당사 팬 페이지에 가입하십시오

- 게시자:

- Nikolay Kositsin

- 조회수:

- 34863

- 평가:

- 게시됨:

- 2011.11.25 12:18

- 업데이트됨:

- 2023.03.29 13:43

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Real author:

Witold Wozniak

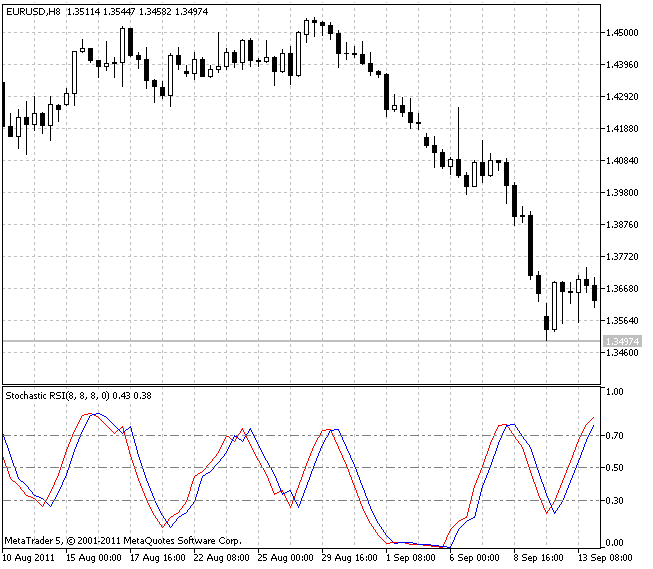

Stochastic RSI is a standard Stochastic oscillator, the values of which are calculated not from a price series but from RSI technical indicator values.

Standard RSI may not show market cycles or volatility changes. In case the market enters trend state, RSI often is not able to reach the appropriate level that can trigger position opening signal according to the trend direction. Implementation of Stochastic oscillator to RSI creates a dynamic indicator that better corresponds to its current volatility.

The indicator is inspired by John Ehlers' article "Using The Fisher Transform" published in November 2002 in the "Technical Analysis Of Stock & Commodities" magazine. The simplest method of working with this indicator is completely equivalent to Stochastic oscillator or RSI.

The indicator uses SmoothAlgorithms.mqh library classes (must be placed to the terminal_data_folder\MQL5\Include). Working with the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/541

Smoothed Adaptive Momentum

Smoothed Adaptive Momentum

Adaptive Momentum from John Ehlers' book "Cybernetic Analysis for Stocks and Futures: Cutting-Edge DSP Technology to Improve Your Trading".

Resonance Hunter

Resonance Hunter

Multi-currency Expert Advisor that analyze resonance events at related financial assets.

ZigZag NK Channel

ZigZag NK Channel

The indicator draws the channel using ZigZag extreme points.

TwoPoleButterworthFilter

TwoPoleButterworthFilter

Two pole Butterworth filter is used for smoothing in this moving average calculation algorithm.