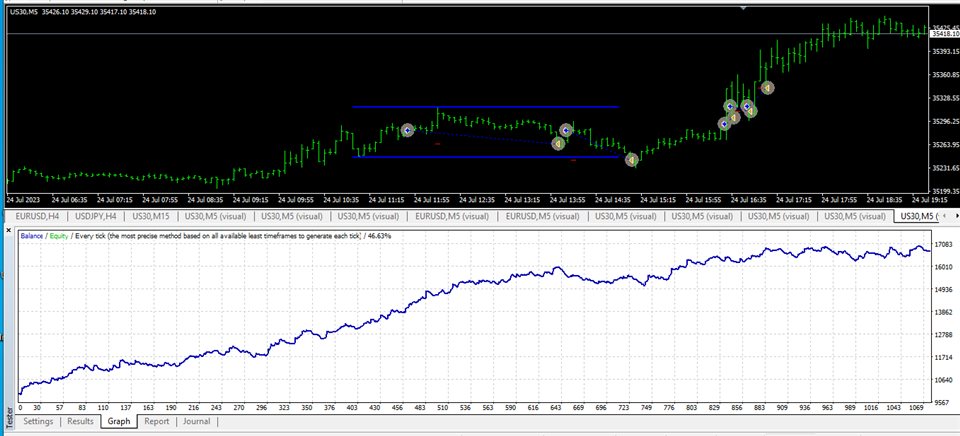

The backtests shown in the screenshots were done with the default settings for DJIA. There might be better or worse settings. Please download the free demo to do your own testing.

Note: To be a profitable trader, you don't need to have a high winning rate, One true breakout, one winning trade a day can cover all your losses and make your account grow and grow.

Note: This expert can be able to overcome the challenges of the forex prop firms, you just have to take a well measured risk!

This EA does not use any martingale and/or grid functionalities.

How it's work : Take a look at the screenshots in the Comments section.

Link for the MT4 version : https://www.mql5.com/en/market/product/103081

Download Set files

| INDICES |

|---|

DOWJONES |

NASDAQ |

SP500 |

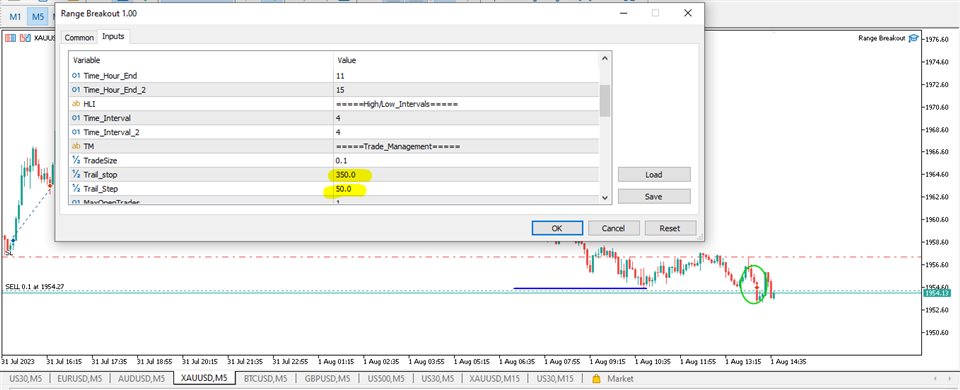

<General Inputs>

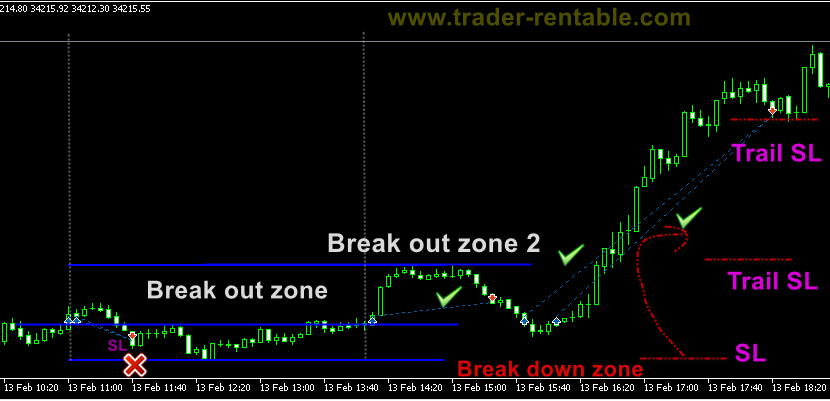

True_Breakout : Buy if price cross above resistance and Sell if price cross below support level.

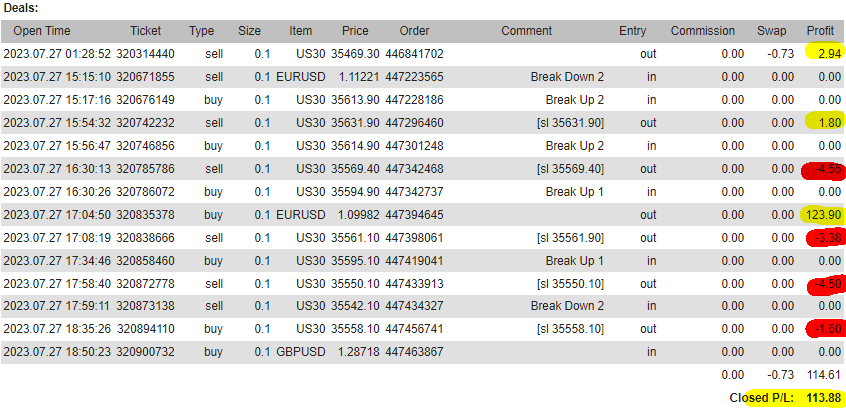

Break Up 1: Breakout zone 1, price break the first level of resistance (range 1),This is a 'Buy' trade.

Break Down 1 : Breakout zone 1, price break the first level of support (range 1), This is a 'Sell' trade.

Break Up 2 : Breakout zone 2, price break the second level of resistance (range 2), This is a 'Buy' trade.

Break Down 2 : Breakout zone 2, price break the second level of support (range 2), This is a 'Sell' trade.

False_Breakout : Sell if price cross above resistance and Buy if price cross below support level.

Revers_Break_Down1 ; Revers_Break_Down2 : ( Buy Orders)

Revers_Break_Up1 ; Revers_Break_Up2 : ( Sell Orders)

Filter_Signals : Activate or desactivate filters to confirm True_Breakouts .

Time end 1: End of the time to identify the high and low values for the first range.

Time end 2 : End of the time to identify the high and low values for the second range.

Time Interival : Number of hours befor "Time end" to identifier High and Low of the range this is a sensitivity of the high and low algorithm for the first ansd second range (smaller value = less highs and lows, greater value = more highs and lows).

Range Width : Prevent EA from entering breakouts positions whena range exceeding certain width (Wide range).

Trail Stop : The Trailing Stop will be trailed in this set distance behind the current market price.

Trail Step : The SL will only be modified if it is at least this distance above the previous SL.

SL_pips : Stop loss in pips

TP_pips : Take profit in pips (activate or descativate)

Trade Size: Lot size for each trade if the fixed trading volume mode is chosen.

Risk % of Balance : Risk percentage of balance per trade (0.01 = 1%, More explanation is provided below).

Daily Drawdown : Pause trading for the reste of the day if your losses reach this specified dollar amount (negative value).

Stopout level in Dollars : Close trades if you losse n dollars from your account (balance - equity)

Next open trades after nBars : No trade will be opened within this time after the previouse trade's close.

Maximum trade duration : Open trades will be closed if they last longer n Hours, in my case 8 Hours.Max Open Trades : Maximum simultaneous open trades.

Time and Day Filter: Activates or deactivates the time filter which will be checked before new orders are placed.

Start Hour: Hour of the start of the allowed trading time.

Start Minute: Minute of the start of the allowed trading time.

End Hour: Hour of the end of the allowed trading time

End Minute: Minute of the end of the allowed trading time

Magic Number: This number should be unique for every EA in your account since the EAs use it to identify their own trades.

Allow Hedging : Chek if you want to sell when a long position long is open, and vice versa.

Audible_Alerts : Alerts for every order "buy or sell".

Push_Notifcations : Notifications for mobile terminals.

Risk % to Lot size

Risk % Per Trade = Percentage of account size to risk on each trade. This is calculated from Stop loss, so don't forget to set the Stop Loss for each order! Otherwise, sending order will fail. For example, if your account size is $1000, you want to risk 1% per trade and the EA is going to open a trade on US30 with a Stop Loss of 50 pips (5000), the lot size is calculated as follows:

If the leverage is 1:100, and the pip value is $10 for one standard lot;

The maximum risk is 1% of $1000 = $10*leverage (100) = 10000$;

The maximum loss of 50 pips is equal to $50000 per one lot. We will open $10000 / $50000 = 0.2 lots.

very good expert advisor , I used with forex and downjones .