1. I want a script, that will first determine if I have a trade on the chart, is it a buy or sell, and the size of the trade in lots to be used in the calculations of the grid of limit orders being created:

a. If no trade is on chart, tell me "You need to first place a trade" then the script takes no further action

b. If multiple trades are already on chart, tell me "Can can have only one trade on chart to run this script" then the script takes no further action

c. If one trade is on chart, the script will take actions below

2. User input: Ask me lot size of each grid level "Spacing of grid levels: ____" and then I enter a number, example 5,

3. User input: Ask me how many grids to place on the chart "How many grid levels below price: ____" and then I enter a number, example 3

4. Using data about the existing trade on the chart, and the two user inputs, take the following action:

a. If buy is on chart, place a number of limit orders equal to what user entered on number of grid levels, below current order, at spacing specified in pips by user

b. If sell is on chart, place a number of limit orders equal to what the user entered on the number of grid levels, above current order, at spacing specified in pips by user

5. Size of each grid level will be in increasing increments depending upon the size of the original trade on the chart

a. If trade on chart is 0.50 lots,

(1) 1st Limit order placed will be 1.00 lots

(2) 2nd Limit order placed will be 1.50 lots

(3) 3rd Limit order placed will be 2.00 lots

etc... to the number of levels indicated by the user

b. If trade on chart is 1.00 for example

(1) 1st Limit order placed will be 2.00 lots

(2) 2nd Limit order placed will be 3.00 lots

(3) 3rd Limit order will be 4.00 lots

c. So each grid level will have limit orders that are incrementally larger than the previous level, based upon the existing trade size on the chart

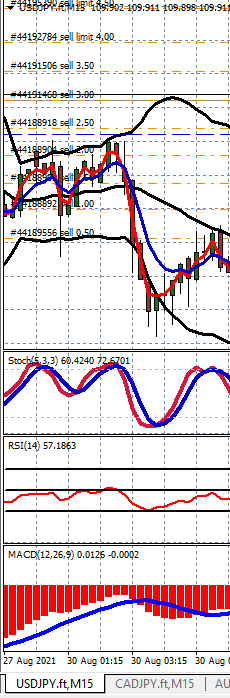

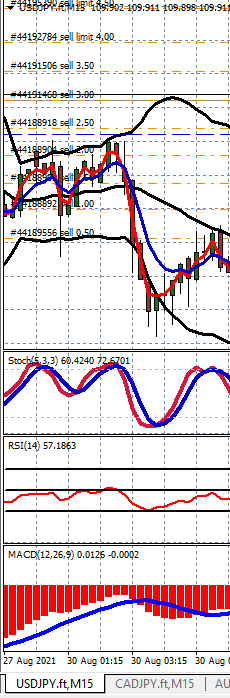

Example from a chart

비슷한 주문

I'm going to fix my AFL code. My AFL code should work follows: Lets say I buy gold at $2,500. I want to add a position each time it goes up 20 ticks up to a maximum of 4 positions. So that would be the initial buy at $2,500. Since gold moves in $.10 increments (ticks) I would then buy another position at $2,502, then another at $2,504 and another at $2,506 which would be a maximum of 4 positions. The adds would use

Hi, I need to make algo trading platform . These are my specifications: 1. Integration with only one broker Zerodha (no need for multi-broker support) 2. Web-based UI for clients where they select which strategy to execute 3. Admin will plug python based strategies to the platform. Client should be able to select from available strategies. I already have a bundle of strategies in python. 4. Source code should

// @version= 5 strategy ( "Operator Psychology Trading Strategy with Heikin-Ashi (Auto Risk-Reward)" , overlay = true , pyramiding = 2 , default_qty_type = strategy.fixed , default_qty_value = 1 ) // Check for the 3-minute timeframe if ( not ( timeframe.isintraday and timeframe.period == "3" )) runtime.error ( "This strategy can only be run on the 3-minute timeframe." ) // Parameters for ATR, Stop-Loss, Risk

Hi, I need to make algo trading platform . These are my specifications: 1. Integration with only one broker Zerodha (no need for multi-broker support) 2. Web-based UI for clients where they select which strategy to execute 3. Admin will plug python based strategies to the platform. Client should be able to select from available strategies. I already have a bundle of strategies in python. 4. Source code should be

I already have a thinkscript, but I need to know if it is possible since I have done a lot of research already on the matter. Basically, I have a DoubleTop and DoubleBottom thinkscript indicator, which is based on futures bars. It prints a Pivot dot with a label when there is a DoubleTop or DoubleBottom on the chart. I can then see this on whatever time-frame I switch to. I would like to have the Scan - Alert

Create a Ninjatrader strategy 1. Identify yesterday’s range (high and low) between 13:30 and 16:00. Call this the NY PM Range. 2. Wait until price trades above the NY PM Range High or below the NY PM Range Low in Regular Trading Hours (9:30 to 16:00) 3. If price trades above the NY PM Range High, Set a Stop Market Order Short at low of the previous candle. Continuously adjust the entry order to the low of the

Hello, I'm looking for an expert in divergence to create a custom indicator for TradingView. The indicator should be able to identify all types of divergences, including hidden ones, with precision. Thank you and good luck

Hey greetings My please to met you Am in need of a tradingview developer that can create alert for me based on a tradingview indicator kindly bid for this project if it is what you can do for me

HI Recently purchased VPS, But now i am getting Following message "failed to get list of virtual hosts [404]", I need one help to fix this isues and make sure my EA working on VPS, when my computer off Thank you

can you help me with: Robot that works in automatic trading and algorithms based on high volatility news captured in economic calendars such as ( https://uk.investing.com/economic-calendar/, thanks Creating an automated trading bot that bases its decisions on economic news and high volatility events, such as those found in economic calendars (e.g., Investing.com's), involves several key components. Here are the steps