당사 팬 페이지에 가입하십시오

- 조회수:

- 107

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

저자: 안드레이 N. 볼콘스키

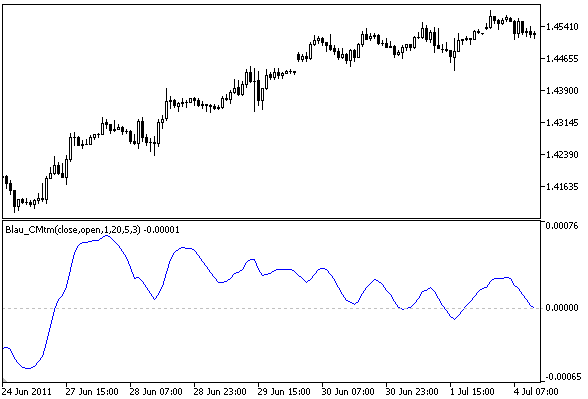

모멘텀 캔들 지표 (모멘텀 q- 기간 캔들, 평활화된 모멘텀 q- 기간 캔들) 윌리엄 블라우, 책 모멘텀 , 방향성 및 발산에 설명되어 있습니다.

모멘텀은 현재 가격(보통 오늘 종가)과 이전 가격(보통 어제 종가)의 차이입니다. 모멘텀은 가격 차트의 모든 기간에 가격 변화를 반영할 수 있습니다.

캔들스틱모멘텀 (윌리엄 블라우에 따르면)은 한 기간(한 캔들스틱 내) 내 종가와 시가의 차이입니다. 캔들 모멘텀의 부호는 가격 변화 방향을 나타냅니다: 양수 캔들 모멘텀 - 해당 기간 동안 가격 상승, 음수 캔들 모멘텀 - 해당 기간 동안 가격 하락.

캔들 모멘텀 공식:

cmtm = close - open

Where:

- 종가 - 현재 기간의 종가(캔들);

- 시가 - 현재 기간의 시초가(캔들).

보편성의 관점에서 캔들 모멘텀의 정의를 확장해 보 겠습니다:

- 캔들 모멘텀은 가격 차트의 모든 시점의 가격 변동을 반영할 수 있습니다;

- 가격 기준(종가, 시초가)은 임의적일 수 있습니다.

차트 주기 캔들 모멘텀의 정의

자세한 내용은 윌리엄 블라우의 MQL5의 인디케이터 및 트레이딩 시스템 문서를 참조하세요. 1부: 인디케이터.

- WilliamBlau.mqh는 터미널_데이터_디렉토리\MQL5\포함\에 위치해야 합니다.

- Blau_CMtm.mq5는 터미널 데이터 디렉토리\MQL5/Indicators\에 위치해야 합니다.

윌리엄 블라우 캔들스틱 모멘텀 인디케이터

계산:

q-주기의 캔들 모멘텀 공식입니다:

CMTM(가격1,가격2,Q) = 가격1 - 가격2[Q-1]

여기서

- q는 캔들 모멘텀 계산에 관련된 가격 차트 기간의 수입니다;

- 가격1 - 기간 q 종료 시점의 종가;

- price2[q-1] - 기간 q 시작 시점의 시초가.

q 기간 캔들스틱의 평활화된 모멘텀 공식:

CMtm(price1,price2,q,r,s,u) = EMA(EMA(EMA( cmtm(price1,price2,q),r),s),u)

여기서

- q는 q-기간 캔들의 모멘텀 계산에 관련된 가격 차트의 기간 수입니다;

- 가격1 - q 기간 종료 시점의 종가;

- 가격2 - q 기간 시작 시점의 시초가;

- CMTM(가격1,가격2,Q)=가격1-가격2[Q-1] - q-기간 캔들의 모멘텀;

- EMA(cmtm(price1,price2,q),r) - 첫 번째 평활화 - 기간 r의 지수 이동 평균(지수)을 q-기간 캔들의 모멘텀에 적용합니다;

- EMA(EMA(...,r),s) - 두 번째 평활화 - 기간 r의 지수에 적용된 기간 s의 지수;

- EMA(EMA(EMA(...,r),s),u) - 세 번째 평활 - 두 번째 평활 결과에 적용된 기간 지수 u입니다.

- q - q-주기 캔들스틱의 모멘텀을 계산하는 주기(기본값은 q=1);

- r - q-주기의 캔들 모멘텀에 적용되는 1차 EMA의 주기(기본값은 r=20);

- s - 첫 번째 평활화 결과에 적용되는 두 번째 EMA의 기간(기본값은 s=5);

- u - 두 번째 평활화 결과에 적용되는 세 번째 EMA의 기간(기본값은 u=3);

- AppliedPrice1 - 종가 유형 (기본값은 AppliedPrice=PRICE_CLOSE);

- AppliedPrice2 - 시가의 유형 (기본값 AppliedPrice=PRICE_OPEN).

- q>0;

- r>0, s>0, u>0. r, s 또는 u가 1이면 해당 EMA 기간에 평활화가 수행되지 않습니다;

- 가격 배열의 최소 크기 =(q-1+r+s+u-3+1).

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/377

Moving Average Candlesticks MT5

Moving Average Candlesticks MT5

이동평균 캔들 MetaTrader 인디케이터 - 캔들 막대를 사용한 표준 이동평균 차트 시각화입니다. 종가, 시가, 저가, 고가에 대해 계산된 이동평균값을 기준으로 캔들스틱을 그립니다. 기존 MA 지표에 비해 더 자세한 시장 정보를 간결하게 볼 수 있습니다. 모든 통화쌍, 차트주기, MA 모드에서 사용할 수 있습니다. 이 인디케이터는 MT4 및 MT5에서 사용할 수 있습니다.

Market Profile MT5

Market Profile MT5

시장 프로필 메타트레이더 지표 - 시간 경과에 따른 가격 밀도를 보여줄 수 있는 고전적인 시장 프로필 구현으로 주어진 거래 세션의 가장 중요한 가격 수준, 가치 영역 및 제어 값을 간략하게 설명합니다. 이 인디케이터는 M1에서 D1 사이의 차트주기에 연결할 수 있으며 일간, 주간, 월간 또는 일중 세션에 대한 시장 프로필을 표시합니다. 주기가 짧을수록 정확도가 높습니다. 가시성을 높이려면 더 높은 주기를 사용하는 것이 좋습니다. 자유 그리기 사각형 세션을 사용하여 원하는 주기로 사용자 지정 시장 프로필을 만들 수도 있습니다. 프로필의 블록을 그리는 데 6가지 색 구성표를 사용할 수 있습니다. 프로필을 일반 색상 히스토그램으로 그릴 수도 있습니다. 또는 강세/약세 막대를 기준으로 프로필의 색상을 선택할 수도 있습니다. 이 지표는 베어 프라이스 액션을 기반으로 하며 표준 지표를 사용하지 않습니다. 메타트레이더 4, 메타트레이더 5에서 사용할 수 있습니다.