거래 로봇을 무료로 다운로드 하는 법을 시청해보세요

당사를 Twitter에서 찾아주십시오!

당사 팬 페이지에 가입하십시오

당사 팬 페이지에 가입하십시오

스크립트가 마음에 드시나요? MetaTrader 5 터미널에서 시도해보십시오

- 조회수:

- 8384

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

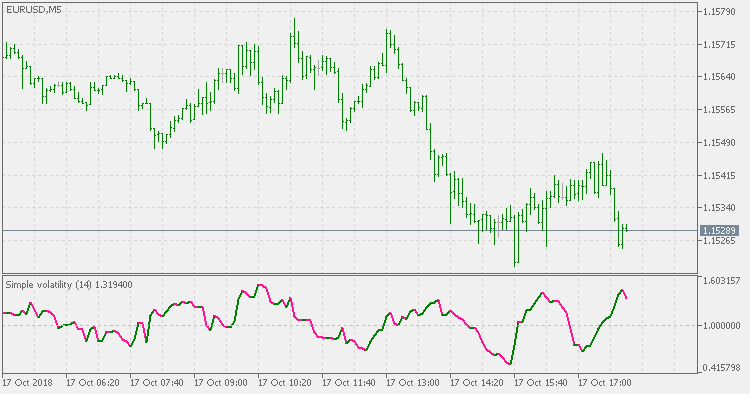

In a lot of cases we need some way to measure the volatility

Among the other ways, here is one simple way : it is a ratio of (sum of price differences) to average of (sum of price differences). As simple as it gets, it seems to be detecting the market volatility in acceptable way. As a point of reference :

- values above 1 are periods of increased volatility

- values bellow 1 are periods of decreased volatility

As it can be seen it detects the volatility change OK even in a "thin" market (when the average difference is small and when even a small change is and should be treated as significant volatility change)

Volatility adjusted RSI

Volatility adjusted RSI

Volatility adjusted RSI

Volatility adjusted WPR

Volatility adjusted WPR

Volatility adjusted WPR (Williams Percent Range)