당사 팬 페이지에 가입하십시오

- 조회수:

- 84

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

저자: 안드레이 N. 볼콘스키

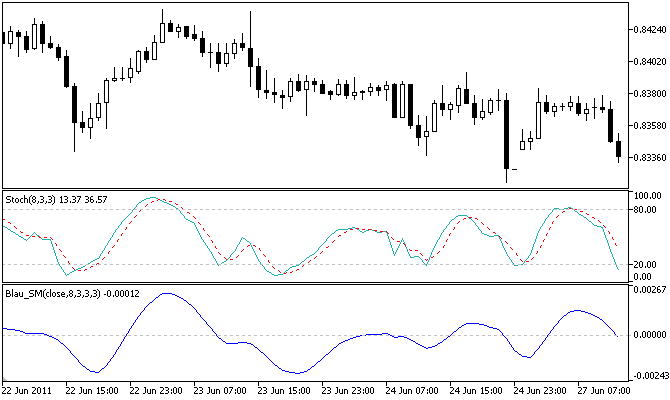

확률적 모멘텀(확률적 모멘텀, SM) 윌리엄 블라우는 모멘텀, 방향성 및 발산이라는 책에서 설명했습니다.

윌리엄 블라우의 확률적 모멘텀 지표(q-기간 확률적 모멘텀, 평활화된 q-기간 확률적 모멘텀)는 현재 기간의 종가에서 이전 q 기간의 가격 변동 범위의 중간까지의 거리로 정의됩니다.

- q-기간 스토캐스틱 모멘텀의 값은 q-기간 가격 변동 범위의 중간을 기준으로 가격이 얼마나 이동했는지를나타냅니다.

- q-기간 스토캐스틱 모멘텀의 부호는 q-기간 가격 변동 범위의 중간을 기준으로 한 가격의 위치를나타냅니다: 양수 스토캐스틱 모멘텀 - 가격이 중간점 이상, 음수 - 가격이 중간점 미만을 나타냅니다.

자세한 내용은 윌리엄 블라우의 MQL5의 인디케이터 및 트레이딩 시스템 문서를 참조하세요 . 1부: 인디케이터.

- WilliamBlau.mqh는 터미널_데이터_터미널 카탈로그\MQL5\Include\에 배치해야 합니다.

- Blau_SM.mq5는 터미널 데이터 디렉토리\MQL5/Indicators\에 배치해야 합니다.

계산:

분기별 스토캐스틱 모멘텀 공식입니다:

sm(price,q) = price - 1/2 * [LL(q) + HH(q)]

- 가격은 현재 기간의 [종가]입니다;

- q - 스토캐스틱 모멘텀 계산에 참여하는 가격 차트의 기간 수입니다;

- LL(q) - 해당 기간 q에 대한 이전 q 기간의 최저 가격의 최소값입니다;

- HH(q) - 기간 q에 대한 이전 q 기간 최고 가격의 최대값입니다;

- 1/2*[LL(q)+HH(q)] - q 기간 가격 변동 범위의 중간값.

평활화된 q-기간 스토캐스틱 모멘텀 공식:

SM(가격,q,r,r,s,u) = EMA(EMA(EMA(sm(가격,q),r),s),u)

- 가격 - 가격 차트의 가격 기준인 [종가] 가격입니다;

- q - 스토캐스틱 모멘텀 계산에 참여하는 가격 차트의 기간 수입니다;

- sm(가격,q)=가격-1/2*[LL(q)+HHH(q)] - q-기간 스토캐스틱 모멘텀;

- EMA(sm(price,q),r) - 1차 평활화 - q-기간 스토캐스틱 모멘텀에 적용된 기간 r의 지수이동평균(지수);

- EMA(EMA(...,r),s) - 두 번째 평활화 - 기간 r의 지수에 적용된 기간 s의 지수;

- EMA(EMA(EMA(sm(q),r),s),u),u)는 세 번째 평활 - 두 번째 평활의 결과에 적용된 기간 u의 지수입니다.

- q - 확률 모멘텀이 계산되는 기간(기본값은 q=5);

- r - 스토캐스틱 모멘텀에 적용되는 1차 EMA의 주기(기본값은 r=20);

- s - 첫 번째 평활화 결과와 관련된 두 번째 EMA의 기간(기본값은 s=5);

- u - 두 번째 평활화 결과에 적용되는 세 번째 EMA의 기간(기본값은 u=3);

- AppliedPrice - 가격 유형 (기본값은 AppliedPrice=PRICE_CLOSE).

- q>0;

- r>0, s>0, u>0. r, s 또는 u가 1이면 해당 EMA 기간에 스무딩이 수행되지 않습니다;

- 가격 배열의 최소 크기 =(q-1+r+s+u-3+1).

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/370

스토캐스틱 오실레이터 Blau_TS_Stochastic

스토캐스틱 오실레이터 Blau_TS_Stochastic

윌리엄 블라우의 스토캐스틱 오실레이터.

Blau_TStochI 확률 인덱스

Blau_TStochI 확률 인덱스

윌리엄 블라우의 스토캐스틱 지수(정규화된 평활화된 분기 스토캐스틱).

마침표 변환기 모드

마침표 변환기 모드

MT4의 기간 변환기와 유사합니다.

Pinbar Detector MT5

Pinbar Detector MT5

핀바 탐지기는 핀바("핀바" 또는 "핀바"라고도 함)를 감지하여 강세 핀바 아래 및 약세 핀바 위에 "웃는 얼굴" 기호를 배치하여 표시하는 메타트레이더 보조지표입니다. 이는 코드에 표준 기술 지표를 사용하지 않는 순수한 가격 행동 지표입니다. 핀바 감지의 구성은 인디케이터의 입력 매개변수를 통해 할 수 있습니다. 핀바 감지기는 감지 시 플랫폼 알림과 이메일 알림을 발행할 수 있습니다. 이 인디케이터는 MT4 및 MT5 버전의 거래 플랫폼에서 모두 사용할 수 있습니다.