당사 팬 페이지에 가입하십시오

- 조회수:

- 5701

- 평가:

- 게시됨:

- 2018.12.28 13:09

- 업데이트됨:

- 2023.03.29 13:48

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Real author:

Rafael Jimenez Tocino

Indicator RJTX_Matches_Smoothed featuring alerts, emails and push notifications for smartphones.

The following changes have been made to the indicator code in order to implement alerts, email messages and push-notifications:

- New input variables are added to the indicator inputs

input uint NumberofBar=1; // Bar number to activate the signal input bool SoundON=true; // Enable alerts input uint NumberofAlerts=2; // Number of alerts input bool EMailON=false; // Enable mailing the signal input bool PushON=false; // Enable sending the signal to mobile devices

- Three new functions have been added to the end of the indicator: BuySignal(), SellSignal(), and GetStringTimeframe()

//+------------------------------------------------------------------+ //| Buy signal function | //+------------------------------------------------------------------+ void BuySignal(string SignalSirname, // text of the indicator name for email and push messages double &BuyArrow[], // indicator buffer with buy signals const int Rates_total, // current number of bars const int Prev_calculated, // number of bar on the previous tick const double &Close[], // close price const int &Spread[]) // spread { //--- static uint counter=0; if(Rates_total!=Prev_calculated) counter=0; bool BuySignal=false; bool SeriesTest=ArrayGetAsSeries(BuyArrow); int index,index1; if(SeriesTest) { index=int(NumberofBar); index1=index+1; } else { index=Rates_total-int(NumberofBar)-1; index1=index-1; } if(!BuyArrow[index1] && BuyArrow[index]) BuySignal=true; if(BuySignal && counter<=NumberofAlerts) { counter++; MqlDateTime tm; TimeToStruct(TimeCurrent(),tm); string text=TimeToString(TimeCurrent(),TIME_DATE)+" "+string(tm.hour)+":"+string(tm.min); SeriesTest=ArrayGetAsSeries(Close); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; double Ask=Close[index]; double Bid=Close[index]; SeriesTest=ArrayGetAsSeries(Spread); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; Bid+=Spread[index]*_Point; string sAsk=DoubleToString(Ask,_Digits); string sBid=DoubleToString(Bid,_Digits); string sPeriod=GetStringTimeframe(ChartPeriod()); if(SoundON) Alert("BUY signal \n Ask=",Ask,"\n Bid=",Bid,"\n currtime=",text,"\n Symbol=",Symbol()," Period=",sPeriod); if(EMailON) SendMail(SignalSirname+": BUY signal alert","BUY signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); if(PushON) SendNotification(SignalSirname+": BUY signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); } //--- } //+------------------------------------------------------------------+ //| Sell signal function | //+------------------------------------------------------------------+ void SellSignal(string SignalSirname, // text of the indicator name for email and push messages double &SellArrow[], // indicator buffer with sell signals const int Rates_total, // current number of bars const int Prev_calculated, // number of bar on the previous tick const double &Close[], // close price const int &Spread[]) // spread { //--- static uint counter=0; if(Rates_total!=Prev_calculated) counter=0; bool SellSignal=false; bool SeriesTest=ArrayGetAsSeries(SellArrow); int index,index1; if(SeriesTest) { index=int(NumberofBar); index1=index+1; } else { index=Rates_total-int(NumberofBar)-1; index1=index-1; } if(!SellArrow[index1] && SellArrow[index]) SellSignal=true; if(SellSignal && counter<=NumberofAlerts) { counter++; MqlDateTime tm; TimeToStruct(TimeCurrent(),tm); string text=TimeToString(TimeCurrent(),TIME_DATE)+" "+string(tm.hour)+":"+string(tm.min); SeriesTest=ArrayGetAsSeries(Close); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; double Ask=Close[index]; double Bid=Close[index]; SeriesTest=ArrayGetAsSeries(Spread); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; Bid+=Spread[index]*_Point; string sAsk=DoubleToString(Ask,_Digits); string sBid=DoubleToString(Bid,_Digits); string sPeriod=GetStringTimeframe(ChartPeriod()); if(SoundON) Alert("SELL signal \n Ask=",Ask,"\n Bid=",Bid,"\n currtime=",text,"\n Symbol=",Symbol()," Period=",sPeriod); if(EMailON) SendMail(SignalSirname+": SELL signal alert","SELL signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); if(PushON) SendNotification(SignalSirname+": SELL signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); } //--- } //+------------------------------------------------------------------+ //| Getting the timeframe as a string | //+------------------------------------------------------------------+ string GetStringTimeframe(ENUM_TIMEFRAMES timeframe) { //---- return(StringSubstr(EnumToString(timeframe),7,-1)); //---- }

- A couple of calls to functions BuySignal() and SellSignal() has been added following the indicator calculation cycles in block OnCalculate()

//--- BuySignal("RJTX_Matches_Smoothed_Alert",BuyBuffer,rates_total,prev_calculated,close,spread); SellSignal("RJTX_Matches_Smoothed_Alert",SellBuffer,rates_total,prev_calculated,close,spread); //---

Where BuyBuffer and SellBuffer are the names of the indicator buffers for storing the buy and sell signals. Either zeros or EMPTY_VALUE must be added to indicator buffers as empty values.

Only one call to each of functions BuySignal() and SellSignal() is assumed to be used in the indicator code in block OnCalculate().

The indicator uses the classes of library SmoothAlgorithms.mqh (to be copied to the <terminal_data_directory>\MQL5\Include folder). The use of the classes was thoroughly described in article Averaging Price Series for Intermediate Calculations Without Using Additional Buffers.

This indicator was first implemented in MQL4 and published in the Code Base on December 23, 2015.

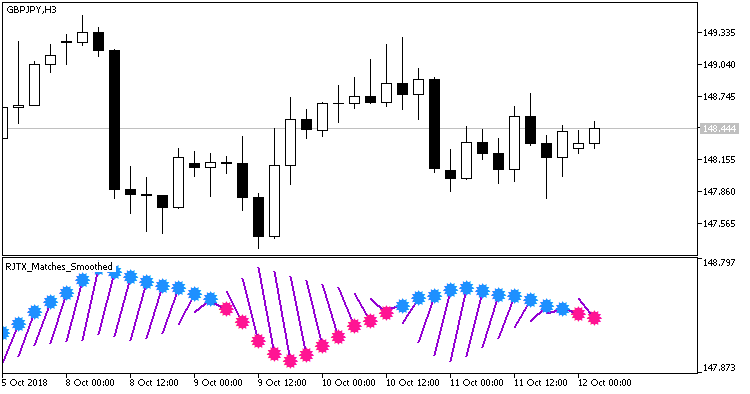

Fig.1. RJTX_Matches_Smoothed_Alert indicator on the chart

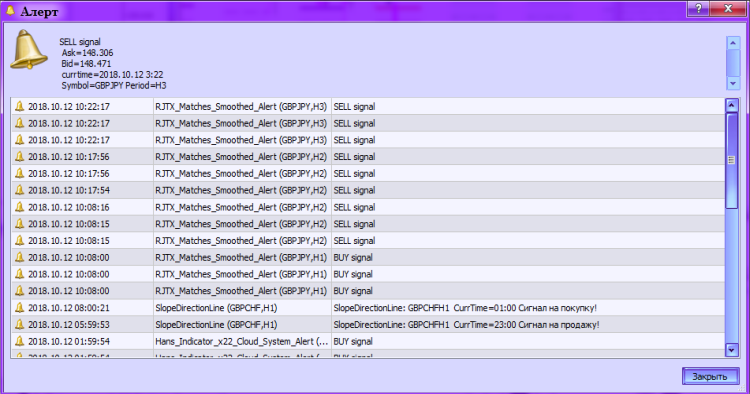

Fig. 2. Indicator RJTX_Matches_Smoothed_Alert. Alerting

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/22712

RJTX_Matches_Smoothed_Alert_xx

RJTX_Matches_Smoothed_Alert_xx

Indicator RJTX_Matches_Smoothed_Alert featuring alerts, emails and push notifications for smartphones. The input variables allow replacing the displayed indicator symbols

VZO

VZO

Indicator VZO

HLCrossSigForWPR_HTF

HLCrossSigForWPR_HTF

Indicator HLCrossSigForWPR with the option of selecting its timeframe in its input parameters

BestInterval

BestInterval

Calculating the best trading interval.