당사 팬 페이지에 가입하십시오

- 조회수:

- 7935

- 평가:

- 게시됨:

- 2018.12.28 13:09

- 업데이트됨:

- 2019.01.17 11:29

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

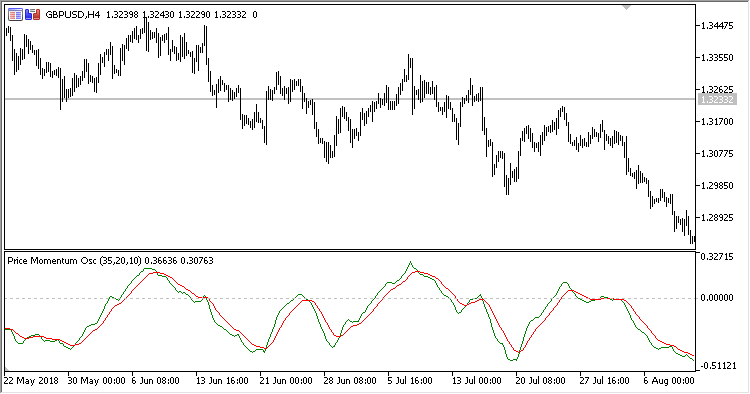

Indicator Price Momentum Oscillator. It is based on the double-smoothed rate of change (ROC).

It has three adjustable parameters:

- Period one - primary smoothing period

- Period two - secondary smoothing period

- Signal period - signal line smoothing period

Calculations:

PMO = Smoothing2

Signal = AvgPMO

where:

Smoothing1 = (Raw1 - PrevSmoothing1) * sm1+PrevSmoothing1

Smoothing2 = (Raw2 - PrevSmoothing2) * sm2+PrevSmoothing2

Raw1 = (((Close / PrevClose) * 100.0) - 100.0)

Raw2 = 10.0 * Smoothing1

sm1 =2.0/Period one

sm2 = 2.0/Period two

AvgPMO = EMA(PMO, Signal period)

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/22709

BestInterval

BestInterval

Calculating the best trading interval.

HLCrossSigForWPR_HTF

HLCrossSigForWPR_HTF

Indicator HLCrossSigForWPR with the option of selecting its timeframe in its input parameters

Extreme EA

Extreme EA

Indicators iCCI (Commodity Channel Index, CCI) and two iMAs (Moving Average, MA) are used.

Volatility_Quality_Index

Volatility_Quality_Index

Indicator Volatility Quality Index