당사 팬 페이지에 가입하십시오

- 조회수:

- 4591

- 평가:

- 게시됨:

- 2015.01.22 13:43

- 업데이트됨:

- 2016.11.22 07:32

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Real author:

klot

The indicator exemplifies smoothing of price time series by means of filtration of harmonics of a greater order.

This approach can be applied for smoothening any indicators' values.

The main advantage of the method is a real absence of a delay.

Indicator input parameters:

//+-----------------------------------+ //| Input parameters of the indicator | //+-----------------------------------+ input uint N = 7; // Series length input uint SS = 20; // Smoothing coefficient input int Shift=0; // Horizontal shift of the indicator in bars

where:

- N specifies series length (power of two);

- SS - A smoothening coefficient in the resulting spectrum zeroes out frequency ratios exceeding set value. SS cannot exceed 2^N. Close series fully repeats itself if SS = 2^N.

https://www.mql5.com/ru/code/7000 library is required for the indicator operation..

This indicator was first implemented in MQL4 and published in CodeBase on November 23, 2006.

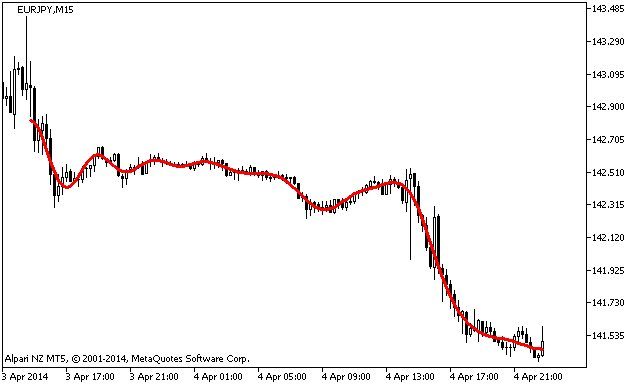

Fig.1. i-SpectrAnalysis Indicator

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/7001

i-SpectrAnalysis_RSI

i-SpectrAnalysis_RSI

The indicator exemplifies smoothing of price time series of the RSI indicator by means of filtration of harmonics of a greater order.

i-SpectrAnalysis_MFI

i-SpectrAnalysis_MFI

The indicator exemplifies smoothing of price time series of the MFI indicator by means of filtration of harmonics of a greater order.

Accumulative Swing Index - ASI

Accumulative Swing Index - ASI

The Accumulative Swing Index indicator is applied for accumulative swing index construction.

Stoch_2HTF

Stoch_2HTF

A colored cloud formed by two Stochastics with different timeframes.